The Internal Revenue Service (IRS) plays a vital role in the United States, primarily responsible for the collection of taxes and enforcement of tax laws. To ensure compliance with tax regulations, the IRS requires various forms and declarations from individuals and organizations. One such form is the Form W-12, also known as the IRS Declaration for Federal Employment.

In this article, we will delve into the details of Form W-12, its importance, and the process of filling it out.

What is Form W-12?

Form W-12 is a declaration form used by the IRS to verify an individual's eligibility for federal employment. It is a critical document that helps the IRS determine whether an applicant is eligible to work in the United States and is compliant with federal tax laws. The form is typically required for individuals applying for federal jobs, including those in the military, government agencies, and other federal organizations.

Why is Form W-12 necessary?

Form W-12 is necessary to ensure that individuals applying for federal employment are eligible to work in the United States and are compliant with federal tax laws. The form helps the IRS verify an individual's identity, citizenship, and tax status. This information is crucial in determining an individual's eligibility for federal employment and ensuring that they are not in violation of any tax laws.

Who needs to fill out Form W-12?

Form W-12 is typically required for individuals applying for federal jobs, including:

- Military personnel

- Government agency employees

- Federal contractors

- Federal interns

- Other federal organizations

If you are applying for a federal job, you will likely be required to fill out Form W-12 as part of the hiring process.

How to fill out Form W-12?

Filling out Form W-12 is a relatively straightforward process. Here are the steps you need to follow:

- Download the form: You can download Form W-12 from the IRS website or obtain it from your employer.

- Read the instructions: Carefully read the instructions provided with the form to ensure you understand what information is required.

- Fill out the form: Fill out the form accurately and completely, providing all required information.

- Sign the form: Sign the form in the presence of a notary public or an authorized representative of your employer.

- Submit the form: Submit the completed form to your employer or the relevant federal agency.

What information is required on Form W-12?

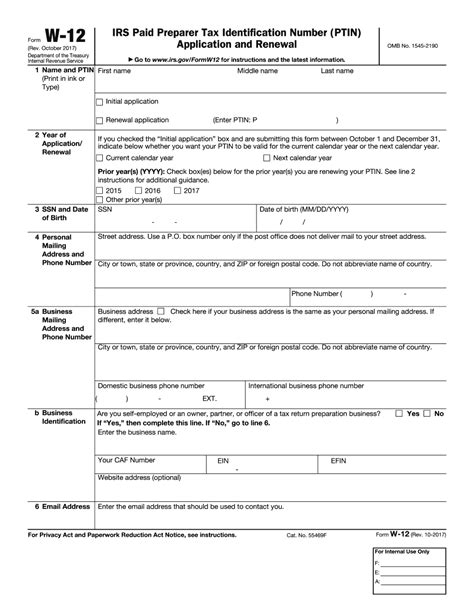

Form W-12 requires the following information:

- Your name and address

- Your date of birth

- Your Social Security number

- Your citizenship status

- Your tax status (e.g., single, married, head of household)

- Your employment status (e.g., full-time, part-time, student)

- Your education level (e.g., high school, college, graduate degree)

- Your work experience (including previous federal employment)

Common mistakes to avoid when filling out Form W-12

Here are some common mistakes to avoid when filling out Form W-12:

- Incomplete or inaccurate information

- Failure to sign the form

- Failure to provide required documentation (e.g., proof of citizenship, Social Security card)

- Failure to submit the form on time

Benefits of Form W-12

Form W-12 provides several benefits, including:

- Verification of eligibility for federal employment

- Compliance with federal tax laws

- Protection against identity theft and tax evasion

- Streamlined hiring process for federal agencies

Conclusion

Form W-12 is a critical document required for federal employment. It helps the IRS verify an individual's eligibility for federal employment and ensures compliance with federal tax laws. By understanding the purpose and requirements of Form W-12, individuals can ensure a smooth hiring process and avoid common mistakes.

Next Steps

If you are applying for a federal job, make sure to obtain Form W-12 from your employer or the relevant federal agency. Carefully fill out the form, providing all required information, and submit it on time. If you have any questions or concerns, do not hesitate to reach out to your employer or the IRS for assistance.

What is the purpose of Form W-12?

+Form W-12 is a declaration form used by the IRS to verify an individual's eligibility for federal employment.

Who needs to fill out Form W-12?

+Form W-12 is typically required for individuals applying for federal jobs, including military personnel, government agency employees, federal contractors, and other federal organizations.

What information is required on Form W-12?

+Form W-12 requires information such as your name and address, date of birth, Social Security number, citizenship status, tax status, employment status, education level, and work experience.