Filing your North Carolina state income tax form can be a daunting task, but it doesn't have to be. With the right guidance, you can navigate the process with ease and ensure you're taking advantage of all the deductions and credits available to you. In this article, we'll explore five ways to file your North Carolina state income tax form, including electronic filing, paper filing, and more.

Understanding Your Filing Options

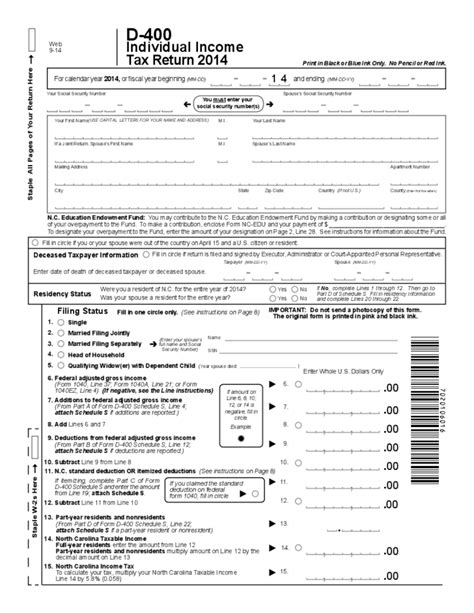

Before we dive into the different filing options, it's essential to understand the basics of North Carolina state income tax. North Carolina is a relatively low-tax state, with a flat income tax rate of 4.99%. However, there are various deductions and credits available to help reduce your tax liability. To file your state income tax form, you'll need to gather necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

Filing Status and Residency

Your filing status and residency also play a crucial role in determining which forms you need to file. North Carolina recognizes the same filing statuses as the federal government, including single, married filing jointly, married filing separately, head of household, and qualifying widow(er). If you're a resident of North Carolina, you'll need to file a state income tax return if your gross income exceeds the minimum threshold.

Option 1: Electronic Filing (E-File)

Electronic filing, or e-filing, is the fastest and most convenient way to file your North Carolina state income tax form. The North Carolina Department of Revenue offers free e-filing options for individuals, including the NCfreefile program. To e-file, you'll need to create an account on the North Carolina Department of Revenue website and follow the prompts to upload your tax documents and submit your return. E-filing is secure, efficient, and often results in faster refunds.

Benefits of E-Filing

E-filing offers numerous benefits, including:

- Faster refunds: E-filed returns are typically processed within 1-2 weeks, compared to 4-6 weeks for paper-filed returns.

- Increased accuracy: E-filing reduces the risk of errors and ensures your return is complete and accurate.

- Environmentally friendly: E-filing eliminates the need for paper and reduces waste.

Option 2: Paper Filing

If you prefer to file a paper return, you can download and print the necessary forms from the North Carolina Department of Revenue website. You'll need to complete the forms accurately and mail them to the address listed on the form. Paper filing is a more time-consuming process, but it's still a viable option for those who prefer to file by mail.

Benefits of Paper Filing

Paper filing offers a few benefits, including:

- No e-filing fees: While some e-filing services charge fees, paper filing is free.

- Control over submission: With paper filing, you have complete control over when and how you submit your return.

Option 3: Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can guide you through the filing process and help you identify deductions and credits. These programs often offer e-filing options and can help you prepare your state income tax return quickly and accurately.

Benefits of Tax Preparation Software

Tax preparation software offers numerous benefits, including:

- Accuracy: Tax preparation software ensures your return is complete and accurate.

- Deductions and credits: These programs can help you identify deductions and credits you may be eligible for.

- E-filing: Many tax preparation software programs offer e-filing options.

Option 4: Tax Professional

If you're unsure about the filing process or have complex tax situations, consider hiring a tax professional. Tax professionals can help you navigate the tax code, identify deductions and credits, and ensure your return is accurate and complete.

Benefits of Hiring a Tax Professional

Hiring a tax professional offers numerous benefits, including:

- Expertise: Tax professionals have extensive knowledge of the tax code and can help you navigate complex situations.

- Time-saving: Tax professionals can save you time and reduce the stress associated with filing your return.

- Accuracy: Tax professionals ensure your return is accurate and complete.

Option 5: Volunteer Income Tax Assistance (VITA) Program

The Volunteer Income Tax Assistance (VITA) program offers free tax preparation and e-filing services to low-income individuals and families. VITA volunteers are trained to help with state income tax returns and can assist with identifying deductions and credits.

Benefits of the VITA Program

The VITA program offers numerous benefits, including:

- Free tax preparation: VITA services are free, making it an excellent option for low-income individuals and families.

- Expertise: VITA volunteers are trained to help with state income tax returns and can assist with identifying deductions and credits.

In conclusion, filing your North Carolina state income tax form doesn't have to be a daunting task. With the right guidance, you can navigate the process with ease and ensure you're taking advantage of all the deductions and credits available to you. Whether you choose to e-file, paper file, or seek the help of a tax professional, remember to take your time, and don't hesitate to ask for help when needed.

Share your thoughts and experiences with filing your North Carolina state income tax form in the comments below! Have you used any of the options mentioned in this article? Do you have any tips or advice for others?

What is the deadline for filing North Carolina state income tax forms?

+The deadline for filing North Carolina state income tax forms is typically April 15th of each year.

Do I need to file a North Carolina state income tax return if I only have a small amount of income?

+Yes, if your gross income exceeds the minimum threshold, you'll need to file a North Carolina state income tax return.

Can I e-file my North Carolina state income tax return if I owe taxes?

+Yes, you can e-file your North Carolina state income tax return even if you owe taxes. However, you'll need to make a payment by the deadline to avoid penalties and interest.