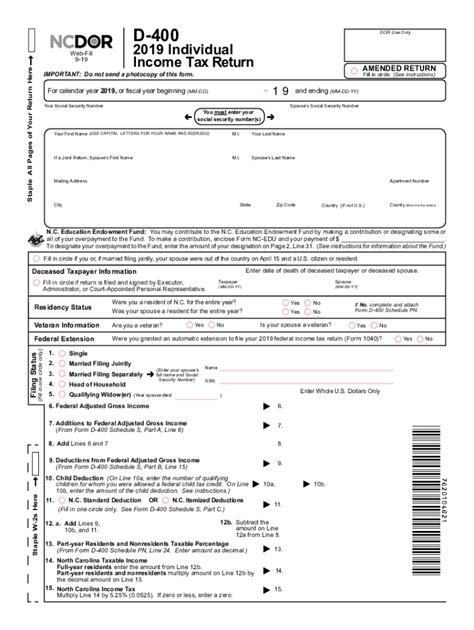

Understanding the NC State Tax Form D-400

As a resident of North Carolina, it's essential to understand the state's tax laws and filing requirements. The NC State Tax Form D-400 is the primary form used for individual income tax returns. In this guide, we'll walk you through the process of filing your NC state taxes using Form D-400.

Who Needs to File Form D-400?

You'll need to file Form D-400 if you're a resident of North Carolina and have income that's subject to state taxation. This includes:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains

- Retirement income

- Social Security benefits

Even if you don't owe state taxes, you may still need to file Form D-400 to report your income and claim any applicable refunds or credits.

Residency Status

To determine if you're a resident of North Carolina, consider the following:

- You lived in North Carolina for at least 183 days during the tax year.

- You maintained a home in North Carolina for the entire tax year.

- You were employed in North Carolina for the entire tax year.

If you meet any of these conditions, you're considered a resident of North Carolina and must file Form D-400.

Gathering Necessary Documents

Before starting your tax return, make sure you have the following documents:

- W-2 forms from your employer(s)

- 1099 forms for self-employment income, interest, and dividends

- Social Security benefits statement (if applicable)

- Retirement account statements (if applicable)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements

Understanding Form D-400

Form D-400 consists of multiple sections and schedules. Here's an overview of what you'll need to complete:

- Section 1: Income

- Report your total income from all sources

- Claim deductions for charitable donations, medical expenses, and mortgage interest

- Section 2: Adjustments to Income

- Claim adjustments for self-employment income, student loan interest, and moving expenses

- Section 3: Tax Credits

- Claim credits for child care expenses, education expenses, and renewable energy investments

- Section 4: Tax Computation

- Calculate your total tax liability

- Apply tax credits and deductions

Filing Options

You can file Form D-400 electronically or by mail.

- Electronic Filing:

- Use tax preparation software like TurboTax or H&R Block

- Submit your return through the NC Department of Revenue's website

- Mail Filing:

- Complete and sign Form D-400

- Attach all required schedules and documentation

- Mail to the NC Department of Revenue

E-Filing Benefits

E-filing offers several benefits, including:

- Faster processing times

- Reduced error rates

- Instant confirmation of receipt

Payment Options

If you owe state taxes, you can pay online, by phone, or by mail.

- Online Payment:

- Use the NC Department of Revenue's website

- Pay by credit card or electronic check

- Phone Payment:

- Call the NC Department of Revenue's customer service number

- Pay by credit card or electronic check

- Mail Payment:

- Complete and sign Form D-400V (Payment Voucher)

- Attach a check or money order

- Mail to the NC Department of Revenue

Extension of Time to File

If you need more time to file your tax return, you can request an automatic six-month extension. This will give you until October 15th to file your return. To request an extension, complete Form D-410 and submit it by the original filing deadline.

Amended Returns

If you need to make changes to your original tax return, you can file an amended return using Form D-400X. This form allows you to correct errors, claim additional credits or deductions, or report changes in income.

Common Errors to Avoid

When filing your tax return, avoid common errors like:

- Math mistakes

- Incomplete or missing schedules

- Failure to sign and date the return

- Incorrect or missing Social Security numbers

Additional Resources

If you need help with your tax return, consider the following resources:

- NC Department of Revenue website:

- Tax preparation software: TurboTax, H&R Block, etc.

- Tax professionals: CPAs, Enrolled Agents, etc.

Stay Informed

Stay up-to-date with the latest tax laws and regulations by:

- Following the NC Department of Revenue on social media

- Subscribing to tax newsletters and publications

- Attending tax seminars and workshops

What is the deadline for filing Form D-400?

+The deadline for filing Form D-400 is typically April 15th. However, if you need an extension, you can file Form D-410 by the original deadline to receive an automatic six-month extension.

Can I file Form D-400 electronically?

+Yes, you can file Form D-400 electronically using tax preparation software or the NC Department of Revenue's website.

What is the penalty for late filing or payment of state taxes?

+The penalty for late filing or payment of state taxes is 5% of the unpaid tax due, plus interest on the unpaid amount.