Filing taxes can be a daunting task, especially when it comes to navigating the complex world of state-specific tax forms. For residents of Ohio, one of the most important forms to understand is the IT 4708. But what exactly is this form, and how does it impact your tax obligations? In this article, we'll break down the five key things you need to know about Ohio Form IT 4708.

What is Ohio Form IT 4708?

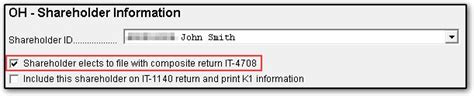

Ohio Form IT 4708 is a tax form used by the state of Ohio to report certain types of income and claim corresponding credits. Specifically, this form is used to report income from pass-through entities, such as partnerships, S corporations, and trusts. The form is typically filed by individuals who have income from these types of entities and need to report it on their Ohio state tax return.

Who Needs to File Ohio Form IT 4708?

Not everyone needs to file Ohio Form IT 4708. Generally, you'll need to file this form if you have income from a pass-through entity and you're required to file an Ohio state tax return. This includes individuals who are:

- Partners in a partnership

- Shareholders in an S corporation

- Beneficiaries of a trust

- Members of a limited liability company (LLC)

If you're unsure whether you need to file this form, it's always a good idea to consult with a tax professional or contact the Ohio Department of Taxation directly.

What Information Do I Need to Report on Ohio Form IT 4708?

When completing Ohio Form IT 4708, you'll need to report certain information related to your income from pass-through entities. This includes:

- Your name and Social Security number

- The name and federal Employer Identification Number (EIN) of the pass-through entity

- The type of entity (partnership, S corporation, trust, etc.)

- Your percentage of ownership in the entity

- The entity's income, deductions, and credits

You'll also need to report any corresponding credits you're claiming, such as the small business investor income deduction or the Ohio historic preservation tax credit.

How Do I File Ohio Form IT 4708?

Ohio Form IT 4708 is typically filed as an attachment to your Ohio state tax return (Form IT 1040). You can file your return electronically or by mail, depending on your preference. If you're filing electronically, you'll need to use the Ohio Department of Taxation's online filing system. If you're filing by mail, be sure to include all required attachments and sign your return.

What Are the Penalties for Not Filing Ohio Form IT 4708?

If you fail to file Ohio Form IT 4708 or fail to report required information, you may be subject to penalties and interest. The Ohio Department of Taxation can impose a penalty of up to $50 for each failure to file or report required information. Additionally, you may be subject to interest on any unpaid tax liability.

How Can I Avoid Penalties and Ensure Compliance?

To avoid penalties and ensure compliance, it's essential to file Ohio Form IT 4708 accurately and on time. Here are some tips to help you stay on track:

- Consult with a tax professional or accountant to ensure you're meeting all requirements

- Keep accurate records of your income from pass-through entities

- File your Ohio state tax return and Form IT 4708 electronically to reduce errors

- Review your return carefully before submitting it to the Ohio Department of Taxation

Conclusion

Ohio Form IT 4708 is an essential part of the state's tax filing process for individuals with income from pass-through entities. By understanding what this form is, who needs to file it, and what information is required, you can ensure compliance and avoid penalties. Remember to consult with a tax professional if you're unsure about any aspect of the filing process.What is the deadline for filing Ohio Form IT 4708?

+The deadline for filing Ohio Form IT 4708 is typically April 15th of each year, although this may vary depending on your specific tax situation.

Can I file Ohio Form IT 4708 electronically?

+Yes, you can file Ohio Form IT 4708 electronically using the Ohio Department of Taxation's online filing system.

What happens if I fail to file Ohio Form IT 4708?

+If you fail to file Ohio Form IT 4708, you may be subject to penalties and interest on any unpaid tax liability.