As a business owner, understanding the intricacies of tax forms is crucial for maintaining compliance and avoiding potential penalties. One such form that requires attention is the Form 1120S K-1, a crucial document for S corporations. Here are five key facts about Form 1120S K-1 that every business owner should know:

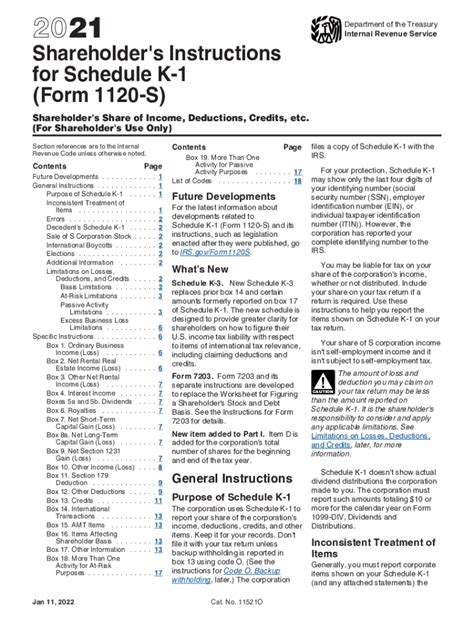

The Form 1120S K-1 is a tax document used by S corporations to report the income, deductions, and credits of the business to its shareholders. The form is an essential part of the annual tax filing process for S corporations, providing shareholders with the necessary information to complete their individual tax returns.

What is Form 1120S K-1?

The Form 1120S K-1 is a schedule attached to the Form 1120S, which is the income tax return for S corporations. The K-1 schedule is used to report the pro-rata share of income, deductions, and credits allocated to each shareholder. This information is essential for shareholders to calculate their tax liability and claim any applicable credits.

Who Needs to File Form 1120S K-1?

Form 1120S K-1 is required to be filed by S corporations that have shareholders who are individuals, estates, or certain trusts. The form must be completed and provided to each shareholder by the S corporation, along with a copy of the Form 1120S. Shareholders use the information reported on the K-1 schedule to complete their individual tax returns.

Key Components of Form 1120S K-1

The Form 1120S K-1 consists of several sections that report different types of income, deductions, and credits. Some of the key components of the form include:

- Ordinary Business Income (Loss): This section reports the S corporation's ordinary business income or loss, which is calculated by subtracting total deductions from total income.

- Capital Gains (Losses): This section reports the S corporation's capital gains and losses, which are calculated by subtracting the basis of assets sold from the proceeds of sale.

- Dividends: This section reports the S corporation's dividend income, which is income earned from investments in other corporations.

- Interest Income: This section reports the S corporation's interest income, which is income earned from investments in debt instruments.

- Credits: This section reports any credits available to the S corporation, such as the work opportunity tax credit or the research and development credit.

Deadlines and Penalties

The deadline for filing Form 1120S K-1 is typically March 15th of each year, although this deadline may be extended if the S corporation files Form 7004. Failure to file the form or provide it to shareholders by the deadline may result in penalties, including a $195 penalty per shareholder for each month or part of a month the form is late, up to a maximum of 12 months.

Consequences of Not Filing Form 1120S K-1

Failure to file Form 1120S K-1 can have serious consequences, including:

- Penalties: The IRS may impose penalties on the S corporation for failure to file the form or provide it to shareholders by the deadline.

- Loss of S Corporation Status: Failure to file Form 1120S K-1 may result in the loss of S corporation status, which can have significant tax implications.

- Delayed Refunds: Shareholders may experience delayed refunds if the S corporation fails to file Form 1120S K-1 or provide it to shareholders by the deadline.

Best Practices for Filing Form 1120S K-1

To avoid penalties and ensure compliance, S corporations should follow these best practices when filing Form 1120S K-1:

- File on Time: File Form 1120S K-1 by the deadline to avoid penalties and ensure timely refunds for shareholders.

- Provide Accurate Information: Ensure that the information reported on the K-1 schedule is accurate and complete to avoid errors or delays.

- Retain Records: Retain records of the K-1 schedule and supporting documentation for at least three years in case of an audit.

In conclusion, Form 1120S K-1 is a critical tax document that requires attention from S corporations and their shareholders. By understanding the key facts about Form 1120S K-1, business owners can ensure compliance, avoid penalties, and maintain the integrity of their S corporation status.

We hope this article has provided valuable insights into the world of Form 1120S K-1. If you have any questions or comments, please don't hesitate to share them below. Your feedback is essential in helping us create informative and engaging content.

What is the purpose of Form 1120S K-1?

+Form 1120S K-1 is used to report the income, deductions, and credits of an S corporation to its shareholders.

Who needs to file Form 1120S K-1?

+Form 1120S K-1 is required to be filed by S corporations that have shareholders who are individuals, estates, or certain trusts.

What are the consequences of not filing Form 1120S K-1?

+Failure to file Form 1120S K-1 can result in penalties, loss of S corporation status, and delayed refunds for shareholders.