The NJ 1099-G form is a crucial document for New Jersey residents who have received certain types of government payments throughout the year. Understanding this form is essential to ensure accurate tax reporting and to avoid any potential penalties. In this article, we will delve into the details of the NJ 1099-G form, its purpose, and what it entails.

What is the NJ 1099-G Form?

The NJ 1099-G form is a tax document issued by the New Jersey Department of Treasury to report various types of government payments made to individuals and businesses. This form is similar to the federal 1099-G form but is specific to New Jersey. The form is used to report income received from sources such as unemployment benefits, state and local income tax refunds, and certain types of government payments.

Purpose of the NJ 1099-G Form

The primary purpose of the NJ 1099-G form is to provide individuals and businesses with a record of their government payments received throughout the year. This information is used to report income on tax returns, ensuring accurate tax reporting and compliance with state tax laws.

Types of Income Reported on the NJ 1099-G Form

The NJ 1099-G form reports various types of government payments, including:

- Unemployment benefits

- State and local income tax refunds

- Reemployment assistance benefits

- Trade readjustment allowances

- Disaster relief payments

- Other types of government payments

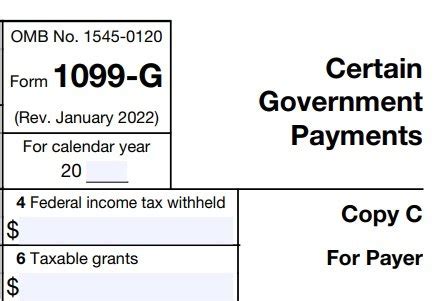

Understanding the NJ 1099-G Form Boxes

The NJ 1099-G form is divided into several boxes, each reporting different types of income. Understanding these boxes is essential to accurately report income on tax returns.

- Box 1: Total Payments

- Box 2: State and Local Income Tax Refunds

- Box 3: Unemployment Benefits

- Box 4: Reemployment Assistance Benefits

- Box 5: Trade Readjustment Allowances

- Box 6: Disaster Relief Payments

- Box 7: Other Government Payments

How to Obtain a Copy of the NJ 1099-G Form

Individuals and businesses can obtain a copy of the NJ 1099-G form from the New Jersey Department of Treasury. The form can be accessed online through the department's website or by contacting their customer service department.

What to Do if You Did Not Receive a NJ 1099-G Form

If you did not receive a NJ 1099-G form and believe you should have, contact the New Jersey Department of Treasury to request a copy. You can also contact your employer or the government agency that made the payment to request a copy of the form.

Reporting NJ 1099-G Income on Tax Returns

The income reported on the NJ 1099-G form must be reported on your tax return. The form provides the necessary information to accurately report income from government payments.

- Report unemployment benefits on Schedule 1 (Form 1040)

- Report state and local income tax refunds on Schedule 1 (Form 1040)

- Report reemployment assistance benefits on Schedule 1 (Form 1040)

- Report trade readjustment allowances on Schedule 1 (Form 1040)

- Report disaster relief payments on Schedule 1 (Form 1040)

Potential Penalties for Not Reporting NJ 1099-G Income

Failure to report NJ 1099-G income on tax returns can result in penalties and fines. It is essential to accurately report income from government payments to avoid any potential penalties.

Common Questions About the NJ 1099-G Form

- What is the deadline for reporting NJ 1099-G income on tax returns?

- How do I report NJ 1099-G income on my tax return?

- What happens if I do not receive a NJ 1099-G form?

- Can I request a copy of the NJ 1099-G form from the New Jersey Department of Treasury?

Conclusion

In conclusion, the NJ 1099-G form is an essential document for New Jersey residents who have received certain types of government payments throughout the year. Understanding the form and its purpose is crucial to ensure accurate tax reporting and to avoid any potential penalties. By following the guidelines outlined in this article, individuals and businesses can ensure compliance with state tax laws and avoid any potential penalties.

We invite you to comment below with any questions or concerns you may have about the NJ 1099-G form. Share this article with others who may benefit from this information.

What is the purpose of the NJ 1099-G form?

+The primary purpose of the NJ 1099-G form is to provide individuals and businesses with a record of their government payments received throughout the year.

How do I report NJ 1099-G income on my tax return?

+The income reported on the NJ 1099-G form must be reported on your tax return. The form provides the necessary information to accurately report income from government payments.

What happens if I do not receive a NJ 1099-G form?

+If you did not receive a NJ 1099-G form and believe you should have, contact the New Jersey Department of Treasury to request a copy.