In the state of Arizona, businesses are required to provide workers' compensation insurance to their employees, with some exceptions. One of these exceptions is for sole proprietors, who may be eligible to waive workers' compensation coverage. However, this waiver must be done through the proper channels and with the necessary documentation. In this article, we will guide you through the process of completing an Arizona sole proprietor workers comp waiver form.

Understanding Arizona Workers' Compensation Laws

Before we dive into the specifics of the waiver form, it's essential to understand the basics of Arizona workers' compensation laws. In Arizona, most employers are required to provide workers' compensation insurance to their employees. This insurance provides financial assistance to employees who are injured on the job or become ill as a result of their job.

However, there are some exceptions to this rule. Sole proprietors, who are business owners that operate as individuals rather than as a corporation or partnership, may be eligible to waive workers' compensation coverage. This is because sole proprietors are not considered employees and are therefore not entitled to workers' compensation benefits.

Who is Eligible for a Waiver?

To be eligible for a waiver, you must meet specific requirements. These requirements include:

- You must be a sole proprietor, meaning you operate your business as an individual rather than as a corporation or partnership.

- You must not have any employees, as employees are entitled to workers' compensation benefits.

- You must not be required by law to have workers' compensation insurance, such as if you work in a high-risk industry.

If you meet these requirements, you may be eligible to waive workers' compensation coverage. However, it's essential to note that waiving coverage does not mean you will never need workers' compensation insurance. If you hire employees in the future, you will be required to provide them with workers' compensation insurance.

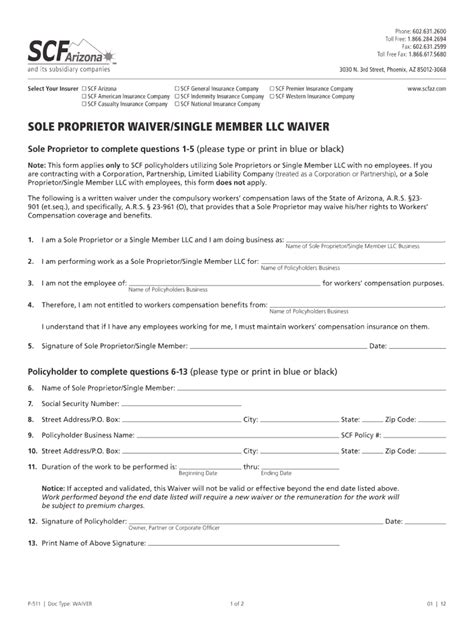

Completing the Waiver Form

To waive workers' compensation coverage, you will need to complete an Arizona sole proprietor workers comp waiver form. This form must be submitted to the Arizona Department of Insurance and Financial Institutions.

The waiver form will require you to provide specific information, including:

- Your name and business name

- Your business address and contact information

- A statement indicating that you are a sole proprietor and do not have any employees

- A statement indicating that you understand you are waiving workers' compensation coverage

It's essential to carefully review the waiver form and ensure you understand the implications of waiving workers' compensation coverage. If you have any questions or concerns, you may want to consider consulting with an attorney or insurance professional.

Benefits of Waiving Workers' Compensation Coverage

Waiving workers' compensation coverage can have several benefits for sole proprietors. These benefits include:

- Cost savings: Workers' compensation insurance can be expensive, especially for small businesses. By waiving coverage, you can save money on premiums.

- Reduced administrative burden: Providing workers' compensation insurance requires administrative tasks, such as filing paperwork and paying premiums. By waiving coverage, you can reduce your administrative burden.

- Increased flexibility: Waiving workers' compensation coverage gives you more flexibility in how you run your business. You can choose to provide alternative benefits to yourself, such as health insurance or disability insurance.

However, it's essential to note that waiving workers' compensation coverage also has risks. If you are injured on the job or become ill as a result of your job, you may not have access to financial assistance. This can be a significant risk, especially if you are the sole income earner for your family.

Risks of Waiving Workers' Compensation Coverage

Waiving workers' compensation coverage can have significant risks. These risks include:

- No financial assistance: If you are injured on the job or become ill as a result of your job, you may not have access to financial assistance. This can be a significant risk, especially if you are the sole income earner for your family.

- Increased financial burden: If you are injured on the job or become ill as a result of your job, you may be required to pay for medical expenses and lost wages out of pocket. This can be a significant financial burden, especially if you are not prepared.

- Reduced credit score: If you are unable to pay for medical expenses and lost wages, you may be at risk of damaging your credit score. This can make it more difficult to obtain credit in the future.

It's essential to carefully consider these risks before waiving workers' compensation coverage. If you are unsure about whether waiving coverage is right for you, you may want to consider consulting with an attorney or insurance professional.

Alternatives to Waiving Workers' Compensation Coverage

If you are unsure about waiving workers' compensation coverage, there are alternatives you can consider. These alternatives include:

- Providing alternative benefits: You can provide alternative benefits to yourself, such as health insurance or disability insurance. This can help ensure you have access to financial assistance if you are injured on the job or become ill as a result of your job.

- Purchasing workers' compensation insurance: You can purchase workers' compensation insurance to provide financial assistance in the event of a work-related injury or illness.

- Creating a self-insurance plan: You can create a self-insurance plan to provide financial assistance in the event of a work-related injury or illness.

It's essential to carefully consider these alternatives before waiving workers' compensation coverage. If you are unsure about which alternative is right for you, you may want to consider consulting with an attorney or insurance professional.

We hope this guide has provided you with a comprehensive understanding of the Arizona sole proprietor workers comp waiver form. If you have any further questions or concerns, please do not hesitate to reach out.

What is the purpose of the Arizona sole proprietor workers comp waiver form?

+The purpose of the Arizona sole proprietor workers comp waiver form is to allow sole proprietors to waive workers' compensation coverage.

Who is eligible to complete the Arizona sole proprietor workers comp waiver form?

+Sole proprietors who do not have any employees and are not required by law to have workers' compensation insurance are eligible to complete the waiver form.

What are the risks of waiving workers' compensation coverage?

+The risks of waiving workers' compensation coverage include no financial assistance, increased financial burden, and reduced credit score.