The IRS Form SSA-561-U2 - a crucial document for individuals receiving social security benefits. Navigating the complexities of tax forms can be overwhelming, but with the right guidance, you can ensure a smooth and stress-free experience. In this article, we will delve into the world of IRS Form SSA-561-U2, exploring its purpose, benefits, and providing you with 5 valuable tips to simplify the filing process.

Understanding IRS Form SSA-561-U2

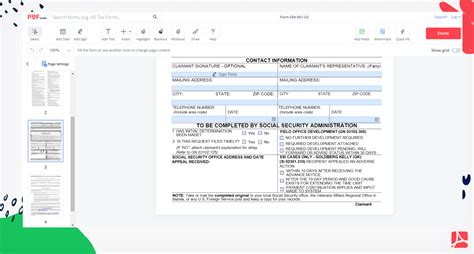

The SSA-561-U2 form, also known as the Request for Reconsideration, is used by individuals who receive social security benefits and wish to dispute a decision made by the Social Security Administration (SSA). This form allows you to request a reconsideration of a denied claim, providing an opportunity to present new evidence or arguments to support your case.

Why is IRS Form SSA-561-U2 Important?

Filing the SSA-561-U2 form is crucial for individuals who believe that the SSA has made an error in their decision. By requesting a reconsideration, you can:

- Provide additional evidence to support your claim

- Clarify any discrepancies or misunderstandings

- Potentially overturn a denied claim

Tips for Filing IRS Form SSA-561-U2

Now that we've covered the basics, let's dive into our 5 tips for filing the SSA-561-U2 form:

Tip 1: Understand the Deadline

When filing the SSA-561-U2 form, it's essential to be aware of the deadline. You have 60 days from the date of the SSA's decision to request a reconsideration. Missing this deadline can result in your request being denied, so mark your calendar and plan accordingly.

Tip 2: Gather Supporting Evidence

To strengthen your case, gather as much supporting evidence as possible. This may include:

- Medical records

- Witness statements

- Financial documents

- Any other relevant information that supports your claim

Ensure that you have all the necessary documents before submitting your request.

Tip 3: Complete the Form Accurately

The SSA-561-U2 form requires precise and accurate information. Take your time when filling out the form, and double-check your answers to avoid any mistakes. Incomplete or inaccurate forms may lead to delays or even rejection.

Tip 4: Submit Additional Evidence

If you have any additional evidence that supports your claim, be sure to submit it along with your request. This may include:

- New medical records

- Updated financial information

- Witness statements

Attach these documents to your form and ensure that they are properly labeled.

Tip 5: Seek Professional Help (If Needed)

If you're unsure about the filing process or need assistance with your request, consider seeking professional help. A social security attorney or advocate can guide you through the process, ensuring that your request is submitted correctly and efficiently.

By following these 5 tips, you'll be well on your way to successfully filing your IRS Form SSA-561-U2. Remember to stay organized, provide supporting evidence, and seek professional help if needed.

Conclusion: Empowering Your Social Security Claim

Filing the SSA-561-U2 form is a crucial step in disputing a denied social security claim. By understanding the deadline, gathering supporting evidence, completing the form accurately, submitting additional evidence, and seeking professional help when needed, you can ensure a smooth and successful filing process. Take control of your social security claim and don't hesitate to reach out for assistance if you need it.

What is the purpose of the SSA-561-U2 form?

+The SSA-561-U2 form is used to request a reconsideration of a denied social security claim.

How long do I have to file the SSA-561-U2 form?

+You have 60 days from the date of the SSA's decision to request a reconsideration.