Ensuring compliance with regulatory requirements is a crucial aspect of managing finances, particularly when dealing with various government forms. Among these, the FS Form 7600A is a critical document that needs to be completed accurately to avoid any issues. The FS Form 7600A, also known as the "Cash and Monetary Instrument Log," is utilized by the Financial Crimes Enforcement Network (FinCEN) to record and report cash and monetary instrument transactions exceeding $10,000. Completing this form correctly is essential for financial institutions, businesses, and individuals to fulfill their obligations under the Bank Secrecy Act (BSA). In this article, we will explore five ways to complete the FS Form 7600A accurately and efficiently.

Understanding the FS Form 7600A

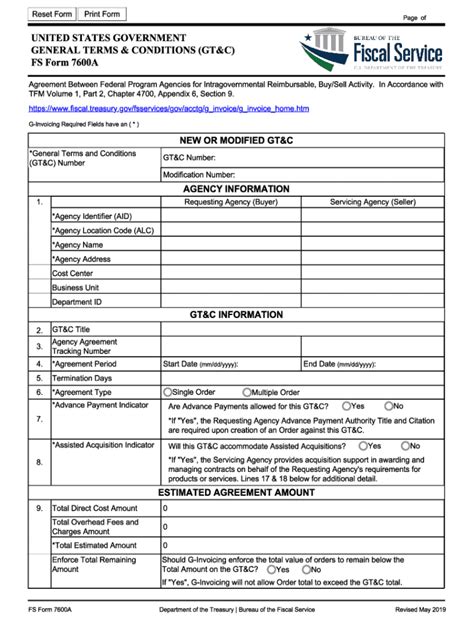

Before delving into the completion process, it's essential to understand the purpose and structure of the FS Form 7600A. This form is designed to capture information about cash and monetary instrument transactions, including the date, amount, and type of transaction. The form consists of several sections, each requiring specific details about the transaction, the parties involved, and the reporting institution.

Section I: Transaction Information

The first section of the FS Form 7600A requires information about the transaction, including the date, amount, and type of transaction. This section also asks for details about the monetary instruments involved, such as checks, money orders, or traveler's checks.

5 Ways to Complete the FS Form 7600A

Completing the FS Form 7600A accurately and efficiently requires attention to detail and an understanding of the reporting requirements. Here are five ways to complete the form:

1. Review the Form Instructions

Before starting to complete the FS Form 7600A, review the form instructions carefully. This will help you understand the reporting requirements and the specific information needed for each section. The instructions provide guidance on how to complete each field and what information is required.

2. Gather Required Information

To complete the FS Form 7600A accurately, gather all the required information beforehand. This includes details about the transaction, the parties involved, and the reporting institution. Ensure that you have all the necessary documents and records to support the information reported on the form.

3. Use the Correct Format

The FS Form 7600A requires specific formatting for certain fields, such as dates and amounts. Ensure that you use the correct format to avoid errors and ensure that the form is processed correctly.

4. Report All Required Information

The FS Form 7600A requires reporting of all cash and monetary instrument transactions exceeding $10,000. Ensure that you report all required information, including details about the transaction, the parties involved, and the reporting institution.

5. Verify and Validate the Information

Before submitting the FS Form 7600A, verify and validate the information reported. This includes checking for errors, inconsistencies, and completeness. Ensure that the form is signed and dated correctly, and that all required attachments are included.

Common Mistakes to Avoid

When completing the FS Form 7600A, there are several common mistakes to avoid. These include:

- Incomplete or inaccurate information

- Failure to report all required transactions

- Incorrect formatting or errors in data entry

- Failure to sign and date the form correctly

- Omitting required attachments or documentation

Benefits of Accurate Completion

Accurate completion of the FS Form 7600A is essential for financial institutions, businesses, and individuals to fulfill their obligations under the BSA. The benefits of accurate completion include:

- Compliance with regulatory requirements

- Reduced risk of errors or omissions

- Improved reporting and tracking of cash and monetary instrument transactions

- Enhanced ability to detect and prevent financial crimes

Conclusion and Next Steps

Completing the FS Form 7600A accurately and efficiently requires attention to detail and an understanding of the reporting requirements. By following the five ways outlined in this article, you can ensure that you complete the form correctly and fulfill your obligations under the BSA. If you have any questions or concerns about completing the FS Form 7600A, consult with a financial expert or regulatory professional.

We encourage you to share your experiences and tips for completing the FS Form 7600A in the comments section below. Your feedback and insights can help others navigate the complexities of financial reporting.

What is the purpose of the FS Form 7600A?

+The FS Form 7600A is used to record and report cash and monetary instrument transactions exceeding $10,000.

Who is required to complete the FS Form 7600A?

+Financial institutions, businesses, and individuals are required to complete the FS Form 7600A to fulfill their obligations under the Bank Secrecy Act (BSA).

What are the common mistakes to avoid when completing the FS Form 7600A?

+Common mistakes to avoid include incomplete or inaccurate information, failure to report all required transactions, incorrect formatting or errors in data entry, failure to sign and date the form correctly, and omitting required attachments or documentation.