Filing taxes can be a daunting task, especially when it comes to navigating the complexities of state tax laws. For residents of New York State, understanding the tax extension form process is crucial to avoid penalties and fines. In this article, we will break down the New York State tax extension form process, providing you with a comprehensive guide on how to file for an extension, the benefits of doing so, and the necessary steps to take.

Understanding New York State Tax Extension Forms

New York State tax extension forms are used to request an automatic six-month extension of time to file your state income tax return. This allows you to postpone filing your tax return until October 15th, rather than the traditional deadline of April 15th. The extension is granted automatically, and no explanation or reason is required for the request.

Benefits of Filing for a New York State Tax Extension

Filing for a New York State tax extension can provide several benefits, including:

- Avoiding penalties and fines for late filing

- Giving you more time to gather necessary documentation and paperwork

- Allowing you to take advantage of tax credits and deductions you may have missed otherwise

- Reducing stress and anxiety associated with last-minute tax filing

Who Can File for a New York State Tax Extension?

Any individual or business required to file a New York State income tax return can request an extension. This includes:

- Residents of New York State

- Non-residents with income earned in New York State

- Businesses operating in New York State

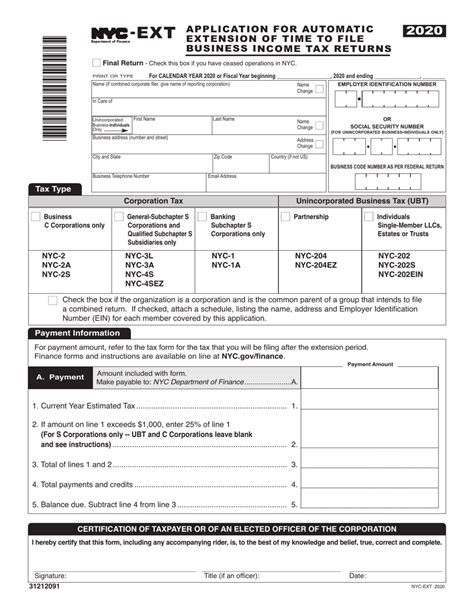

How to File for a New York State Tax Extension

To file for a New York State tax extension, you can use one of the following methods:

- Online: You can file for an extension online through the New York State Department of Taxation and Finance website.

- Phone: You can call the New York State Department of Taxation and Finance at (518) 457-5181 to request an extension.

- Mail: You can mail a paper Form IT-370, Application for Automatic Six-Month Extension of Time to File, to the address listed on the form.

New York State Tax Extension Form Requirements

To file for a New York State tax extension, you will need to provide the following information:

- Your name and social security number or ITIN

- Your spouse's name and social security number or ITIN (if filing jointly)

- Your New York State tax account number (if you have filed a state tax return previously)

Payment Options for New York State Tax Extension

If you owe taxes, you can make a payment with your extension request. You can pay online, by phone, or by mail. Payment options include:

- Electronic funds transfer (EFT)

- Credit or debit card

- Check or money order

Tips for Filing a New York State Tax Extension

Here are some tips to keep in mind when filing a New York State tax extension:

- File as soon as possible to avoid penalties and fines

- Make sure to pay any owed taxes to avoid additional penalties and interest

- Keep a copy of your extension request and payment receipt for your records

- Use the extra time to gather necessary documentation and paperwork

Common Mistakes to Avoid When Filing a New York State Tax Extension

Here are some common mistakes to avoid when filing a New York State tax extension:

- Missing the deadline for filing the extension

- Not making a payment if you owe taxes

- Not providing required documentation and paperwork

- Not keeping a copy of your extension request and payment receipt

Conclusion: New York State Tax Extension Made Easy

Filing a New York State tax extension can seem like a daunting task, but with the right guidance, it can be a straightforward process. By understanding the benefits, requirements, and tips for filing a tax extension, you can avoid penalties and fines, and take advantage of the extra time to gather necessary documentation and paperwork. Remember to file as soon as possible, make any necessary payments, and keep a copy of your extension request and payment receipt for your records.

We hope this article has provided you with a comprehensive guide on how to file for a New York State tax extension. If you have any further questions or concerns, please don't hesitate to reach out to us. Share this article with friends and family who may be in need of tax extension guidance, and leave a comment below with any questions or feedback.

What is the deadline for filing a New York State tax extension?

+The deadline for filing a New York State tax extension is April 15th.

Do I need to provide a reason for requesting a tax extension?

+No, you do not need to provide a reason for requesting a tax extension.

How do I make a payment with my tax extension request?

+You can make a payment with your tax extension request online, by phone, or by mail using electronic funds transfer (EFT), credit or debit card, or check or money order.