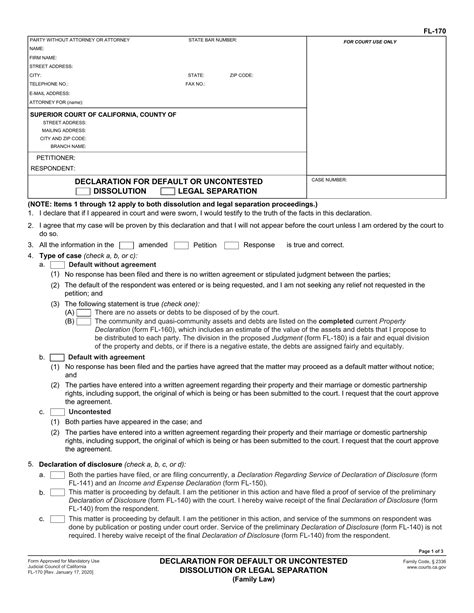

The FL-170 form is a crucial document in the California family court system, used to provide financial information in various family law cases, including divorce, child custody, and spousal support. Understanding the FL-170 form is essential for individuals navigating the complexities of family law in California. In this article, we will delve into the details of the FL-170 form, its purpose, and provide guidance on how to complete it accurately.

What is the FL-170 Form?

The FL-170 form, also known as the "Declaration of Estimated Annual Income and Expenses," is a court-required document that provides a comprehensive overview of an individual's financial situation. The form is used to estimate annual income and expenses, which helps the court make informed decisions regarding spousal support, child support, and other financial aspects of family law cases.

Why is the FL-170 Form Important?

The FL-170 form plays a critical role in family law cases, as it provides the court with a clear understanding of an individual's financial situation. The information provided on the form helps the court determine:

- Spousal support: The court uses the FL-170 form to determine the amount of spousal support one spouse must pay to the other.

- Child support: The form helps the court calculate the amount of child support one parent must pay to the other.

- Property division: The court uses the FL-170 form to determine the division of community property and debts.

- Attorney's fees: The form may be used to determine the amount of attorney's fees one spouse must pay to the other.

How to Complete the FL-170 Form

Completing the FL-170 form requires careful attention to detail and accuracy. Here are some tips to help you complete the form correctly:

- Gather financial documents: Collect all relevant financial documents, including pay stubs, tax returns, and bank statements.

- Estimate annual income: Calculate your estimated annual income from all sources, including employment, investments, and self-employment.

- List expenses: Itemize all monthly expenses, including housing, transportation, food, and entertainment.

- Be accurate: Ensure that all information provided on the form is accurate and complete.

Section 1: Estimated Annual Income

- List all sources of income, including employment, investments, and self-employment.

- Estimate annual income from each source.

Section 2: Monthly Expenses

- Itemize all monthly expenses, including housing, transportation, food, and entertainment.

- Be sure to include all expenses, even if they seem insignificant.

Section 3: Assets and Debts

- List all assets, including real property, vehicles, and investments.

- List all debts, including credit cards, loans, and mortgages.

Common Mistakes to Avoid

When completing the FL-170 form, it's essential to avoid common mistakes that can lead to delays or even dismissal of your case. Here are some common mistakes to avoid:

- Inaccurate information: Ensure that all information provided on the form is accurate and complete.

- Failure to disclose assets: Failing to disclose assets or debts can lead to serious consequences, including fines or even jail time.

- Incomplete forms: Ensure that all sections of the form are completed and signed.

Conclusion

In conclusion, the FL-170 form is a critical document in California family law cases. Understanding the form and completing it accurately is essential to ensure that the court has a clear understanding of your financial situation. By following the tips and guidelines outlined in this article, you can ensure that your FL-170 form is completed correctly and helps you achieve a favorable outcome in your family law case.

What is the purpose of the FL-170 form?

+The FL-170 form is used to provide financial information in various family law cases, including divorce, child custody, and spousal support.

How do I complete the FL-170 form?

+To complete the FL-170 form, gather all relevant financial documents, estimate annual income, list expenses, and be accurate.

What are the common mistakes to avoid when completing the FL-170 form?

+