The world of tax forms can be overwhelming, especially for small business owners, freelancers, and independent contractors. One of the most critical forms is the Form 1099, which reports various types of income and payments to the Internal Revenue Service (IRS). In this article, we will provide a comprehensive, step-by-step guide to Form 1099 general instructions, making it easier for you to navigate the process.

The importance of accurate and timely reporting of income and payments cannot be overstated. The IRS uses the information reported on Form 1099 to ensure that individuals and businesses are meeting their tax obligations. Failure to comply with these regulations can result in penalties, fines, and even audits.

What is Form 1099?

Form 1099 is a series of tax forms used to report various types of income and payments to the IRS. There are several types of Form 1099, each designed for specific purposes, such as:

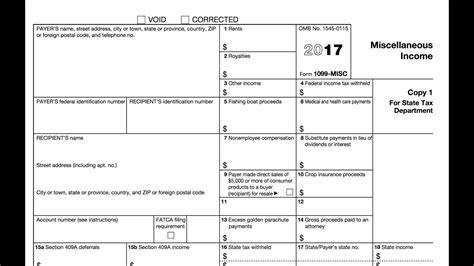

- Form 1099-MISC: Reports miscellaneous income, such as freelance work, rent, and royalties.

- Form 1099-INT: Reports interest income from banks, credit unions, and other financial institutions.

- Form 1099-DIV: Reports dividend income from stocks and mutual funds.

- Form 1099-B: Reports proceeds from broker and barter exchange transactions.

Who Needs to File Form 1099?

Businesses, organizations, and individuals who make payments to others are required to file Form 1099. This includes:

- Employers who pay independent contractors and freelancers.

- Banks and financial institutions that pay interest on deposits.

- Corporations that pay dividends to shareholders.

- Brokers and barter exchanges that facilitate transactions.

Step-by-Step Guide to Form 1099 General Instructions

Now that we have covered the basics, let's dive into the step-by-step guide to Form 1099 general instructions.

Step 1: Determine Which Form 1099 to Use

The first step is to determine which type of Form 1099 is required for your specific situation. Refer to the list above to identify the correct form for your needs.

Step 2: Gather Required Information

To complete Form 1099, you will need to gather the following information:

- The recipient's name, address, and Taxpayer Identification Number (TIN).

- The type and amount of payment made.

- The date of payment.

Step 3: Complete Form 1099

Once you have gathered the required information, complete Form 1099 according to the specific instructions for each type of form. Make sure to include all required information and follow the instructions carefully.

Step 4: Furnish Copies to Recipients

After completing Form 1099, furnish a copy to each recipient by January 31st of each year. This is a critical step, as recipients need this information to complete their own tax returns.

Step 5: File Form 1099 with the IRS

Finally, file Form 1099 with the IRS by February 28th of each year (or March 31st if filing electronically). Make sure to include a transmittal form (Form 1096) with your submission.

Common Mistakes to Avoid

When completing Form 1099, it's essential to avoid common mistakes that can result in penalties and delays. Some of the most common mistakes include:

- Failing to report all payments.

- Incorrectly reporting payment amounts.

- Failing to furnish copies to recipients.

- Missing filing deadlines.

Penalties for Non-Compliance

Failure to comply with Form 1099 regulations can result in significant penalties, including:

- Fines of up to $250 per form for failure to file or furnish copies.

- Fines of up to $500 per form for intentional disregard of filing requirements.

- Interest and penalties on unpaid taxes.

Conclusion

Form 1099 is a critical tax form that requires accurate and timely reporting of income and payments. By following these step-by-step instructions and avoiding common mistakes, you can ensure compliance with IRS regulations and avoid penalties.

We hope this article has provided valuable insights into Form 1099 general instructions. If you have any questions or concerns, please don't hesitate to reach out to us.

What is the deadline for filing Form 1099?

+February 28th of each year (or March 31st if filing electronically)

Who is required to file Form 1099?

+Businesses, organizations, and individuals who make payments to others

What is the penalty for failing to file Form 1099?

+Fines of up to $250 per form for failure to file or furnish copies