In the world of taxes, understanding the various forms and their requirements is crucial for both individuals and businesses. One such form that plays a significant role in the realm of tax compliance is the NY IT-203 form. This form is specifically designed for New York State residents and businesses, serving as a vital tool for reporting income and claiming deductions. However, the intricacies of tax laws and the nuances of specific forms like the NY IT-203 can be overwhelming. Let's delve into the essential facts about this form to ensure a clearer understanding of its significance and requirements.

What is the NY IT-203 Form?

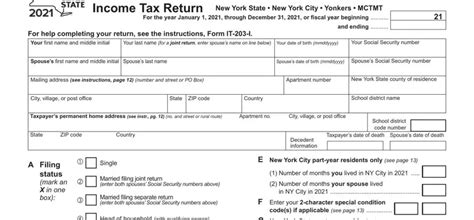

The NY IT-203 form is a tax document used by individuals, estates, and trusts in New York State to report income and claim any applicable deductions. It serves as the state's counterpart to the federal income tax return, essentially allowing taxpayers to calculate their state income tax liability. This form is an integral part of the state's tax compliance system, ensuring that taxpayers accurately report their income and adhere to state tax laws.

Key Components of the NY IT-203 Form

- Identification Section: This section requires basic information about the taxpayer, including name, address, and Social Security number or Employer Identification Number (EIN).

- Income Reporting: Taxpayers must report all income earned from various sources, including wages, interest, dividends, and capital gains.

- Deductions and Credits: The form allows taxpayers to claim deductions and credits that reduce their tax liability, such as the standard deduction, mortgage interest deduction, and child tax credit.

- Tax Computation: Based on the reported income and claimed deductions/credits, taxpayers calculate their state income tax liability.

- Payment and Refund Information: If a taxpayer owes additional tax, they must include a payment with the form. Conversely, if they are due a refund, they can choose to receive it via direct deposit or a paper check.

Who Must File the NY IT-203 Form?

Not everyone needs to file the NY IT-203 form. The necessity to file depends on the taxpayer's income level, residency status, and other factors. Generally, New York State residents, part-year residents, and non-residents with New York-sourced income may need to file this form. However, specific thresholds and exemptions apply, so it's essential to consult the New York State Department of Taxation and Finance for detailed guidelines.

Penalties for Not Filing or Late Filing

Failure to file the NY IT-203 form or filing it late can result in penalties and interest on the unpaid tax. The New York State Department of Taxation and Finance encourages taxpayers to file on time to avoid these additional charges. In cases of late filing, taxpayers can request a waiver of penalties, but this is subject to approval.

How to File the NY IT-203 Form

The NY IT-203 form can be filed electronically or by mail. Electronic filing is generally recommended as it reduces errors and speeds up processing times. Taxpayers can use the New York State Department of Taxation and Finance's online portal or engage a tax professional to ensure accurate and timely filing.

Amending a Previously Filed NY IT-203 Form

If a taxpayer discovers errors or omissions on a previously filed NY IT-203 form, they can amend it using Form IT-203-X, the amended return. This form is also used to report changes made to the original return due to federal audit adjustments.

Seeking Help with the NY IT-203 Form

Given the complexity of tax laws and the specificity of the NY IT-203 form, seeking professional help is advisable for many taxpayers. Tax professionals can guide individuals through the filing process, ensure compliance with state tax laws, and maximize deductions and credits. Additionally, resources such as the New York State Department of Taxation and Finance's website and taxpayer assistance centers can provide valuable information and support.

Conclusion: Staying Compliant with the NY IT-203 Form

Understanding the NY IT-203 form is crucial for taxpayers in New York State to ensure compliance with state tax laws and to accurately report income. By grasping the essential facts about this form, taxpayers can navigate the tax filing process more effectively, avoid penalties, and make the most of available deductions and credits. Remember, staying informed and seeking professional help when needed can make a significant difference in managing tax obligations.

What is the NY IT-203 form used for?

+The NY IT-203 form is used by individuals, estates, and trusts in New York State to report income and claim any applicable deductions.

Who must file the NY IT-203 form?

+New York State residents, part-year residents, and non-residents with New York-sourced income may need to file this form, depending on their income level and residency status.

How can I file the NY IT-203 form?

+The NY IT-203 form can be filed electronically through the New York State Department of Taxation and Finance's online portal or by mail.