Completing Oklahoma Form 512 is a crucial step for individuals and businesses looking to withhold Oklahoma state income tax from certain types of income. This form is used to certify the number of allowances claimed for Oklahoma state income tax withholding purposes. In this article, we will guide you through the 5 steps to complete Oklahoma Form 512.

Step 1: Determine Your Filing Status

Before you start filling out Oklahoma Form 512, you need to determine your filing status. Your filing status will help you determine the number of allowances you are eligible to claim. Oklahoma recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Understanding Oklahoma Filing Status

It's essential to understand that Oklahoma's filing status is the same as the federal filing status. If you are unsure about your filing status, you can refer to the IRS instructions for Form W-4.

Step 2: Calculate Your Allowances

Once you have determined your filing status, you need to calculate the number of allowances you are eligible to claim. Oklahoma allows you to claim one allowance for yourself, your spouse, and each dependent. You can also claim additional allowances if you have other sources of income or if you are eligible for the Oklahoma standard deduction.

Oklahoma Allowance Calculator

You can use the Oklahoma allowance calculator to determine the number of allowances you are eligible to claim. The calculator takes into account your filing status, number of dependents, and other sources of income.

Step 3: Complete Form 512

Now that you have determined your filing status and calculated your allowances, you can complete Oklahoma Form 512.

- Enter your name and address in the top section of the form.

- Check the box that corresponds to your filing status.

- Enter the number of allowances you are claiming in the "Allowances Claimed" section.

- Sign and date the form.

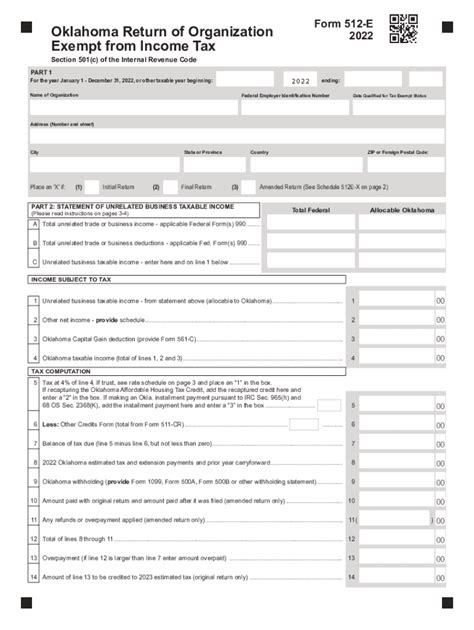

Example of Completed Form 512

Here's an example of a completed Oklahoma Form 512:

Step 4: Submit Form 512

Once you have completed Oklahoma Form 512, you need to submit it to your employer or payer. You can submit the form in person, by mail, or by fax.

Submission Guidelines

Make sure to submit the form to the correct address or fax number. You can find this information on the Oklahoma Tax Commission website.

Step 5: Verify Your Withholding

After you have submitted Oklahoma Form 512, you need to verify that your withholding is correct. You can do this by reviewing your pay stub or by contacting your employer or payer.

Importance of Verifying Withholding

Verifying your withholding is essential to ensure that you are not overpaying or underpaying your Oklahoma state income tax. If you find any errors, you can contact your employer or payer to make corrections.

We hope this article has helped you understand the 5 steps to complete Oklahoma Form 512. Remember to verify your withholding to ensure that you are paying the correct amount of Oklahoma state income tax.

Share your thoughts and experiences with us in the comments section below. If you have any questions or need further clarification, don't hesitate to ask.

What is Oklahoma Form 512?

+Oklahoma Form 512 is a form used to certify the number of allowances claimed for Oklahoma state income tax withholding purposes.

How do I calculate my allowances?

+You can use the Oklahoma allowance calculator to determine the number of allowances you are eligible to claim. The calculator takes into account your filing status, number of dependents, and other sources of income.

Where do I submit Oklahoma Form 512?

+You can submit Oklahoma Form 512 to your employer or payer. You can find the correct address or fax number on the Oklahoma Tax Commission website.