As a resident of California, managing your tax obligations is crucial to avoid any penalties or fines. One of the key aspects of tax compliance is ensuring you have the right amount of taxes withheld from your income. This is where California Form 592 V comes into play. In this article, we will delve into the world of California Form 592 V, exploring its purpose, benefits, and how to use it to solve your tax withholding needs.

What is California Form 592 V?

California Form 592 V is a withholding exemption certificate used by employers to determine the correct amount of state income taxes to withhold from an employee's wages. The form is used to claim an exemption from withholding or to claim a reduced rate of withholding. It is an essential document for employees who want to ensure they are not overpaying or underpaying their taxes.

Why Do You Need California Form 592 V?

You may need California Form 592 V in various situations, such as:

- When you start a new job and want to ensure you are not overpaying taxes

- If you have changed your marital status, number of dependents, or filing status

- When you want to claim an exemption from withholding due to low income or other reasons

- If you have a complex tax situation, such as self-employment income or investments

Benefits of Using California Form 592 V

Using California Form 592 V can provide several benefits, including:

- Accurate tax withholding: By submitting the form, you can ensure that your employer withholds the correct amount of taxes from your wages.

- Reduced tax liability: If you are eligible for an exemption or reduced rate of withholding, you can avoid overpaying taxes.

- Increased take-home pay: By reducing the amount of taxes withheld, you can increase your take-home pay.

- Compliance with tax laws: Failing to submit the form or providing incorrect information can result in penalties and fines. Using California Form 592 V helps you comply with tax laws and regulations.

How to Fill Out California Form 592 V

Filling out California Form 592 V is a straightforward process. Here are the steps to follow:

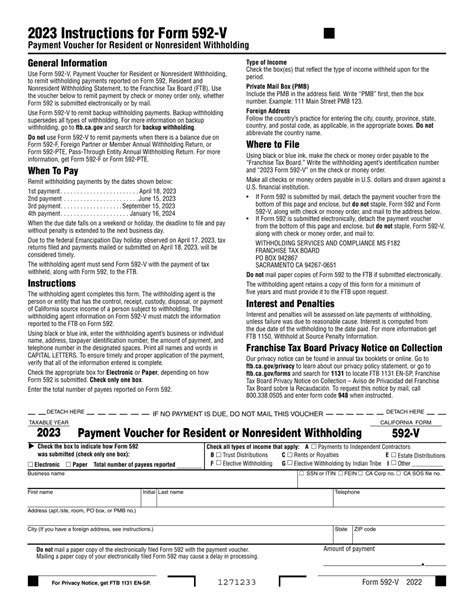

- Download the form from the California Franchise Tax Board (FTB) website or obtain it from your employer.

- Read the instructions carefully and fill out the form accurately.

- Provide your personal and employment information, including your name, address, social security number, and employer's name and address.

- Claim your exemption or reduced rate of withholding by checking the relevant boxes.

- Sign and date the form.

- Submit the form to your employer.

Common Mistakes to Avoid When Filing California Form 592 V

When filing California Form 592 V, it is essential to avoid common mistakes that can result in penalties or delays. Here are some mistakes to avoid:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Submitting the form too late or too early

- Claiming an exemption or reduced rate of withholding incorrectly

- Not keeping a copy of the form for your records

Tips for Managing Your Tax Withholding

Here are some tips for managing your tax withholding:

- Review your tax withholding regularly to ensure it is accurate.

- Adjust your withholding as needed to avoid overpaying or underpaying taxes.

- Keep accurate records of your tax-related documents, including California Form 592 V.

- Consult with a tax professional if you have complex tax situations or questions.

Conclusion: Taking Control of Your Tax Withholding

California Form 592 V is a powerful tool for managing your tax withholding needs. By understanding the form's purpose, benefits, and how to use it correctly, you can take control of your tax withholding and avoid costly mistakes. Remember to review your tax withholding regularly, adjust it as needed, and keep accurate records to ensure you are in compliance with tax laws and regulations.

We encourage you to share your experiences or ask questions about California Form 592 V in the comments section below. Don't forget to share this article with your friends and family who may benefit from this information.

FAQ Section:

What is the purpose of California Form 592 V?

+California Form 592 V is a withholding exemption certificate used by employers to determine the correct amount of state income taxes to withhold from an employee's wages.

Who needs to file California Form 592 V?

+Employees who want to claim an exemption from withholding or a reduced rate of withholding need to file California Form 592 V.

How do I fill out California Form 592 V?

+Read the instructions carefully and fill out the form accurately, providing your personal and employment information, claiming your exemption or reduced rate of withholding, signing and dating the form, and submitting it to your employer.