New York City's real estate market is one of the most competitive and complex in the world. Whether you're a buyer, seller, or agent, navigating the intricacies of NYC's real estate landscape can be daunting. One crucial document that plays a vital role in this process is the NYC 202 Form, also known as the "NYC Condominium and Cooperative Sales Report." In this article, we'll delve into the world of the NYC 202 Form, exploring its importance, benefits, and step-by-step instructions for completion.

What is the NYC 202 Form?

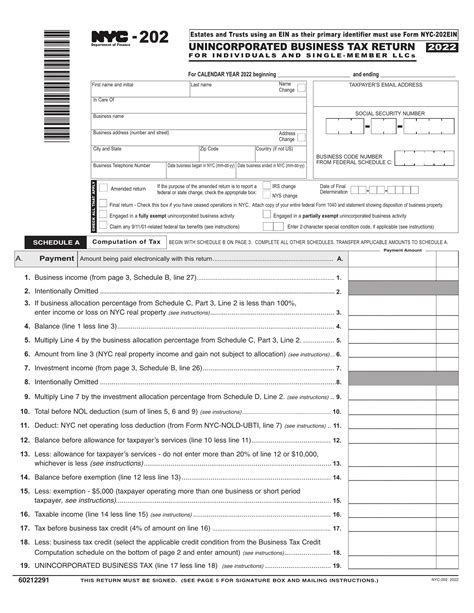

The NYC 202 Form is a mandatory document required for the sale of condominium and cooperative units in New York City. The form provides the city with vital information regarding the sale, including the property's characteristics, sale price, and tax implications. The NYC Department of Finance (DOF) uses this data to calculate the city's Real Property Transfer Tax (RPTT) and to update property records.

Why is the NYC 202 Form Important?

The NYC 202 Form serves several purposes:

- It provides the city with accurate and up-to-date information regarding property sales, which helps in assessing taxes and tracking market trends.

- It ensures compliance with NYC's Real Property Transfer Tax (RPTT) regulations.

- It helps in identifying potential tax evasion or underreporting.

Benefits of the NYC 202 Form

The NYC 202 Form offers several benefits to buyers, sellers, and agents:

- Streamlined Process: The form helps to expedite the sales process by providing a standardized format for reporting property sales.

- Accurate Tax Assessment: The form ensures that the city has accurate information regarding property sales, which helps in assessing taxes correctly.

- Market Insights: The data collected from the NYC 202 Form provides valuable insights into NYC's real estate market trends.

Step-by-Step Instructions for Completing the NYC 202 Form

To complete the NYC 202 Form, follow these steps:

- Obtain the form: You can download the NYC 202 Form from the NYC Department of Finance website or obtain a copy from your agent or attorney.

- Gather required information: Collect all necessary documents and information, including:

- Property address and tax block/lot number

- Sale price and terms of the sale

- Buyer and seller information

- Property characteristics (e.g., number of units, square footage)

- Complete the form: Fill out the form accurately and thoroughly, ensuring that all required fields are completed.

- Sign and date the form: The buyer, seller, and agent (if applicable) must sign and date the form.

- Submit the form: Submit the completed form to the NYC Department of Finance, either electronically or by mail.

Common Mistakes to Avoid When Completing the NYC 202 Form

When completing the NYC 202 Form, avoid the following common mistakes:

- Inaccurate or incomplete information: Ensure that all required fields are completed accurately and thoroughly.

- Failure to sign and date the form: All required parties must sign and date the form.

- Late submission: Submit the form on time to avoid penalties and delays.

Conclusion

The NYC 202 Form is a critical document in NYC's real estate market, providing the city with vital information regarding property sales. By understanding the form's importance, benefits, and step-by-step instructions for completion, buyers, sellers, and agents can navigate the sales process with confidence. Remember to avoid common mistakes and submit the form on time to ensure a smooth transaction.

We hope this comprehensive guide has provided you with a deeper understanding of the NYC 202 Form. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with your friends and colleagues who may benefit from this information.

FAQ Section

What is the purpose of the NYC 202 Form?

+The NYC 202 Form provides the city with vital information regarding property sales, including the property's characteristics, sale price, and tax implications.

Who is required to complete the NYC 202 Form?

+The buyer, seller, and agent (if applicable) are required to complete and sign the NYC 202 Form.

What are the consequences of failing to submit the NYC 202 Form on time?

+Failure to submit the form on time may result in penalties, delays, and potential tax implications.