If you're a recipient of the In-Home Supportive Services (IHSS) program, you may have received an IHSS W2 form in the mail. The IHSS W2 form can be confusing, especially if you're not familiar with tax-related documents. However, understanding your IHSS W2 form is crucial to ensure you're meeting your tax obligations and taking advantage of the benefits you're eligible for. In this article, we'll break down the key components of the IHSS W2 form, explain how to read it, and provide valuable insights on what to do with the information provided.

What is an IHSS W2 Form?

An IHSS W2 form is a tax document issued by the state of California to IHSS caregivers who have earned income through the program. The form reports the amount of money you earned as an IHSS caregiver, as well as any taxes withheld from your earnings. The IHSS W2 form is used to report your income to the Internal Revenue Service (IRS) and the state of California.

**Key Components of the IHSS W2 Form**

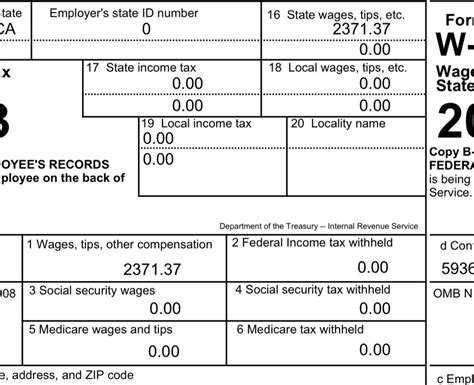

The IHSS W2 form is divided into several sections, each containing important information about your earnings and taxes withheld. Here are the key components of the IHSS W2 form:

- Employee's name and address: This section shows your name and address as it appears in the IHSS system.

- Employer's name and address: This section shows the name and address of the state of California, as the employer.

- Wages, tips, and other compensation: This section shows the total amount of money you earned as an IHSS caregiver.

- Federal income tax withheld: This section shows the amount of federal income tax withheld from your earnings.

- State income tax withheld: This section shows the amount of state income tax withheld from your earnings.

- Social Security tax withheld: This section shows the amount of Social Security tax withheld from your earnings.

- Medicare tax withheld: This section shows the amount of Medicare tax withheld from your earnings.

**How to Read Your IHSS W2 Form**

Reading your IHSS W2 form can be confusing, but it's essential to understand the information provided. Here's a step-by-step guide on how to read your IHSS W2 form:

- Check your name and address to ensure it's accurate.

- Review the employer's name and address to ensure it's the state of California.

- Check the wages, tips, and other compensation section to ensure it matches your earnings.

- Review the federal, state, and local tax withheld sections to ensure the amounts are correct.

- Check the Social Security and Medicare tax withheld sections to ensure the amounts are correct.

What to Do with Your IHSS W2 Form

Now that you've received your IHSS W2 form, you may be wondering what to do with it. Here are some steps to follow:

- File your taxes: Use the information on your IHSS W2 form to file your taxes. You can file your taxes online or by mail.

- Report your income: Report your IHSS income on your tax return, using the information provided on your IHSS W2 form.

- Claim your benefits: If you're eligible for benefits, such as the Earned Income Tax Credit (EITC), claim them on your tax return.

- Keep a copy: Keep a copy of your IHSS W2 form for your records.

**Frequently Asked Questions**

Here are some frequently asked questions about the IHSS W2 form:

**Q: What is the deadline for filing my taxes?**

A: The deadline for filing your taxes is typically April 15th of each year.

**Q: How do I file my taxes online?**

A: You can file your taxes online using tax software, such as TurboTax or H&R Block.

**Q: What is the Earned Income Tax Credit (EITC)?**

A: The EITC is a tax credit for low-income working individuals and families.

**Q: Can I get help with filing my taxes?**

A: Yes, you can get help with filing your taxes from a tax professional or by contacting the IRS.

Take Action

Now that you've read this article, take action by:

- Reviewing your IHSS W2 form carefully

- Filing your taxes on time

- Reporting your IHSS income accurately

- Claiming your benefits, if eligible

- Keeping a copy of your IHSS W2 form for your records

What is an IHSS W2 form?

+An IHSS W2 form is a tax document issued by the state of California to IHSS caregivers who have earned income through the program.

How do I read my IHSS W2 form?

+Check your name and address, review the employer's name and address, and review the wages, tips, and other compensation section.

What do I do with my IHSS W2 form?

+File your taxes, report your income, claim your benefits, and keep a copy of your IHSS W2 form for your records.