In today's complex tax landscape, navigating the intricacies of tax forms can be a daunting task for individuals and businesses alike. One such form that requires attention to detail and a thorough understanding of tax regulations is Form 480.7c, also known as the "Request for Relief from Joint and Several Liability" form. In this comprehensive guide, we will walk you through the process of completing Form 480.7c, step by step, to help you navigate the complexities of tax relief.

The Importance of Form 480.7c

Form 480.7c is a critical document for individuals who have been deemed jointly and severally liable for a tax debt, often as a result of filing a joint tax return. When the IRS determines that a joint tax liability exists, both spouses are held responsible for the entire amount of tax due, plus interest and penalties. However, there are situations where one spouse may be eligible for relief from this joint liability. This is where Form 480.7c comes into play.

Understanding Joint and Several Liability

Before diving into the form itself, it's essential to grasp the concept of joint and several liability. Joint and several liability is a principle of tax law that holds both spouses responsible for the entire amount of tax due, regardless of which spouse earned the income or incurred the debt. This means that if one spouse is unable or unwilling to pay their share of the tax debt, the other spouse may be held liable for the entire amount.

To be eligible for relief from joint and several liability, a spouse must meet specific conditions. These conditions include:

- Filing a joint tax return

- Having a joint tax liability

- Being separated or divorced from the spouse with whom the joint return was filed

- Being unable to pay the joint tax liability due to circumstances beyond their control

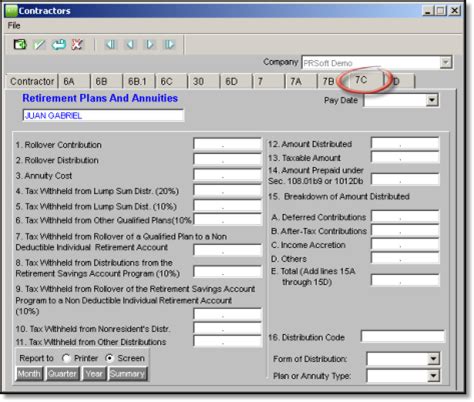

Step-by-Step Guide to Completing Form 480.7c

Now that we've covered the importance of Form 480.7c and the concept of joint and several liability, let's move on to the step-by-step guide to completing the form.

Section 1: Request for Relief

This section is where you'll begin by providing your personal details, including your name, Social Security number, and mailing address. Make sure to fill in the correct information, as this will be used to identify you and process your request.

- Box 1: Enter your name and Social Security number.

- Box 2: Provide your mailing address.

Section 2: Joint Return Information

In this section, you'll need to provide information about the joint tax return that resulted in the joint liability.

- Box 3: Enter the tax year for which you're requesting relief.

- Box 4: Provide the date the joint return was filed.

Section 3: Reason for Request

Here, you'll need to explain why you're requesting relief from joint and several liability.

- Box 5: Choose the reason for your request from the drop-down menu.

- Box 6: Provide a detailed explanation of your situation.

Section 4: Signature

This is where you'll sign and date the form.

- Box 7: Sign your name in the presence of a notary public, if required.

- Box 8: Date the form.

Section 5: Supporting Documentation

In this section, you'll need to attach supporting documentation to substantiate your claim for relief.

- Attach: Provide copies of relevant documents, such as divorce decrees, separation agreements, or financial statements.

Section 6: Certification

This section is where you'll certify that the information provided is accurate and true.

- Box 9: Check the box to certify that the information is accurate.

Section 7: Notary Public (If Required)

If required, have a notary public sign and date the form.

- Box 10: Notary public signature and date.

Section 8: Mailing Instructions

Finally, you'll need to mail the completed form to the IRS.

- Mail to: Send the form to the address listed in the instructions.

Tips and Best Practices

When completing Form 480.7c, keep the following tips and best practices in mind:

- Read the instructions carefully: Take the time to read and understand the instructions before filling out the form.

- Provide accurate information: Make sure to provide accurate and complete information to avoid delays or rejection of your request.

- Attach supporting documentation: Provide all required supporting documentation to substantiate your claim for relief.

- Keep a copy: Keep a copy of the completed form and supporting documentation for your records.

Frequently Asked Questions

Q: What is Form 480.7c used for? A: Form 480.7c is used to request relief from joint and several liability for a tax debt.

Q: Who is eligible for relief from joint and several liability? A: Spouses who have filed a joint tax return and have a joint tax liability may be eligible for relief.

Q: What documentation is required to support my claim for relief? A: You'll need to attach supporting documentation, such as divorce decrees, separation agreements, or financial statements, to substantiate your claim.

Q: Where do I mail the completed form? A: Mail the completed form to the address listed in the instructions.

In conclusion, completing Form 480.7c requires attention to detail and a thorough understanding of tax regulations. By following this step-by-step guide, you'll be well on your way to requesting relief from joint and several liability. Remember to provide accurate information, attach supporting documentation, and keep a copy of the completed form for your records.

What is the purpose of Form 480.7c?

+Form 480.7c is used to request relief from joint and several liability for a tax debt.

Who is eligible for relief from joint and several liability?

+Spouses who have filed a joint tax return and have a joint tax liability may be eligible for relief.

What documentation is required to support my claim for relief?

+You'll need to attach supporting documentation, such as divorce decrees, separation agreements, or financial statements, to substantiate your claim.