Oklahoma Form 561, also known as the " Oklahoma Annual Franchise Tax Return", is a crucial document that business entities in Oklahoma must file annually with the Oklahoma Tax Commission. This form is used to report and pay the annual franchise tax, which is a mandatory requirement for all businesses operating in the state. In this article, we will delve into the details of Oklahoma Form 561, its importance, and provide a step-by-step guide on how to file and comply with the regulations.

What is Oklahoma Form 561?

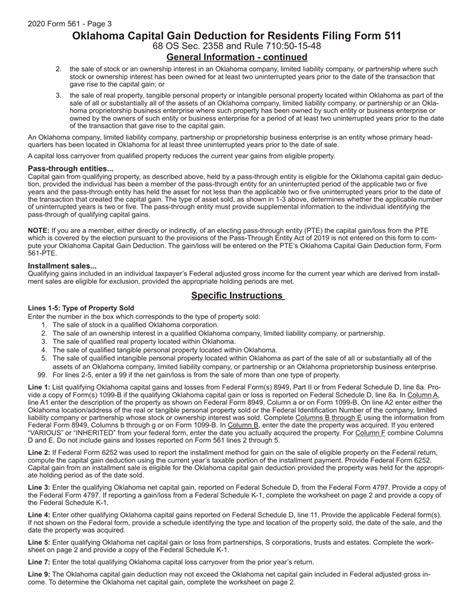

Oklahoma Form 561 is an annual return that business entities, including corporations, limited liability companies (LLCs), and limited partnerships, must file with the Oklahoma Tax Commission. The form requires businesses to report their income, expenses, and other relevant information for the tax year. The primary purpose of this form is to calculate and pay the annual franchise tax, which is a fee levied on businesses for the privilege of operating in Oklahoma.

Why is Oklahoma Form 561 important?

Filing Oklahoma Form 561 is essential for businesses operating in Oklahoma, as failure to do so can result in penalties, fines, and even the revocation of business licenses. The form provides the Oklahoma Tax Commission with necessary information to assess the franchise tax liability of businesses. By filing this form, businesses demonstrate their compliance with Oklahoma tax laws and regulations.

Who needs to file Oklahoma Form 561?

The following business entities are required to file Oklahoma Form 561:

- Corporations

- Limited Liability Companies (LLCs)

- Limited Partnerships

- Business Trusts

- Real Estate Investment Trusts (REITs)

What information is required on Oklahoma Form 561?

When filing Oklahoma Form 561, businesses must provide the following information:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Business type (corporation, LLC, etc.)

- Date of incorporation or formation

- Tax year end date

- Income and expense statements

- Balance sheet information

- Franchise tax calculation

How to file Oklahoma Form 561

To file Oklahoma Form 561, follow these steps:

- Gather required information: Collect all necessary documents, including financial statements, tax returns, and business records.

- Complete the form: Fill out Oklahoma Form 561 accurately and completely, making sure to include all required information.

- Calculate franchise tax: Calculate the franchise tax liability based on the business's income and expenses.

- Submit the form: File the completed form with the Oklahoma Tax Commission by the deadline (usually April 15th for calendar-year filers).

- Pay franchise tax: Pay the calculated franchise tax along with the filed form.

Penalties for non-compliance

Failure to file Oklahoma Form 561 or pay the franchise tax on time can result in penalties, fines, and even the revocation of business licenses. The Oklahoma Tax Commission may impose the following penalties:

- Late filing fee: $50

- Late payment fee: 10% of the unpaid tax

- Interest on unpaid tax: 1.25% per month

Conclusion and Next Steps

In conclusion, Oklahoma Form 561 is a critical document that businesses in Oklahoma must file annually to comply with state tax regulations. By understanding the requirements and following the step-by-step guide provided, businesses can ensure they meet the necessary obligations and avoid penalties. It is essential to consult with a tax professional or attorney to ensure accurate filing and compliance.

We encourage you to share your experiences and ask questions about Oklahoma Form 561 in the comments section below.