Accurate cash handling is crucial for any business, and cash drawer reconciliation is a vital process to ensure that your company's finances are in order. A cash drawer reconciliation template in Excel can simplify this process, making it easier to manage your cash transactions. In this article, we will explore the importance of cash drawer reconciliation, its benefits, and provide a step-by-step guide on how to create a cash drawer reconciliation template in Excel.

What is Cash Drawer Reconciliation?

Cash drawer reconciliation is the process of verifying the cash in the drawer against the recorded cash transactions. This process ensures that the physical cash in the drawer matches the cash transactions recorded in the accounting system. Reconciliation helps to identify any discrepancies or errors, which can be investigated and corrected.

Why is Cash Drawer Reconciliation Important?

Cash drawer reconciliation is essential for several reasons:

- Ensures accuracy: Reconciliation ensures that the cash transactions are accurately recorded and matched with the physical cash in the drawer.

- Prevents errors: Regular reconciliation helps to identify and correct errors, which can prevent financial losses.

- Reduces theft: Reconciliation makes it difficult for employees to steal cash, as discrepancies are quickly identified.

- Improves accountability: Reconciliation promotes accountability among employees handling cash.

Benefits of Using a Cash Drawer Reconciliation Template in Excel

Using a cash drawer reconciliation template in Excel offers several benefits:

- Simplifies the process: The template simplifies the reconciliation process, making it easier to manage cash transactions.

- Reduces errors: The template helps to reduce errors, as calculations are automated.

- Saves time: The template saves time, as reconciliation can be completed quickly.

- Improves accuracy: The template ensures accuracy, as calculations are precise.

Step-by-Step Guide to Creating a Cash Drawer Reconciliation Template in Excel

Creating a cash drawer reconciliation template in Excel is straightforward. Here's a step-by-step guide:

Step 1: Set up the Template

- Open a new Excel spreadsheet and create a table with the following columns:

- Date

- Cash In

- Cash Out

- Net Cash

- Beginning Balance

- Ending Balance

- Format the columns to fit your needs.

Step 2: Enter Cash Transactions

- Enter the cash transactions for the day, including cash in and cash out.

- Calculate the net cash by subtracting the cash out from the cash in.

Step 3: Calculate the Beginning and Ending Balances

- Calculate the beginning balance by adding the previous day's ending balance to the cash in.

- Calculate the ending balance by adding the beginning balance to the net cash.

Step 4: Reconcile the Cash Drawer

- Reconcile the cash drawer by comparing the physical cash in the drawer to the ending balance.

- Identify any discrepancies and investigate the cause.

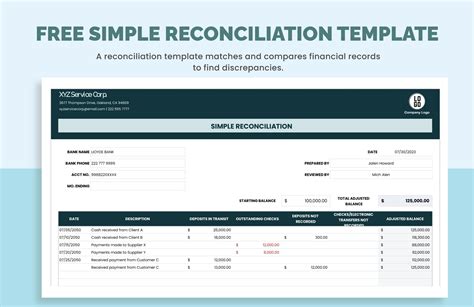

Example of a Cash Drawer Reconciliation Template in Excel

| Date | Cash In | Cash Out | Net Cash | Beginning Balance | Ending Balance |

|---|---|---|---|---|---|

| 2023-02-20 | 1000 | 500 | 500 | 2000 | 2500 |

| 2023-02-21 | 800 | 300 | 500 | 2500 | 3000 |

| 2023-02-22 | 1200 | 400 | 800 | 3000 | 3800 |

Tips for Using a Cash Drawer Reconciliation Template in Excel

- Regularly reconcile the cash drawer to identify discrepancies.

- Use the template to track cash transactions and calculate the beginning and ending balances.

- Investigate any discrepancies and correct errors.

- Use the template to improve accountability among employees handling cash.

Common Errors to Avoid When Using a Cash Drawer Reconciliation Template in Excel

- Ensure that the template is set up correctly to avoid calculation errors.

- Enter cash transactions accurately to avoid discrepancies.

- Regularly reconcile the cash drawer to identify errors.

- Investigate and correct errors promptly.

Best Practices for Cash Drawer Reconciliation

- Regularly reconcile the cash drawer to ensure accuracy.

- Use a cash drawer reconciliation template in Excel to simplify the process.

- Investigate and correct errors promptly.

- Improve accountability among employees handling cash.

Conclusion

A cash drawer reconciliation template in Excel simplifies the reconciliation process, making it easier to manage cash transactions. By following the step-by-step guide and using the template, you can ensure accuracy, prevent errors, and reduce theft. Regular reconciliation and investigation of errors will improve accountability among employees handling cash.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.

What is cash drawer reconciliation?

+Cash drawer reconciliation is the process of verifying the cash in the drawer against the recorded cash transactions.

Why is cash drawer reconciliation important?

+Cash drawer reconciliation is essential for ensuring accuracy, preventing errors, reducing theft, and improving accountability among employees handling cash.

How do I create a cash drawer reconciliation template in Excel?

+Follow the step-by-step guide provided in this article to create a cash drawer reconciliation template in Excel.