The world of corporate taxes can be complex and overwhelming, especially for small business owners who are already juggling multiple responsibilities. However, understanding the tax forms and schedules required for your business is crucial to ensure compliance and minimize tax liabilities. In this article, we will delve into the S Corp tax form 1120S Schedule K, explaining its purpose, components, and how to complete it accurately.

What is Schedule K?

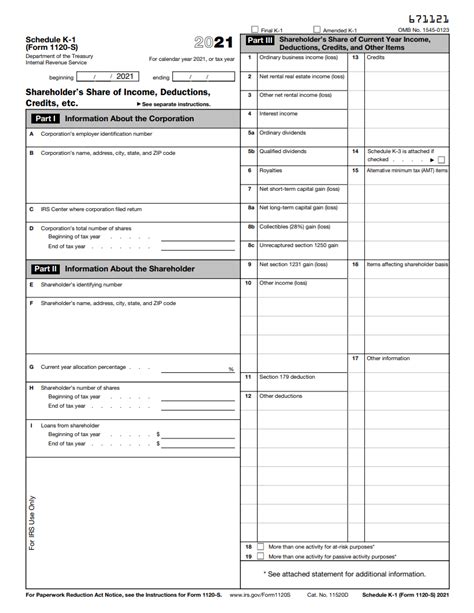

Schedule K is a supporting schedule to Form 1120S, which is the income tax return form for S corporations. The purpose of Schedule K is to report the shareholders' shares of income, deductions, and credits. This schedule is used to allocate the corporation's income and expenses to each shareholder, which is then reported on their individual tax returns.

Components of Schedule K

Schedule K consists of several parts, including:

- Part I: Income (Lines 1-10)

- Part II: Deductions (Lines 11-20)

- Part III: Credits (Lines 21-25)

- Part IV: Tax and Payments (Lines 26-30)

- Part V: Other Information (Lines 31-35)

Each part requires specific information about the corporation's income, deductions, credits, and tax payments. The schedule also includes lines for reporting various types of income, such as ordinary business income, capital gains, and dividends.

How to Complete Schedule K

To complete Schedule K accurately, follow these steps:

- Gather all necessary financial statements and records, including the corporation's income statement, balance sheet, and general ledger.

- Identify the shareholders and their respective ownership percentages.

- Calculate the corporation's total income, deductions, and credits.

- Allocate the income, deductions, and credits to each shareholder based on their ownership percentage.

- Complete each part of the schedule, using the calculations from step 4.

- Review the schedule for accuracy and completeness.

Tips and Considerations

When completing Schedule K, keep the following tips and considerations in mind:

- Ensure accurate calculation of income, deductions, and credits to avoid errors or omissions.

- Verify the ownership percentages of each shareholder to ensure accurate allocation of income and expenses.

- Report all types of income, including ordinary business income, capital gains, and dividends.

- Claim all eligible credits and deductions to minimize tax liabilities.

- Review the schedule for consistency with the corporation's financial statements and records.

Benefits of Accurate Schedule K Completion

Accurate completion of Schedule K is crucial for several reasons:

- Ensures compliance with tax laws and regulations

- Minimizes tax liabilities and potential penalties

- Provides accurate reporting of shareholders' income and expenses

- Facilitates smooth audit processes

- Enhances credibility and transparency with shareholders and stakeholders

Common Errors and Mistakes

Common errors and mistakes to avoid when completing Schedule K include:

- Inaccurate calculation of income, deductions, and credits

- Failure to report all types of income

- Incorrect allocation of income and expenses to shareholders

- Omission of required information or schedules

- Inconsistent reporting with financial statements and records

By understanding the purpose and components of Schedule K, and following the steps and tips outlined above, you can ensure accurate completion of this critical tax schedule.

Conclusion

In conclusion, Schedule K is a vital component of the S Corp tax return, providing essential information about shareholders' income, deductions, and credits. By understanding the schedule's purpose, components, and completion requirements, you can ensure accurate and compliant reporting. Remember to avoid common errors and mistakes, and seek professional advice if needed. With this knowledge, you can navigate the complexities of S Corp taxation with confidence.

We encourage you to share your experiences and questions about Schedule K in the comments below. Don't forget to share this article with your colleagues and friends who may benefit from this information.

What is the purpose of Schedule K?

+Schedule K is a supporting schedule to Form 1120S, used to report the shareholders' shares of income, deductions, and credits.

What are the components of Schedule K?

+Schedule K consists of several parts, including Income, Deductions, Credits, Tax and Payments, and Other Information.

How do I complete Schedule K accurately?

+To complete Schedule K accurately, gather all necessary financial statements and records, identify shareholders and their ownership percentages, calculate income, deductions, and credits, and allocate them to each shareholder.