Form DTF-95 is a crucial document for businesses operating in the state of New York, particularly those involved in the sale of petroleum products. As a business owner, understanding the intricacies of this form is vital for maintaining compliance with state regulations and avoiding potential penalties. In this article, we will delve into the world of Form DTF-95, exploring its significance, requirements, and implications for businesses.

What is Form DTF-95?

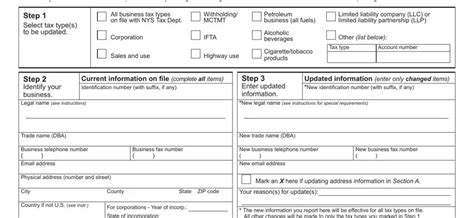

Form DTF-95, also known as the "Petroleum Business Tax Return," is a quarterly tax return filed by businesses engaged in the sale of petroleum products in New York State. The form is used to report and pay taxes on the sale of gasoline, diesel fuel, and other petroleum products. The New York State Department of Taxation and Finance requires businesses to file this form on a quarterly basis, with specific due dates for each quarter.

Who Needs to File Form DTF-95?

Not all businesses are required to file Form DTF-95. The following entities must file this form:

- Gasoline distributors

- Gasoline retailers

- Diesel fuel distributors

- Diesel fuel retailers

- Businesses that sell other petroleum products, such as aviation fuel, marine fuel, and lubricating oils

Businesses that do not engage in the sale of petroleum products are not required to file Form DTF-95.

Key Requirements for Filing Form DTF-95

When filing Form DTF-95, businesses must ensure they meet the following requirements:

- Quarterly Filing: Form DTF-95 must be filed on a quarterly basis, with due dates as follows:

- April 20th for the first quarter (January 1 - March 31)

- July 20th for the second quarter (April 1 - June 30)

- October 20th for the third quarter (July 1 - September 30)

- January 20th for the fourth quarter (October 1 - December 31)

- Tax Payment: Businesses must pay the required tax on the sale of petroleum products. The tax rate varies depending on the type of product sold.

- Accurate Reporting: Businesses must accurately report the amount of petroleum products sold during the quarter. This includes reporting the total gallons sold, the tax due, and any credits or exemptions claimed.

Consequences of Non-Compliance

Failure to file Form DTF-95 or pay the required tax can result in severe consequences, including:

- Penalties: Businesses may be subject to penalties, fines, and interest on the unpaid tax.

- Audits: The New York State Department of Taxation and Finance may conduct audits to ensure compliance.

- Loss of Business: In extreme cases, non-compliance can result in the loss of business licenses or permits.

How to File Form DTF-95

Filing Form DTF-95 can be a complex process, but the following steps can help guide businesses through the process:

- Register with the New York State Department of Taxation and Finance: Businesses must register with the department to obtain a tax identification number.

- Gather Required Documents: Businesses must gather records of petroleum product sales, including invoices, receipts, and inventory records.

- Complete Form DTF-95: Businesses must accurately complete Form DTF-95, reporting the required information and calculating the tax due.

- Submit the Form and Payment: Businesses must submit the completed form and payment to the New York State Department of Taxation and Finance by the due date.

Additional Resources

For businesses that require additional assistance with filing Form DTF-95, the following resources are available:

- New York State Department of Taxation and Finance Website: The department's website provides detailed information on Form DTF-95, including instructions, forms, and FAQs.

- Tax Professionals: Businesses can consult with tax professionals, such as accountants or attorneys, to ensure compliance with Form DTF-95 requirements.

Conclusion

Form DTF-95 is a critical document for businesses operating in the state of New York, particularly those involved in the sale of petroleum products. By understanding the requirements and implications of this form, businesses can ensure compliance with state regulations and avoid potential penalties. If you have any further questions or concerns about Form DTF-95, please don't hesitate to comment below. Share this article with your colleagues and friends who may find it helpful.

What is the due date for filing Form DTF-95?

+The due date for filing Form DTF-95 varies by quarter. The due dates are as follows: April 20th for the first quarter, July 20th for the second quarter, October 20th for the third quarter, and January 20th for the fourth quarter.

Who is required to file Form DTF-95?

+Businesses that engage in the sale of petroleum products, including gasoline distributors, gasoline retailers, diesel fuel distributors, diesel fuel retailers, and businesses that sell other petroleum products, are required to file Form DTF-95.

What are the consequences of non-compliance with Form DTF-95?

+Failure to file Form DTF-95 or pay the required tax can result in penalties, fines, interest on the unpaid tax, audits, and in extreme cases, the loss of business licenses or permits.