The California Form FL-142, also known as the "Schedule of Assets and Debts," is a crucial document in the state's divorce proceedings. As a mandatory form, it requires detailed information about the assets and debts of both spouses. In this article, we will delve into the five ways to fill out California Form FL-142, ensuring that you understand the process and can navigate it with ease.

Understanding the Purpose of California Form FL-142

Before we dive into the five ways to fill out California Form FL-142, it's essential to understand the purpose of this form. The primary goal of FL-142 is to provide a comprehensive list of the assets and debts of both spouses, which will be used to determine the division of property during the divorce proceedings. This form is usually filed with the court along with the Petition for Dissolution of Marriage or Domestic Partnership.

Way 1: Gathering Necessary Information

To accurately fill out California Form FL-142, you'll need to gather all the necessary information about your assets and debts. This includes:

- Bank account statements

- Retirement accounts

- Real estate deeds

- Vehicle titles

- Credit card statements

- Loan documents

It's crucial to be thorough and include all relevant documents to ensure that your FL-142 form is accurate and complete.

Organizing Your Documents

To make the process easier, consider organizing your documents into categories, such as:

- Assets:

- Real estate

- Vehicles

- Bank accounts

- Retirement accounts

- Debts:

- Credit cards

- Loans

- Mortgages

This will help you quickly identify and list all your assets and debts on the FL-142 form.

Way 2: Identifying Community and Separate Property

In California, property acquired during the marriage is considered community property, while property acquired before the marriage or by gift or inheritance is considered separate property. It's essential to identify whether each asset or debt is community or separate property, as this will affect how it's divided during the divorce proceedings.

Understanding Community Property

Community property includes:

- Assets acquired during the marriage

- Income earned during the marriage

- Debts incurred during the marriage

Understanding Separate Property

Separate property includes:

- Assets acquired before the marriage

- Gifts or inheritances received during the marriage

- Assets acquired after the date of separation

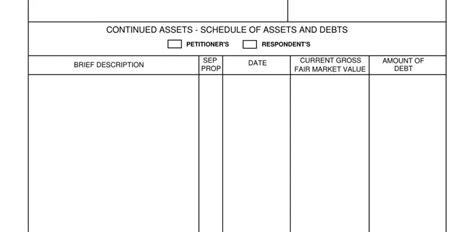

Way 3: Listing Assets on California Form FL-142

When listing assets on California Form FL-142, be sure to include the following information:

- Description of the asset

- Date acquired

- Value of the asset

- Community or separate property designation

Real Estate Assets

When listing real estate assets, include:

- Address of the property

- Date acquired

- Value of the property

- Community or separate property designation

Vehicles and Other Assets

When listing vehicles and other assets, include:

- Make and model of the vehicle

- Year of the vehicle

- Value of the vehicle

- Community or separate property designation

Way 4: Listing Debts on California Form FL-142

When listing debts on California Form FL-142, be sure to include the following information:

- Description of the debt

- Date incurred

- Balance of the debt

- Community or separate property designation

Credit Cards and Loans

When listing credit cards and loans, include:

- Type of credit card or loan

- Date incurred

- Balance of the debt

- Community or separate property designation

Way 5: Reviewing and Signing California Form FL-142

Once you've completed California Form FL-142, review it carefully to ensure that all information is accurate and complete. Make sure to sign and date the form, as required by the court.

Seeking Professional Help

If you're unsure about how to fill out California Form FL-142 or need help with the process, consider seeking the advice of a qualified attorney or financial advisor. They can provide guidance and ensure that your form is accurate and complete.

What is the purpose of California Form FL-142?

+The primary goal of FL-142 is to provide a comprehensive list of the assets and debts of both spouses, which will be used to determine the division of property during the divorce proceedings.

What information do I need to gather to fill out California Form FL-142?

+You'll need to gather all the necessary information about your assets and debts, including bank account statements, retirement accounts, real estate deeds, vehicle titles, credit card statements, and loan documents.

How do I determine whether an asset or debt is community or separate property?

+In California, property acquired during the marriage is considered community property, while property acquired before the marriage or by gift or inheritance is considered separate property.

In conclusion, filling out California Form FL-142 requires careful attention to detail and a thorough understanding of the assets and debts involved. By following these five ways to fill out the form, you'll be well on your way to completing the process accurately and efficiently.