Tax season is upon us, and for many individuals, that means navigating the complexities of the Il Form 1040. As the standard form used for personal income tax returns, the Il Form 1040 can be daunting, especially for those who are new to filing taxes or have experienced significant changes in their financial situation. However, with the right guidance, you can ensure that your tax return is accurate, complete, and filed on time.

In this article, we will provide you with five essential tips for understanding Il Form 1040 instructions, helping you to avoid common mistakes and make the most of your tax return.

Understanding Your Filing Status

Before diving into the Il Form 1040 instructions, it's essential to understand your filing status. Your filing status determines the tax rates and deductions you're eligible for, so it's crucial to choose the correct one. The five filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the filing status that best reflects your situation, and ensure you meet the necessary requirements.

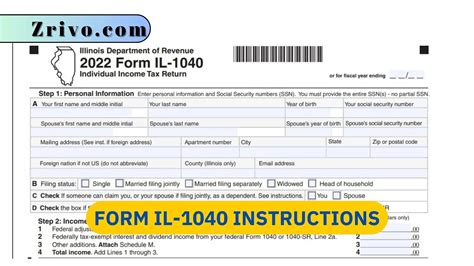

What to Expect from Il Form 1040

Il Form 1040 is divided into several sections, each addressing a specific aspect of your income and tax situation. The form is designed to guide you through the tax-filing process, but it's essential to understand what to expect from each section. Here's a brief overview:

- Section 1: Income – report your income from all sources, including wages, salaries, tips, and self-employment income.

- Section 2: Adjustments to income – claim deductions for contributions to retirement accounts, student loan interest, and other eligible expenses.

- Section 3: Tax credits – claim credits for education expenses, child care, and other eligible expenses.

- Section 4: Tax – calculate your total tax liability based on your income and deductions.

Gathering Required Documents

To ensure accuracy and completeness, it's essential to gather all required documents before starting your Il Form 1040. Some of the most common documents include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work, interest, and dividends

- Receipts for charitable donations and medical expenses

- Records of mortgage interest and property taxes

- Social Security number or Individual Taxpayer Identification Number (ITIN)

Make sure to keep these documents organized and easily accessible to avoid delays or errors.

Claiming Deductions and Credits

Deductions and credits can significantly impact your tax liability, so it's essential to claim all eligible expenses. Here are some common deductions and credits to consider:

- Standard deduction – a fixed amount that reduces your taxable income

- Itemized deductions – expenses like mortgage interest, property taxes, and charitable donations

- Earned Income Tax Credit (EITC) – a refundable credit for low-to-moderate-income working individuals and families

- Child Tax Credit – a non-refundable credit for families with qualifying children

Research and claim all eligible deductions and credits to minimize your tax liability.

Filing Electronically vs. Paper

When it comes to filing your Il Form 1040, you have two options: electronic or paper. Electronic filing is generally faster, more accurate, and more convenient. Here are some benefits of electronic filing:

- Faster refunds – electronic filing allows the IRS to process your return more quickly

- Reduced errors – electronic filing reduces the risk of mathematical errors and missing information

- Convenience – electronic filing can be done from the comfort of your own home

However, if you prefer to file by paper, make sure to follow the instructions carefully and submit your return on time.

Seeking Professional Help

If you're unsure about any aspect of the Il Form 1040 instructions or need help with your tax return, consider seeking professional assistance. Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide guidance and support to ensure your return is accurate and complete.

Don't hesitate to ask for help if you need it – it's always better to be safe than sorry when it comes to your tax return.

Final Tips and Reminders

As you navigate the Il Form 1040 instructions, keep the following tips and reminders in mind:

- File on time – the tax filing deadline is typically April 15th, but it may vary depending on your location and circumstances.

- Keep records – maintain accurate and complete records of your income, deductions, and credits.

- Stay informed – stay up-to-date with tax law changes and updates to ensure you're taking advantage of all eligible deductions and credits.

By following these tips and reminders, you can ensure a smooth and stress-free tax-filing experience.

We hope this article has provided you with valuable insights and guidance on understanding Il Form 1040 instructions. Remember to stay calm, take your time, and seek help if you need it. Happy filing!

What is the deadline for filing Il Form 1040?

+The tax filing deadline is typically April 15th, but it may vary depending on your location and circumstances.

Can I file Il Form 1040 electronically?

+Yes, you can file Il Form 1040 electronically. Electronic filing is generally faster, more accurate, and more convenient.

What documents do I need to gather for Il Form 1040?

+You'll need to gather documents such as W-2 forms, 1099 forms, receipts for charitable donations and medical expenses, and records of mortgage interest and property taxes.