As a trader or investor, you're likely no stranger to the world of financial forms and documents. One form that may have crossed your desk is the Etrade Form 3922. But what exactly is this form, and what does it mean for your financial situation? In this article, we'll break down the Etrade Form 3922 and provide six tips for understanding its significance.

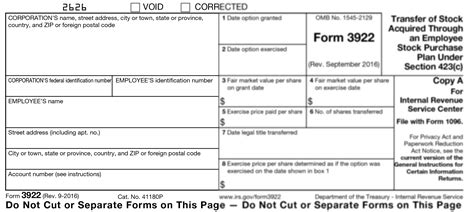

First, let's define what the Etrade Form 3922 is. This form is used to report exercises and other transfers of stock acquired through employee stock purchase plans (ESPPs) and stock incentive plans. If you've participated in such plans, you may receive this form from your employer or brokerage firm.

Tip #1: Understand the Purpose of the Form

The primary purpose of the Etrade Form 3922 is to report the transfer of stock acquired through ESPPs and stock incentive plans. This form provides the IRS with the necessary information to calculate any taxes owed on these transactions. As an employee, it's essential to understand the tax implications of these plans and how they may affect your overall tax liability.

Deciphering the Form: A Section-by-Section Guide

To better understand the Etrade Form 3922, let's break down its various sections:

- Section 1: This section reports the transfer of stock acquired through an ESPP or stock incentive plan.

- Section 2: This section reports the type of plan and the type of transfer (e.g., exercise, vesting, or cancellation).

- Section 3: This section provides information about the transferred stock, including the date of transfer, the number of shares transferred, and the fair market value of the stock on the transfer date.

- Section 4: This section reports any federal income tax withholding on the transfer.

Tip #2: Keep Accurate Records

It's crucial to keep accurate records of your Etrade Form 3922, including any supporting documentation, such as receipts or bank statements. This will help you ensure that you report the correct information on your tax return and avoid any potential penalties or audits.

Common Scenarios: How the Form Impacts Your Taxes

The Etrade Form 3922 can impact your taxes in various ways, depending on the specific scenario. Here are a few common scenarios to consider:

- Exercise of stock options: If you exercise stock options, you may be subject to ordinary income tax on the difference between the fair market value of the stock and the exercise price.

- Vesting of restricted stock units (RSUs): When RSUs vest, you may be subject to ordinary income tax on the fair market value of the stock on the vesting date.

- Cancellation of stock awards: If you cancel a stock award, you may be subject to ordinary income tax on the fair market value of the stock on the cancellation date.

Tip #3: Consult a Tax Professional

Given the complexity of the Etrade Form 3922 and its potential tax implications, it's highly recommended that you consult a tax professional to ensure you're reporting the correct information on your tax return. A tax professional can help you navigate any potential tax liabilities and ensure you're taking advantage of any available tax deductions or credits.

Avoiding Common Mistakes: Tips for Accurate Reporting

To avoid common mistakes when reporting information on the Etrade Form 3922, follow these tips:

- Double-check your math: Ensure that you accurately calculate any tax withholdings or liabilities.

- Verify the information: Double-check the information reported on the form, including the date of transfer, number of shares transferred, and fair market value of the stock.

- Keep supporting documentation: Keep accurate records of any supporting documentation, such as receipts or bank statements.

Tip #4: Stay Organized

Staying organized is crucial when dealing with the Etrade Form 3922. Keep all relevant documents, including the form itself, any supporting documentation, and tax returns, in a safe and easily accessible location.

Tip #5: Review and Understand Your Tax Return

When reviewing your tax return, ensure that you understand how the Etrade Form 3922 has impacted your tax liability. Take the time to review your tax return carefully, and don't hesitate to ask questions if you're unsure about any information.

Additional Resources: Where to Find Help

If you need additional help understanding the Etrade Form 3922 or its tax implications, consider the following resources:

- IRS Website: The IRS website provides a wealth of information on the Etrade Form 3922, including instructions and FAQs.

- Tax Professionals: Consult a tax professional for personalized guidance and advice.

- Etrade Customer Support: Etrade customer support can provide assistance with any questions or concerns you may have about the form.

Tip #6: Stay Informed

Finally, stay informed about any changes to the Etrade Form 3922 or its tax implications. The IRS regularly updates its forms and instructions, so it's essential to stay up-to-date on any changes that may affect your tax situation.

What is the purpose of the Etrade Form 3922?

+The primary purpose of the Etrade Form 3922 is to report the transfer of stock acquired through employee stock purchase plans (ESPPs) and stock incentive plans.

How does the Etrade Form 3922 impact my taxes?

+The Etrade Form 3922 can impact your taxes in various ways, depending on the specific scenario. For example, you may be subject to ordinary income tax on the difference between the fair market value of the stock and the exercise price if you exercise stock options.

Where can I find additional resources to help me understand the Etrade Form 3922?

+You can find additional resources on the IRS website, consult a tax professional, or contact Etrade customer support for assistance.

In conclusion, understanding the Etrade Form 3922 is crucial for ensuring accurate reporting and minimizing potential tax liabilities. By following these six tips, you'll be better equipped to navigate the complexities of this form and ensure you're taking advantage of any available tax deductions or credits.