As a self-employed individual, managing your finances and taxes can be a daunting task. The Schedule C form is a crucial part of the tax filing process for self-employed individuals, and understanding how to navigate it can make a significant difference in your tax obligations. In this article, we will delve into the world of Schedule C, exploring its importance, benefits, and providing a comprehensive guide on how to fill it out accurately.

What is Schedule C?

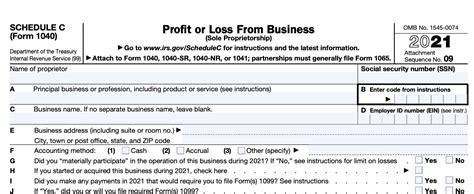

Schedule C (Form 1040) is a tax form used by self-employed individuals to report their business income and expenses. It is also known as the "Form 1040, Schedule C, Profit or Loss from Business." This form is used to calculate the net profit or loss from a business, which is then reported on the individual's tax return.

Why is Schedule C Important?

Schedule C is essential for self-employed individuals because it helps them report their business income and expenses accurately. By completing this form, self-employed individuals can:

- Calculate their business net profit or loss

- Claim business deductions and credits

- Report self-employment tax

- Determine their taxable income

Benefits of Filing Schedule C

Filing Schedule C offers several benefits to self-employed individuals, including:

- Accurate tax reporting: By completing Schedule C, self-employed individuals can ensure they are reporting their business income and expenses accurately, which helps them avoid any potential tax errors or penalties.

- Maximizing deductions: Schedule C allows self-employed individuals to claim business deductions and credits, which can help reduce their taxable income and lower their tax liability.

- Self-employment tax reporting: Schedule C is used to report self-employment tax, which is essential for self-employed individuals who need to pay Social Security and Medicare taxes.

- Record-keeping: Completing Schedule C helps self-employed individuals maintain accurate records of their business income and expenses, which is essential for tax purposes and future business planning.

How to Fill Out Schedule C

Filling out Schedule C can seem overwhelming, but breaking it down into smaller sections can make it more manageable. Here's a step-by-step guide on how to fill out Schedule C:

- Business Information: Enter your business name, address, and employer identification number (EIN) in the top section of the form.

- Business Income: Report your business income from various sources, such as sales, services, and interest income.

- Cost of Goods Sold: Calculate the cost of goods sold, which includes the direct costs of producing and selling your products or services.

- Operating Expenses: List your operating expenses, such as rent, utilities, and salaries.

- Depreciation and Amortization: Calculate depreciation and amortization expenses, which can help reduce your taxable income.

- Other Expenses: Report any other business expenses, such as travel expenses and business use of your home.

- Net Profit or Loss: Calculate your net profit or loss from business by subtracting your total expenses from your total income.

Tips for Filling Out Schedule C

- Keep accurate records: Maintain accurate records of your business income and expenses throughout the year to make filling out Schedule C easier.

- Use a tax professional: Consider hiring a tax professional to help you fill out Schedule C, especially if you have complex business expenses or deductions.

- Take advantage of deductions: Claim all eligible business deductions and credits to reduce your taxable income and lower your tax liability.

Common Mistakes to Avoid When Filing Schedule C

When filling out Schedule C, it's essential to avoid common mistakes that can lead to errors or penalties. Here are some common mistakes to avoid:

- Inaccurate business income reporting: Ensure you report all business income accurately, including cash and non-cash income.

- Failure to claim deductions: Claim all eligible business deductions and credits to reduce your taxable income and lower your tax liability.

- Incorrect depreciation and amortization: Calculate depreciation and amortization expenses accurately to avoid errors or penalties.

Conclusion

Filing Schedule C is a crucial part of the tax filing process for self-employed individuals. By understanding how to navigate this form, self-employed individuals can ensure they are reporting their business income and expenses accurately, claiming all eligible deductions and credits, and reducing their taxable income. Remember to keep accurate records, use a tax professional if needed, and avoid common mistakes to make filling out Schedule C a breeze.

What is the purpose of Schedule C?

+Schedule C is used to report business income and expenses, calculate net profit or loss, and claim business deductions and credits.

Who needs to file Schedule C?

+What are the benefits of filing Schedule C?

+Filing Schedule C allows self-employed individuals to report their business income and expenses accurately, claim business deductions and credits, and reduce their taxable income.