Filling out a G4 form can be a daunting task, especially for those who are new to the world of taxes and accounting. The G4 form, also known as the "State of Georgia Employee's Withholding Exemption Certificate," is a document that employees must complete to determine the amount of state income tax withheld from their paychecks. In this article, we will guide you through the process of filling out a G4 form, making it easy for beginners to understand and complete.

The Importance of Accurate G4 Forms

Accurate completion of the G4 form is crucial to ensure that the correct amount of state income tax is withheld from your paychecks. If the form is not completed correctly, it may lead to over-withholding or under-withholding of taxes, resulting in penalties and fines. Moreover, incorrect information may also lead to delays in processing your tax returns.

What You Need to Know Before Filling Out the G4 Form

Before filling out the G4 form, you need to understand the basics of state income tax withholding. Here are some key points to consider:

- Residency: You must be a resident of the state of Georgia to complete the G4 form.

- Withholding Allowances: The G4 form allows you to claim withholding allowances, which determine the amount of taxes withheld from your paycheck.

- Dependents: You can claim dependents on the G4 form, which may affect the amount of taxes withheld.

Step-by-Step Guide to Filling Out the G4 Form

Now that you understand the basics of the G4 form, let's dive into the step-by-step guide to filling it out.

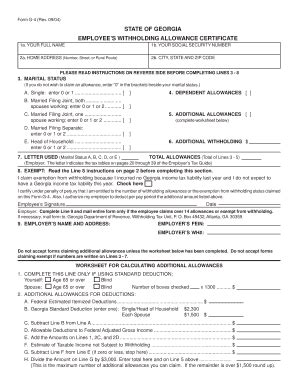

Step 1: Enter Your Personal Information

- Name: Enter your full name as it appears on your social security card.

- Address: Enter your current address, including your street address, city, state, and zip code.

- Social Security Number: Enter your social security number.

Step 2: Claim Withholding Allowances

- Single: If you are single, you can claim one withholding allowance.

- Married: If you are married, you can claim two withholding allowances.

- Dependents: If you have dependents, you can claim additional withholding allowances.

Step 3: Claim Dependents

- Dependent Children: Enter the number of dependent children you have.

- Dependent Relatives: Enter the number of dependent relatives you have.

Step 4: Sign and Date the Form

- Signature: Sign the form with your full name.

- Date: Date the form with the current date.

Tips for Filling Out the G4 Form

Here are some tips to keep in mind when filling out the G4 form:

- Read the instructions carefully: Make sure you understand the instructions before filling out the form.

- Use a pen: Use a pen to fill out the form, as pencil marks may not be accepted.

- Double-check your information: Double-check your information to ensure accuracy.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out the G4 form:

- Incorrect social security number: Make sure you enter your correct social security number.

- Incorrect address: Make sure you enter your correct address.

Conclusion

Filling out a G4 form can seem intimidating, but with the right guidance, it can be a breeze. Remember to read the instructions carefully, use a pen, and double-check your information to ensure accuracy. Avoid common mistakes, such as incorrect social security numbers and addresses. By following these tips, you can complete the G4 form with ease and ensure that your state income tax withholding is accurate.

Encourage Engagement

We hope this article has helped you understand the G4 form and how to fill it out accurately. If you have any questions or concerns, please leave a comment below. Share this article with your friends and family who may be struggling with filling out the G4 form.

FAQ Section

What is the purpose of the G4 form?

+The G4 form is used to determine the amount of state income tax withheld from an employee's paycheck.

Who is required to complete the G4 form?

+All employees who are residents of the state of Georgia are required to complete the G4 form.

How often do I need to update the G4 form?

+You need to update the G4 form whenever your personal or financial situation changes, such as getting married or having a child.