Direct deposit is a convenient and efficient way to receive your paycheck, benefits, or other regular payments. Midfirst Bank offers direct deposit services to its customers, making it easy to manage your finances. However, to set up direct deposit, you need to provide your employer or payer with a direct deposit form. In this article, we will guide you through the process of completing a Midfirst Bank direct deposit form, making it easy and hassle-free.

What is a Direct Deposit Form?

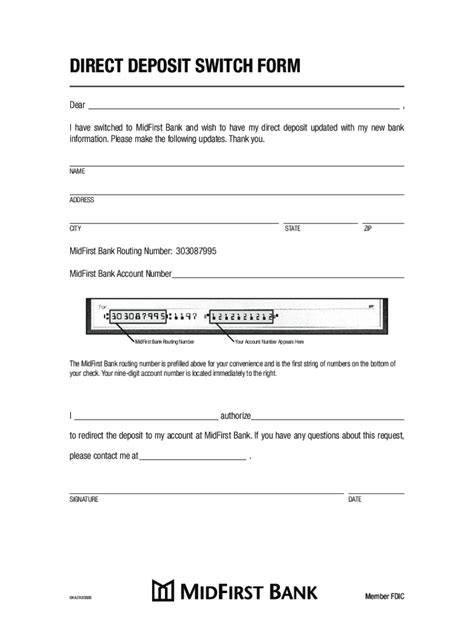

A direct deposit form is a document that provides your employer or payer with the necessary information to deposit your payments directly into your bank account. The form typically includes your name, account number, routing number, and other relevant details. By completing this form, you can ensure that your payments are deposited quickly and securely into your Midfirst Bank account.

Benefits of Direct Deposit

Direct deposit offers numerous benefits, including:

- Convenience: Direct deposit eliminates the need to visit a bank branch or ATM to deposit your payments.

- Speed: Payments are deposited quickly, usually on the same day they are received.

- Security: Direct deposit reduces the risk of lost or stolen checks.

- Flexibility: You can have your payments deposited into multiple accounts, making it easy to manage your finances.

How to Complete a Midfirst Bank Direct Deposit Form

To complete a Midfirst Bank direct deposit form, you will need to provide the following information:

- Your name and address

- Your Midfirst Bank account number

- The Midfirst Bank routing number (103011352)

- The type of account you want to deposit into (checking or savings)

- The amount you want to deposit (optional)

You can obtain a direct deposit form from your employer or payer, or you can download one from the Midfirst Bank website. Once you have the form, fill it out accurately and completely, making sure to sign and date it.

What is the Midfirst Bank Routing Number?

The Midfirst Bank routing number is 103011352. This number is used to identify Midfirst Bank and facilitate direct deposit transactions. You will need to provide this number on your direct deposit form to ensure that your payments are deposited correctly.

How to Find Your Midfirst Bank Account Number

Your Midfirst Bank account number can be found on your account statement, online banking, or mobile banking app. You can also contact Midfirst Bank customer service to obtain your account number.

Common Issues with Direct Deposit Forms

While direct deposit forms are generally straightforward, there are some common issues to be aware of:

- Incomplete or inaccurate information: Make sure to fill out the form completely and accurately to avoid delays or errors.

- Incorrect routing number: Double-check that you have entered the correct routing number to ensure that your payments are deposited correctly.

- Account type: Make sure to specify the correct account type (checking or savings) to avoid errors.

Conclusion

Completing a Midfirst Bank direct deposit form is a simple process that can save you time and hassle. By providing your employer or payer with the necessary information, you can ensure that your payments are deposited quickly and securely into your bank account. Remember to double-check your information and routing number to avoid errors. If you have any issues or concerns, contact Midfirst Bank customer service for assistance.

We hope this article has been helpful in guiding you through the process of completing a Midfirst Bank direct deposit form. If you have any questions or comments, please feel free to share them below.

What is the Midfirst Bank routing number?

+The Midfirst Bank routing number is 103011352.

How do I find my Midfirst Bank account number?

+Your Midfirst Bank account number can be found on your account statement, online banking, or mobile banking app. You can also contact Midfirst Bank customer service to obtain your account number.

What are the benefits of direct deposit?

+Direct deposit offers numerous benefits, including convenience, speed, security, and flexibility.