If you're a taxpayer who has suffered a loss due to theft, vandalism, fire, storm, or other casualty, you may be eligible to claim a deduction on your tax return. To do this, you'll need to complete Form 4684, also known as the Casualties and Thefts form. In this article, we'll guide you through the process of completing Form 4684 in 7 easy steps.

Understanding the Purpose of Form 4684

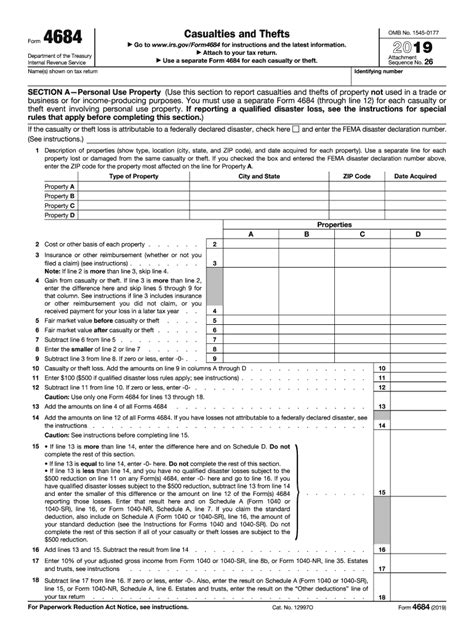

Before we dive into the steps, let's quickly review the purpose of Form 4684. This form is used to report losses due to casualty or theft, and to calculate the amount of the loss that can be deducted on your tax return. The form is divided into two main sections: Section A, which deals with personal-use property, and Section B, which deals with business or investment property.

Step 1: Determine If You Need to File Form 4684

Not all losses qualify for a deduction on Form 4684. To determine if you need to file this form, ask yourself the following questions:

- Did you suffer a loss due to theft, vandalism, fire, storm, or other casualty?

- Was the loss related to personal-use property, such as your home or car?

- Was the loss related to business or investment property?

- Did you receive any reimbursement or insurance proceeds for the loss?

If you answered "yes" to any of these questions, you may need to file Form 4684.

**Step 2: Gather Required Documents and Information**

To complete Form 4684, you'll need to gather the following documents and information:

- Proof of the loss, such as police reports, appraisals, or photographs

- Records of any reimbursement or insurance proceeds received

- Records of the fair market value of the property before and after the loss

- Records of any expenses related to the loss, such as repair costs or rental fees

Step 3: Complete Section A - Personal-Use Property

Section A of Form 4684 deals with personal-use property, such as your home or car. To complete this section, follow these steps:

- List each item of personal-use property that was damaged or destroyed

- Enter the fair market value of each item before and after the loss

- Calculate the amount of the loss for each item

- Total the amounts of all losses in this section

**Section A Example**

Let's say you had a fire in your home that damaged your kitchen. You had to replace the appliances, cabinets, and flooring. Here's how you might complete Section A:

| Item | Fair Market Value Before Loss | Fair Market Value After Loss | Amount of Loss |

|---|---|---|---|

| Kitchen Appliances | $3,000 | $0 | $3,000 |

| Kitchen Cabinets | $2,000 | $0 | $2,000 |

| Flooring | $1,500 | $0 | $1,500 |

| Total | $6,500 |

Step 4: Complete Section B - Business or Investment Property

Section B of Form 4684 deals with business or investment property, such as rental property or stocks. To complete this section, follow these steps:

- List each item of business or investment property that was damaged or destroyed

- Enter the fair market value of each item before and after the loss

- Calculate the amount of the loss for each item

- Total the amounts of all losses in this section

Step 5: Calculate the Total Loss

Once you've completed Sections A and B, calculate the total loss by adding the amounts from each section.

**Step 6: Apply the $100 and 10% Limits**

There are two limits that apply to casualty and theft losses:

- The $100 limit: You can only deduct losses that exceed $100.

- The 10% limit: You can only deduct losses that exceed 10% of your adjusted gross income (AGI).

To apply these limits, follow these steps:

- Subtract $100 from the total loss

- Calculate 10% of your AGI

- Subtract the 10% limit from the total loss

Step 7: Report the Loss on Your Tax Return

Finally, report the loss on your tax return by entering the amount on Schedule A (Form 1040). You'll also need to attach Form 4684 to your tax return.

By following these 7 easy steps, you can complete Form 4684 and claim a deduction for your casualty or theft loss.

FAQ Section

What is Form 4684 used for?

+Form 4684 is used to report losses due to casualty or theft, and to calculate the amount of the loss that can be deducted on your tax return.

Do I need to file Form 4684 if I received reimbursement or insurance proceeds?

+Yes, you still need to file Form 4684 even if you received reimbursement or insurance proceeds. You'll need to report the amount of the reimbursement or insurance proceeds on the form.

How do I calculate the fair market value of my property before and after the loss?

+You can use appraisals, photographs, or other records to determine the fair market value of your property before and after the loss. You can also use online pricing guides or consult with a professional appraiser.

We hope this article has helped you understand how to complete Form 4684. If you have any further questions or need additional guidance, please don't hesitate to ask.