Understanding Form 941-V: A Guide to Accurate Filing

As an employer, filing taxes accurately and on time is crucial to avoid penalties and maintain a good standing with the IRS. One of the essential tax forms you'll need to submit is Form 941-V, the Payment Voucher for Form 941. In this article, we'll guide you through the process of filling out Form 941-V correctly, ensuring you comply with IRS regulations and avoid any issues.

The importance of accurate tax filing cannot be overstated. It not only helps you avoid penalties but also ensures you're taking advantage of the tax credits and deductions you're eligible for. Form 941-V is a critical component of this process, and understanding how to fill it out correctly is vital. In the following sections, we'll break down the key aspects of Form 941-V and provide practical tips to ensure you're filing accurately.

What is Form 941-V?

Before we dive into the details of filling out Form 941-V, let's take a brief look at what this form is and why it's necessary. Form 941-V is a payment voucher that accompanies Form 941, the Employer's Quarterly Federal Tax Return. This form is used to report employment taxes, including income taxes withheld from employees, Social Security taxes, and Medicare taxes.

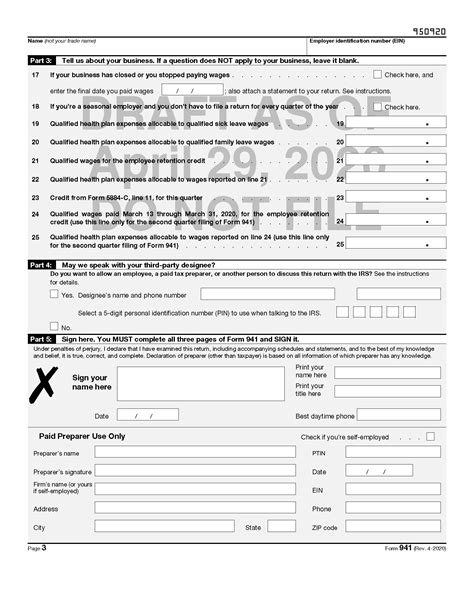

Step-by-Step Guide to Filling Out Form 941-V

Now that we've covered the basics of Form 941-V, let's move on to the step-by-step guide to filling it out correctly.

1. Identify the Correct Form and Version

Before you start filling out Form 941-V, ensure you have the correct form and version. The IRS regularly updates tax forms, so it's essential to use the latest version. You can download the latest version of Form 941-V from the IRS website or use tax preparation software that provides the updated form.

2. Enter Your Employer Identification Number (EIN)

Your EIN is a unique number assigned to your business by the IRS. It's essential to enter your EIN correctly on Form 941-V, as this is how the IRS identifies your business. You can find your EIN on your tax return or other tax-related documents.

3. Report Your Payment Amount

The payment amount is the total amount of employment taxes you're reporting on Form 941. This includes income taxes withheld from employees, Social Security taxes, and Medicare taxes. Ensure you enter the correct payment amount, as this will affect your tax liability.

4. Select the Correct Payment Type

On Form 941-V, you'll need to select the correct payment type. You can choose from the following options:

- Payment for the current quarter

- Payment for a prior quarter

- Payment for a tax year

Select the correct payment type based on the tax period you're reporting.

5. Sign and Date the Form

Finally, sign and date Form 941-V. This is an essential step, as it confirms that the information you've provided is accurate and complete.

Common Mistakes to Avoid When Filling Out Form 941-V

When filling out Form 941-V, it's essential to avoid common mistakes that can lead to delays or penalties. Here are some mistakes to watch out for:

- Incorrect EIN: Ensure you enter your EIN correctly, as this is how the IRS identifies your business.

- Incorrect payment amount: Double-check your payment amount to ensure it's accurate.

- Incorrect payment type: Select the correct payment type based on the tax period you're reporting.

By avoiding these common mistakes, you can ensure that your Form 941-V is accurate and complete.

Conclusion

Filling out Form 941-V correctly is crucial to ensure accurate tax filing and avoid penalties. By following the step-by-step guide outlined in this article, you can ensure that your Form 941-V is accurate and complete. Remember to avoid common mistakes and double-check your information before submitting your form.

We hope this guide has been helpful in assisting you in filling out Form 941-V correctly. If you have any further questions or concerns, please don't hesitate to reach out to us.

What is Form 941-V?

+Form 941-V is a payment voucher that accompanies Form 941, the Employer's Quarterly Federal Tax Return. This form is used to report employment taxes, including income taxes withheld from employees, Social Security taxes, and Medicare taxes.

How do I fill out Form 941-V?

+To fill out Form 941-V, you'll need to enter your Employer Identification Number (EIN), report your payment amount, select the correct payment type, and sign and date the form. Ensure you use the correct form and version, and avoid common mistakes such as incorrect EIN, payment amount, or payment type.

What are the common mistakes to avoid when filling out Form 941-V?

+Common mistakes to avoid when filling out Form 941-V include incorrect EIN, payment amount, or payment type. Ensure you double-check your information before submitting your form to avoid delays or penalties.