The New York Form IT-370-PF is a crucial document for pass-through entities operating in the state of New York. As a business owner or tax professional, understanding the intricacies of this form is vital for ensuring compliance with state tax regulations. In this article, we will delve into five essential facts about the New York Form IT-370-PF, providing you with a comprehensive guide to navigate the complexities of this form.

What is the New York Form IT-370-PF?

The New York Form IT-370-PF is a tax form used by pass-through entities, such as partnerships and S corporations, to report their income and claim any applicable credits. The form is used to calculate the entity's tax liability and to provide information to the state about the entity's income, deductions, and credits.

Purpose of the Form

The primary purpose of the New York Form IT-370-PF is to report the entity's income and claim any applicable credits. The form is used to calculate the entity's tax liability and to provide information to the state about the entity's income, deductions, and credits. The form is typically filed annually, and the deadline for filing is usually March 15th of each year.

Who is Required to File the Form?

The New York Form IT-370-PF is required to be filed by pass-through entities that have income or gain derived from New York sources. This includes:

- Partnerships

- S corporations

- Limited liability companies (LLCs) that are treated as partnerships for federal tax purposes

- Other pass-through entities that have income or gain derived from New York sources

Filing Requirements

To file the New York Form IT-370-PF, entities must meet certain requirements. These include:

- The entity must have income or gain derived from New York sources

- The entity must be a pass-through entity

- The entity must have a valid Federal Employer Identification Number (FEIN)

- The entity must have a valid New York State tax account number

What Information is Required on the Form?

The New York Form IT-370-PF requires entities to provide detailed information about their income, deductions, and credits. This includes:

- Income from all sources, including business income, investment income, and rental income

- Deductions for business expenses, depreciation, and amortization

- Credits for taxes paid to other states or local governments

- Information about the entity's ownership structure and tax classification

Additional Schedules and Attachments

In addition to the main form, entities may be required to file additional schedules and attachments. These include:

- Schedule A: Income and Deductions

- Schedule B: Credits and Taxes

- Schedule C: Depreciation and Amortization

- Schedule D: Capital Gains and Losses

- Form IT-203: Attachment for schedule of depreciation and amortization

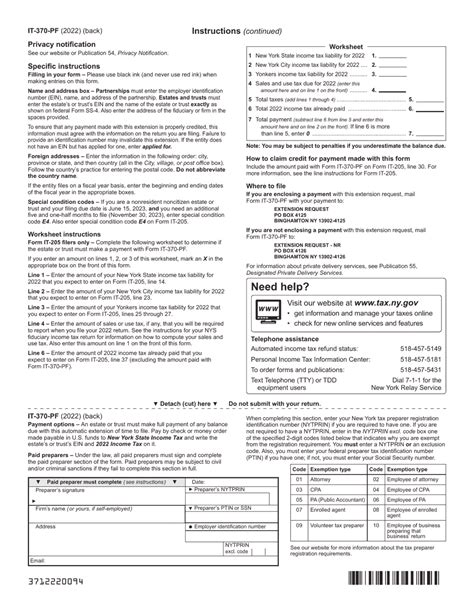

How to File the Form

The New York Form IT-370-PF can be filed electronically or by mail. To file electronically, entities can use the New York State Department of Taxation and Finance's online filing system. To file by mail, entities can send the completed form to the address listed on the form.

Filing Deadlines and Penalties

The deadline for filing the New York Form IT-370-PF is typically March 15th of each year. Entities that fail to file the form on time may be subject to penalties and interest. The penalty for late filing is $100 per month, up to a maximum of $500.

Additional Resources

For additional information about the New York Form IT-370-PF, entities can consult the following resources:

- New York State Department of Taxation and Finance website

- New York State Tax Law and Regulations

- IRS website and publications

Conclusion

In conclusion, the New York Form IT-370-PF is a critical document for pass-through entities operating in the state of New York. By understanding the essential facts about this form, entities can ensure compliance with state tax regulations and avoid penalties and interest.

Who is required to file the New York Form IT-370-PF?

+The New York Form IT-370-PF is required to be filed by pass-through entities that have income or gain derived from New York sources. This includes partnerships, S corporations, limited liability companies (LLCs) that are treated as partnerships for federal tax purposes, and other pass-through entities.

What is the deadline for filing the New York Form IT-370-PF?

+The deadline for filing the New York Form IT-370-PF is typically March 15th of each year.

What are the penalties for late filing of the New York Form IT-370-PF?

+The penalty for late filing of the New York Form IT-370-PF is $100 per month, up to a maximum of $500.