Understanding the Brighthouse Annuity Withdrawal Process

Withdrawing from a Brighthouse annuity can be a complex process, especially for those who are not familiar with the procedures involved. It's essential to understand the rules and regulations surrounding annuity withdrawals to avoid any potential penalties or fees. In this article, we will provide a step-by-step guide on how to withdraw from a Brighthouse annuity, including the necessary forms and documentation required.

Why Withdraw from a Brighthouse Annuity?

There are several reasons why you may need to withdraw from a Brighthouse annuity. Some common reasons include:

- Retirement: If you're approaching retirement age, you may need to access your annuity funds to support your living expenses.

- Emergency: In the event of an unexpected emergency, you may need to withdraw from your annuity to cover unexpected expenses.

- Investment: You may want to withdraw from your annuity to invest in other financial products or assets.

Eligibility for Withdrawal

Before you can withdraw from a Brighthouse annuity, you need to meet certain eligibility criteria. These criteria include:

- Age: You must be at least 59 1/2 years old to withdraw from a Brighthouse annuity without incurring a 10% penalty.

- Ownership: You must be the owner of the annuity contract to withdraw funds.

- Beneficiary: If you're a beneficiary of the annuity, you may be eligible to withdraw funds after the owner's death.

Step-by-Step Guide to Withdrawing from a Brighthouse Annuity

Withdrawing from a Brighthouse annuity involves several steps, including:

- Review your annuity contract: Before you start the withdrawal process, review your annuity contract to understand the rules and regulations surrounding withdrawals.

- Gather required documents: You'll need to gather certain documents, including your annuity contract, identification, and proof of address.

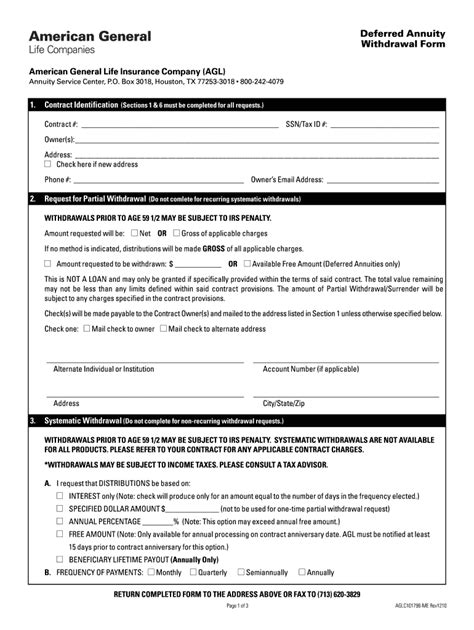

- Complete the withdrawal form: You'll need to complete the Brighthouse annuity withdrawal form, which can be obtained from the Brighthouse website or by contacting their customer service department.

- Submit the withdrawal form: Once you've completed the withdrawal form, submit it to Brighthouse along with the required documents.

- Wait for processing: Brighthouse will process your withdrawal request, which may take several days or weeks.

Brighthouse Annuity Withdrawal Form: What You Need to Know

The Brighthouse annuity withdrawal form is a critical document that requires accurate and complete information. Here are some key things to know about the form:

- Form availability: The Brighthouse annuity withdrawal form can be obtained from the Brighthouse website or by contacting their customer service department.

- Form requirements: The form requires your personal and annuity contract information, including your name, address, and annuity contract number.

- Signature requirements: The form must be signed by the annuity owner or beneficiary, depending on who is requesting the withdrawal.

Common Mistakes to Avoid When Withdrawing from a Brighthouse Annuity

When withdrawing from a Brighthouse annuity, it's essential to avoid common mistakes that can result in penalties or fees. Here are some common mistakes to avoid:

- Insufficient documentation: Failing to provide required documents can delay or reject your withdrawal request.

- Incomplete or inaccurate information: Providing incomplete or inaccurate information on the withdrawal form can result in delays or penalties.

- Failure to review the annuity contract: Failing to review the annuity contract can result in unexpected penalties or fees.

Tax Implications of Withdrawing from a Brighthouse Annuity

Withdrawing from a Brighthouse annuity can have tax implications, including:

- Ordinary income tax: Withdrawals from a Brighthouse annuity are taxed as ordinary income, which can impact your tax bracket.

- Penalties: Withdrawing from a Brighthouse annuity before age 59 1/2 can result in a 10% penalty, in addition to ordinary income tax.

Conclusion

Withdrawing from a Brighthouse annuity requires careful consideration and attention to detail. By following the step-by-step guide outlined in this article, you can ensure a smooth and successful withdrawal process. Remember to review your annuity contract, gather required documents, and complete the withdrawal form accurately to avoid any potential penalties or fees.

What is the Brighthouse annuity withdrawal form?

+The Brighthouse annuity withdrawal form is a document required to withdraw funds from a Brighthouse annuity. The form can be obtained from the Brighthouse website or by contacting their customer service department.

What are the eligibility criteria for withdrawing from a Brighthouse annuity?

+To withdraw from a Brighthouse annuity, you must be at least 59 1/2 years old, be the owner of the annuity contract, or be a beneficiary of the annuity.

What are the tax implications of withdrawing from a Brighthouse annuity?

+Withdrawals from a Brighthouse annuity are taxed as ordinary income, and may be subject to a 10% penalty if withdrawn before age 59 1/2.