Oklahoma Form 514 is a vital document for individuals and businesses operating in the state. It's a crucial component of Oklahoma's tax compliance requirements, and understanding its intricacies can make a significant difference in ensuring a smooth and efficient filing process. In this article, we'll delve into the world of Oklahoma Form 514, exploring its key aspects, benefits, and steps to follow.

What is Oklahoma Form 514?

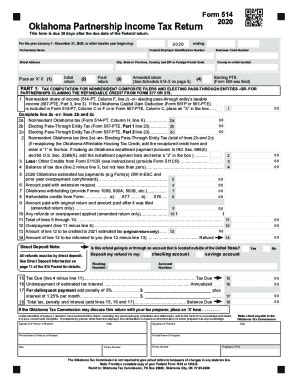

Oklahoma Form 514, also known as the "Oklahoma Partnership Return," is a tax form used by partnerships, limited liability companies (LLCs), and S corporations to report their annual income, deductions, and credits to the Oklahoma Tax Commission (OTC). The form is designed to provide a comprehensive overview of a business's financial activities, enabling the OTC to assess the correct amount of taxes owed.

Benefits of Filing Oklahoma Form 514

Filing Oklahoma Form 514 offers several benefits to businesses operating in the state. Some of the key advantages include:

- Simplified tax compliance: By filing Form 514, businesses can ensure they are meeting Oklahoma's tax requirements, reducing the risk of penalties and fines.

- Accurate tax calculation: The form helps businesses accurately calculate their tax liability, minimizing errors and ensuring they are paying the correct amount of taxes.

- State tax credits: Form 514 allows businesses to claim state tax credits, which can help reduce their tax liability and increase their bottom line.

Who Needs to File Oklahoma Form 514?

Not all businesses operating in Oklahoma need to file Form 514. The following entities are required to file the form:

- Partnerships: General partnerships, limited partnerships, and limited liability partnerships must file Form 514.

- LLCs: Single-member LLCs, multi-member LLCs, and LLCs that elect to be treated as corporations must file the form.

- S corporations: Oklahoma S corporations must file Form 514 to report their annual income and deductions.

How to File Oklahoma Form 514

Filing Oklahoma Form 514 involves several steps:

- Gather necessary documents: Businesses must gather all necessary documents, including financial statements, tax returns, and supporting schedules.

- Complete the form: Form 514 must be completed accurately and thoroughly, ensuring all required information is included.

- Submit the form: The completed form must be submitted to the OTC by the designated filing deadline.

Deadlines and Penalties

The deadline for filing Oklahoma Form 514 is typically March 15th for calendar-year entities. Failure to file the form or pay taxes owed by the deadline can result in penalties and interest.

In conclusion, Oklahoma Form 514 is a critical component of Oklahoma's tax compliance requirements. By understanding the form's essential facts, benefits, and steps to follow, businesses can ensure a smooth and efficient filing process, minimizing errors and penalties.