For individuals in Nevada looking to transfer property ownership, a quitclaim deed is a viable option. This type of deed is used to convey one person's interest in a property to another person or entity, but it does not guarantee that the grantor has clear ownership of the property. In this article, we will provide seven essential tips for navigating the Nevada quitclaim deed form.

Understanding the Nevada Quitclaim Deed Form

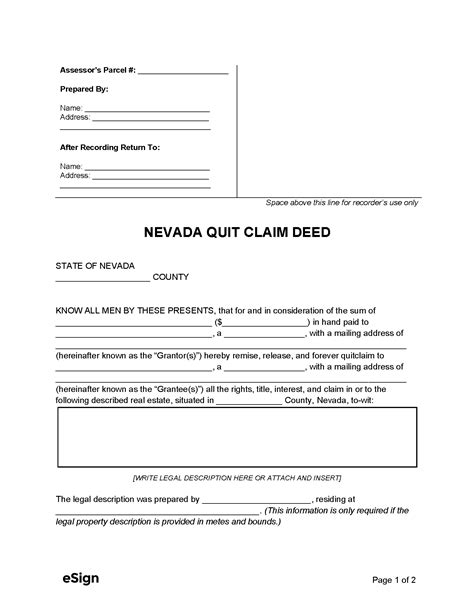

Before diving into the tips, it's essential to understand the basics of a quitclaim deed in Nevada. A quitclaim deed is a type of deed that transfers the grantor's interest in a property to the grantee. It does not provide any warranties or guarantees about the property's title, which means the grantee assumes the risk of any potential title issues.

Tip 1: Ensure Proper Identification

When filling out the Nevada quitclaim deed form, it's crucial to ensure that all parties involved are properly identified. This includes the grantor (the person transferring the property) and the grantee (the person receiving the property). Make sure to include the full names and addresses of both parties.

The Importance of Property Description

A crucial aspect of the Nevada quitclaim deed form is the property description. This section requires a detailed description of the property being transferred, including the address, county, and any relevant parcel numbers.

Tip 2: Accurate Property Description

To avoid any potential issues, ensure that the property description is accurate and complete. You can obtain the necessary information from the county recorder's office or by hiring a title company to perform a title search.

Signing and Notarization Requirements

In Nevada, the quitclaim deed form must be signed and notarized by the grantor. This ensures that the grantor is acknowledging the transfer of ownership and that the deed is legitimate.

Tip 3: Comply with Signing and Notarization Requirements

Make sure that the grantor signs the quitclaim deed form in the presence of a notary public. The notary will verify the grantor's identity and witness the signature. This step is essential to ensure the validity of the deed.

Recording the Quitclaim Deed

After the quitclaim deed form is signed and notarized, it must be recorded with the county recorder's office in Nevada. This step is critical to provide public notice of the transfer of ownership.

Tip 4: Record the Quitclaim Deed Promptly

To avoid any potential issues, record the quitclaim deed form with the county recorder's office as soon as possible. This will provide public notice of the transfer of ownership and help prevent any future disputes.

Tax Implications

When transferring property ownership using a quitclaim deed, there may be tax implications. In Nevada, the grantor may be responsible for paying any applicable transfer taxes.

Tip 5: Consider Tax Implications

Before signing the quitclaim deed form, consider the potential tax implications. Consult with a tax professional or attorney to ensure you understand any tax obligations.

Potential Risks and Consequences

Using a quitclaim deed to transfer property ownership can have potential risks and consequences. For example, if the grantor does not have clear ownership of the property, the grantee may assume the risk of any title issues.

Tip 6: Understand Potential Risks and Consequences

Before signing the quitclaim deed form, make sure you understand the potential risks and consequences. Consider consulting with an attorney to ensure you are making an informed decision.

Seeking Professional Advice

When navigating the Nevada quitclaim deed form, it's essential to seek professional advice. An attorney or title company can help ensure that the transfer of ownership is completed correctly and efficiently.

Tip 7: Seek Professional Advice

Consider consulting with an attorney or title company to ensure that the quitclaim deed form is completed correctly. They can provide valuable guidance and help you avoid any potential issues.

By following these seven tips, individuals in Nevada can navigate the quitclaim deed form with confidence. Remember to ensure proper identification, accurate property description, comply with signing and notarization requirements, record the quitclaim deed promptly, consider tax implications, understand potential risks and consequences, and seek professional advice.

We invite you to share your experiences or ask questions about the Nevada quitclaim deed form in the comments section below.