Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. In Nebraska, residents are required to file a state income tax return, known as the Nebraska Form 1040N, in addition to their federal tax return. To make the process easier, here are 7 tips for filing Nebraska Form 1040N.

Understanding the Nebraska Form 1040N

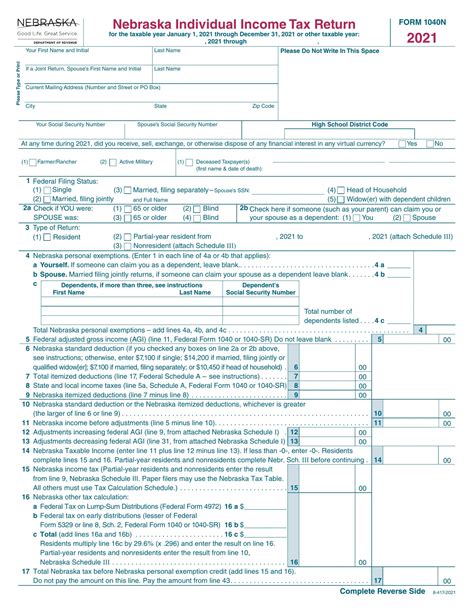

Before we dive into the tips, it's essential to understand what the Nebraska Form 1040N is and what it's used for. The Nebraska Form 1040N is the state's individual income tax return, which is used to report an individual's income, deductions, and credits. The form is similar to the federal Form 1040, but it's specific to Nebraska's tax laws and regulations.

Who Needs to File the Nebraska Form 1040N?

Not everyone who lives in Nebraska needs to file the Nebraska Form 1040N. Generally, you need to file a Nebraska state tax return if you:

- Are a resident of Nebraska and have income from Nebraska sources

- Are a non-resident of Nebraska and have income from Nebraska sources

- Have a Nebraska tax liability

- Want to claim a refund of Nebraska state income taxes withheld

Tips for Filing Nebraska Form 1040N

Now that we've covered the basics, here are 7 tips to help you file your Nebraska Form 1040N correctly and efficiently:

Tip 1: Gather All Necessary Documents

Before you start filling out the Nebraska Form 1040N, make sure you have all the necessary documents and information. This includes:

- Your federal tax return (Form 1040)

- Your W-2 forms from your employer(s)

- Your 1099 forms for freelance work or other income

- Your interest statements from banks and investments

- Your charitable donation receipts

- Your medical expense receipts

Tip 2: Use the Correct Filing Status

Your filing status affects your tax liability, so it's essential to use the correct filing status on your Nebraska Form 1040N. The filing status options are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Tip 3: Report All Income

Make sure to report all your income on the Nebraska Form 1040N, including:

- Wages and salaries

- Tips and bonuses

- Interest and dividends

- Capital gains and losses

- Freelance work and other income

Tip 4: Claim All Eligible Deductions and Credits

Nebraska offers various deductions and credits that can reduce your tax liability. Make sure to claim all eligible deductions and credits, including:

- Standard deduction or itemized deductions

- Personal exemption

- Earned income tax credit (EITC)

- Child tax credit

- Education credits

Tip 5: File Electronically

Filing your Nebraska Form 1040N electronically is faster and more accurate than filing a paper return. You can e-file your return through the Nebraska Department of Revenue's website or through a tax preparation software.

Tip 6: Pay Any Tax Due by the Deadline

If you owe taxes, make sure to pay by the deadline to avoid penalties and interest. You can pay online, by phone, or by mail.

Tip 7: Seek Help If Needed

If you're unsure about how to file your Nebraska Form 1040N or need help with the process, don't hesitate to seek help. You can contact the Nebraska Department of Revenue or a tax professional for assistance.

By following these 7 tips, you can ensure that you file your Nebraska Form 1040N correctly and efficiently. Remember to stay organized, report all income, and claim all eligible deductions and credits to minimize your tax liability.

What is the deadline for filing the Nebraska Form 1040N?

+The deadline for filing the Nebraska Form 1040N is typically April 15th of each year.

Can I file my Nebraska Form 1040N electronically?

+What is the standard deduction for the Nebraska Form 1040N?

+The standard deduction for the Nebraska Form 1040N varies depending on your filing status. You can check the Nebraska Department of Revenue's website for the current standard deduction amounts.