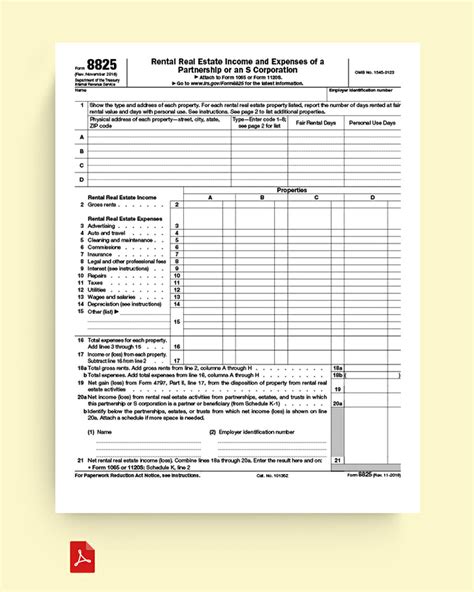

When it comes to completing IRS Form 8825, also known as the Rental Income and Expenses form, many taxpayers feel overwhelmed. This form is used to report income and expenses from rental properties, and it's a crucial part of the tax filing process for landlords and property owners. In this article, we'll provide you with 7 essential tips to help you complete IRS Form 8825 accurately and efficiently.

Understanding the Purpose of IRS Form 8825

Before we dive into the tips, it's essential to understand the purpose of IRS Form 8825. This form is used to report income and expenses from rental properties, including houses, apartments, and commercial buildings. The form is used to calculate the net rental income or loss, which is then reported on the taxpayer's individual tax return.

Who Needs to File IRS Form 8825?

Not everyone who owns rental property needs to file IRS Form 8825. The form is required for taxpayers who receive rental income from a property that is not their primary residence. This includes landlords, property owners, and individuals who rent out their vacation homes.

Tips for Completing IRS Form 8825

Now that we've covered the basics, let's move on to the 7 essential tips for completing IRS Form 8825.

Tip 1: Gather All Necessary Documents

Before starting to complete IRS Form 8825, make sure you have all the necessary documents. This includes:

- Rental income statements

- Expense receipts

- Property tax bills

- Mortgage interest statements

- Insurance premiums

Having all the documents in one place will make it easier to complete the form accurately.

Tip 2: Understand the Different Types of Rental Income

There are several types of rental income that can be reported on IRS Form 8825. These include:

- Rent received from tenants

- Rent received from short-term rentals (e.g., Airbnb)

- Rent received from long-term rentals

- Income from other sources (e.g., parking fees, laundry facilities)

Make sure you understand the different types of rental income and report them correctly on the form.

Tip 3: Calculate Your Rental Expenses

Rental expenses are a crucial part of completing IRS Form 8825. These expenses can include:

- Mortgage interest

- Property taxes

- Insurance premiums

- Maintenance and repairs

- Utilities

Make sure you calculate your rental expenses accurately and report them on the form.

Tip 4: Claim Depreciation

Depreciation is a type of expense that can be claimed on IRS Form 8825. Depreciation is the decrease in value of a property over time due to wear and tear. To claim depreciation, you'll need to calculate the cost basis of the property and the useful life of the asset.

Tip 5: Report Rental Income and Expenses Separately

Rental income and expenses should be reported separately on IRS Form 8825. This means you'll need to complete two separate sections of the form: one for rental income and one for rental expenses.

Tip 6: Keep Accurate Records

Accurate record-keeping is essential when completing IRS Form 8825. Make sure you keep records of all rental income and expenses, including receipts and invoices. This will help you complete the form accurately and provide proof of income and expenses in case of an audit.

Tip 7: Seek Professional Help If Needed

Finally, if you're unsure about how to complete IRS Form 8825, don't hesitate to seek professional help. A tax professional can guide you through the process and ensure you're reporting your rental income and expenses accurately.

By following these 7 essential tips, you'll be able to complete IRS Form 8825 accurately and efficiently. Remember to gather all necessary documents, understand the different types of rental income, calculate your rental expenses, claim depreciation, report rental income and expenses separately, keep accurate records, and seek professional help if needed.

We hope this article has been helpful in providing you with the information you need to complete IRS Form 8825. If you have any questions or comments, please feel free to share them below.

What is IRS Form 8825?

+IRS Form 8825 is a tax form used to report income and expenses from rental properties.

Who needs to file IRS Form 8825?

+Taxpayers who receive rental income from a property that is not their primary residence need to file IRS Form 8825.

What types of rental income can be reported on IRS Form 8825?

+Rental income from tenants, short-term rentals, long-term rentals, and other sources can be reported on IRS Form 8825.