Filing taxes can be a daunting task, especially for individuals and businesses in New York State. The New York Form IT-203 is a crucial document for non-resident individuals who need to report their income and pay taxes to the state. In this comprehensive guide, we will walk you through the process of filing Form IT-203, highlighting the key steps, requirements, and deadlines.

Understanding the Purpose of Form IT-203

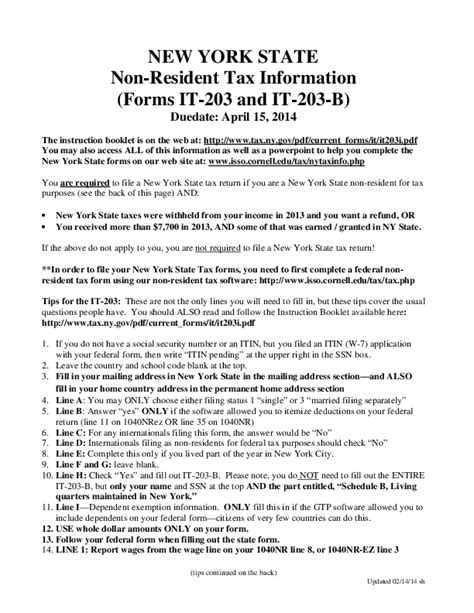

The New York Form IT-203 is used by non-resident individuals to report their income and claim a credit for taxes paid to another state or country. This form is designed to ensure that non-resident individuals comply with New York State tax laws and regulations.

Who Needs to File Form IT-203?

Non-resident individuals who meet the following criteria need to file Form IT-203:

- Have a New York State tax liability

- Have income from New York State sources

- Claim a credit for taxes paid to another state or country

Gathering Required Documents

Before starting the filing process, non-resident individuals need to gather the following documents:

- W-2 forms from all employers

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and financial institutions

- Dividend statements from investments

- Records of taxes paid to another state or country

Filing Form IT-203: Step-by-Step Instructions

- Download and Complete Form IT-203: Visit the New York State Department of Taxation and Finance website to download Form IT-203. Complete the form accurately and thoroughly, making sure to include all required information.

- Calculate Tax Liability: Calculate your tax liability using the New York State tax tables or schedules. You can also use tax software or consult a tax professional to ensure accuracy.

- Claim Credits: Claim credits for taxes paid to another state or country. Attach supporting documentation, such as W-2 forms or tax returns from the other state or country.

- Sign and Date the Form: Sign and date the form, making sure to include your social security number or Individual Taxpayer Identification Number (ITIN).

- Submit the Form: Submit the completed form and supporting documentation to the New York State Department of Taxation and Finance.

Filing Deadlines and Penalties

The filing deadline for Form IT-203 is typically April 15th of each year. However, if you need more time to file, you can request an automatic six-month extension by submitting Form IT-203-EXT.

Failure to file or pay taxes on time can result in penalties and interest. The New York State Department of Taxation and Finance imposes a penalty of 5% of the unpaid tax per month, up to a maximum of 25%.

Additional Resources and Support

If you need help with filing Form IT-203 or have questions about the process, you can:

- Contact the New York State Department of Taxation and Finance customer service center

- Visit the New York State Department of Taxation and Finance website for additional resources and guidance

- Consult a tax professional or accountant

Amending a Previously Filed Return

If you need to amend a previously filed return, you can submit Form IT-203-X. This form is used to correct errors or report changes to your original return.

Requesting a Refund

If you overpaid your taxes, you can request a refund by submitting Form IT-203-R. Make sure to include your social security number or ITIN and a copy of your original return.

Understanding New York State Tax Laws and Regulations

New York State tax laws and regulations can be complex and change frequently. It's essential to stay informed about changes to tax rates, credits, and deductions. You can visit the New York State Department of Taxation and Finance website for the latest information and guidance.

Best Practices for Filing Form IT-203

To ensure a smooth and accurate filing process, follow these best practices:

- Use tax software or consult a tax professional to ensure accuracy and completeness

- Keep accurate records of income and taxes paid to another state or country

- Submit the form and supporting documentation on time to avoid penalties and interest

- Request an automatic six-month extension if you need more time to file

Frequently Asked Questions

What is the deadline for filing Form IT-203?

+The filing deadline for Form IT-203 is typically April 15th of each year.

Who needs to file Form IT-203?

+Non-resident individuals with a New York State tax liability need to file Form IT-203.

What is the penalty for failing to file or pay taxes on time?

+The New York State Department of Taxation and Finance imposes a penalty of 5% of the unpaid tax per month, up to a maximum of 25%.

Take Action Today

Don't wait until the last minute to file your taxes. Take action today by downloading Form IT-203 and starting the filing process. If you need help or have questions, don't hesitate to contact the New York State Department of Taxation and Finance or a tax professional. Remember to stay informed about changes to tax laws and regulations, and follow best practices for filing Form IT-203.

Share Your Experience

Have you filed Form IT-203 before? Share your experience and tips with others by commenting below. If you found this guide helpful, please share it with your friends and colleagues.