Introduction to Form 17a-5: A Critical Component of SEC Reporting Requirements

As a registered broker-dealer, compliance with SEC reporting requirements is crucial to maintaining the integrity and transparency of your firm. One of the most critical components of these requirements is Form 17a-5, a quarterly report that provides insight into a broker-dealer's financial condition and operational practices. In this article, we will delve into the world of Form 17a-5, exploring its purpose, key components, and best practices for compliance.

What is Form 17a-5?

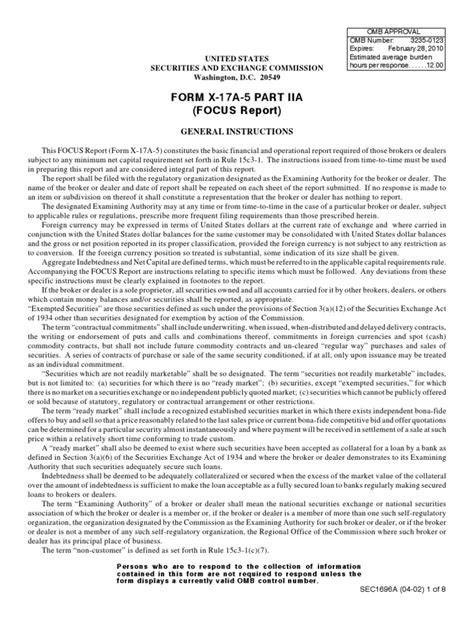

Form 17a-5 is a quarterly report filed with the Securities and Exchange Commission (SEC) by registered broker-dealers. The report provides a snapshot of a firm's financial condition, including its net capital, aggregate indebtedness, and other critical metrics. The form is designed to help the SEC monitor a broker-dealer's compliance with the net capital rule, Rule 15c3-1, and other regulatory requirements.

Purpose of Form 17a-5

The primary purpose of Form 17a-5 is to provide the SEC with a comprehensive understanding of a broker-dealer's financial condition and operational practices. The report is used to:

- Monitor a firm's compliance with the net capital rule and other regulatory requirements

- Identify potential risks and vulnerabilities in a firm's financial condition

- Evaluate a firm's ability to meet its financial obligations and maintain adequate liquidity

Key Components of Form 17a-5

Form 17a-5 is a complex report that requires broker-dealers to provide a wide range of financial and operational data. The key components of the report include:

-

Part I: Net Capital and Aggregate Indebtedness

+ Broker-dealers must report their net capital, aggregate indebtedness, and other critical metrics. + This section provides insight into a firm's financial condition and its ability to meet its financial obligations. -

Part II: Operational Practices

+ Broker-dealers must report on their operational practices, including their custody and control of customer securities and cash. + This section provides insight into a firm's risk management practices and its ability to protect customer assets. -

Part III: Supervisory Controls

+ Broker-dealers must report on their supervisory controls, including their procedures for monitoring and controlling risk. + This section provides insight into a firm's ability to manage risk and maintain adequate internal controls.

Best Practices for Compliance

To ensure compliance with Form 17a-5 requirements, broker-dealers should follow these best practices:

-

Establish a Strong Compliance Program

+ Develop a comprehensive compliance program that includes policies and procedures for filing Form 17a-5. + Ensure that all employees understand their roles and responsibilities in the compliance program. -

Conduct Regular Reviews and Audits

+ Conduct regular reviews and audits of your firm's financial condition and operational practices. + Identify and address any potential risks or vulnerabilities. -

Seek Professional Advice

+ Seek professional advice from a qualified attorney or accountant to ensure compliance with Form 17a-5 requirements. + Ensure that all filings are accurate and complete.

Conclusion

Form 17a-5 is a critical component of SEC reporting requirements for registered broker-dealers. By understanding the purpose, key components, and best practices for compliance, firms can ensure that they are meeting their regulatory obligations and maintaining the integrity and transparency of their operations. Remember to stay informed, establish a strong compliance program, and seek professional advice to ensure compliance with Form 17a-5 requirements.

We encourage you to share your thoughts and experiences with Form 17a-5 in the comments below. If you have any questions or concerns, please don't hesitate to reach out to us.

What is the purpose of Form 17a-5?

+The primary purpose of Form 17a-5 is to provide the SEC with a comprehensive understanding of a broker-dealer's financial condition and operational practices.

What are the key components of Form 17a-5?

+The key components of Form 17a-5 include Part I: Net Capital and Aggregate Indebtedness, Part II: Operational Practices, and Part III: Supervisory Controls.

What are the best practices for compliance with Form 17a-5?

+Best practices for compliance include establishing a strong compliance program, conducting regular reviews and audits, and seeking professional advice.