Navigating the complexities of tax forms can be a daunting task, especially for those who are new to the process. One such form that may cause confusion is the PA-8453, which is used by the Pennsylvania Department of Revenue for various purposes. In this article, we will delve into the world of the PA-8453 form, explaining its purpose, benefits, and providing a step-by-step guide on how to fill it out accurately.

What is the PA-8453 Form?

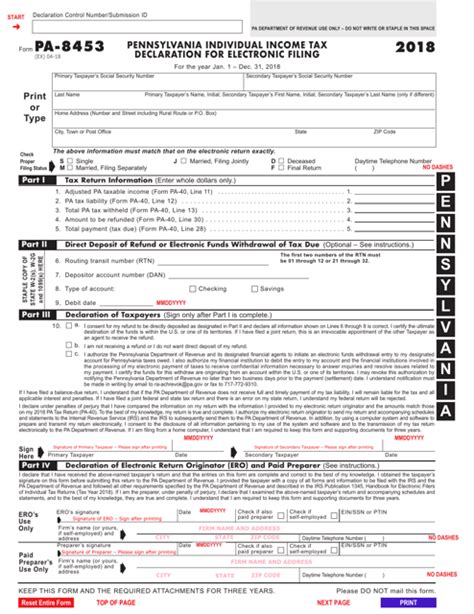

The PA-8453 form is a document used by the Pennsylvania Department of Revenue to verify the identity of individuals and businesses that file tax returns electronically. The form is used to authenticate the taxpayer's identity and ensure that the tax return is filed correctly. The PA-8453 form is also known as the "Individual Income Tax Declaration for Electronic Filing" form.

Why is the PA-8453 Form Important?

The PA-8453 form is essential for several reasons:

- It helps to prevent identity theft and ensures that the tax return is filed by the actual taxpayer.

- It verifies the taxpayer's identity and ensures that the tax return is accurate.

- It helps to prevent errors and delays in processing tax returns.

- It is required by the Pennsylvania Department of Revenue for electronic tax filing.

Step-by-Step Guide to Filling Out the PA-8453 Form

Filling out the PA-8453 form can seem intimidating, but it is a relatively straightforward process. Here is a step-by-step guide to help you fill out the form accurately:

Step 1: Download and Print the Form

You can download the PA-8453 form from the Pennsylvania Department of Revenue's website or obtain it from your tax preparer. Print the form and make sure you have a copy of your tax return and identification documents.

Step 2: Fill Out the Taxpayer Information Section

Fill out the taxpayer information section with your name, address, and Social Security number. Make sure to enter the correct information, as this will be used to verify your identity.

Step 3: Fill Out the Spouse Information Section (If Applicable)

If you are filing a joint tax return, fill out the spouse information section with your spouse's name, address, and Social Security number.

Step 4: Fill Out the Tax Return Information Section

Fill out the tax return information section with your tax return details, including the tax year, tax return type, and Electronic Filing Identification Number (EFIN).

Step 5: Sign and Date the Form

Sign and date the form, making sure to use the same signature and date as on your tax return.

Tips and Reminders

Here are some tips and reminders to keep in mind when filling out the PA-8453 form:

- Make sure to enter the correct information, as this will be used to verify your identity.

- Use the same signature and date as on your tax return.

- Keep a copy of the form and your tax return for your records.

- If you are filing a joint tax return, make sure to fill out the spouse information section accurately.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out the PA-8453 form:

- Entering incorrect information, such as a misspelled name or incorrect Social Security number.

- Forgetting to sign and date the form.

- Not keeping a copy of the form and tax return for your records.

Conclusion

Filling out the PA-8453 form may seem daunting, but it is a relatively straightforward process. By following the step-by-step guide and tips provided in this article, you can ensure that your tax return is filed accurately and efficiently. Remember to enter the correct information, sign and date the form, and keep a copy for your records.

If you have any questions or concerns about the PA-8453 form, feel free to comment below or share this article with a friend or family member who may need help with their tax return.

What is the purpose of the PA-8453 form?

+The PA-8453 form is used to verify the identity of individuals and businesses that file tax returns electronically.

Where can I download the PA-8453 form?

+You can download the PA-8453 form from the Pennsylvania Department of Revenue's website or obtain it from your tax preparer.

What information do I need to fill out the PA-8453 form?

+You will need to fill out the taxpayer information section, spouse information section (if applicable), and tax return information section.