Completing tax forms can be a daunting task, especially for those who are new to the process. The NYS Form IT-204-LL is a crucial document for limited liability companies (LLCs) operating in New York State, as it reports the company's income and losses. In this article, we will explore five ways to complete the NYS Form IT-204-LL, ensuring that you meet the necessary requirements and avoid any potential penalties.

Understanding the NYS Form IT-204-LL

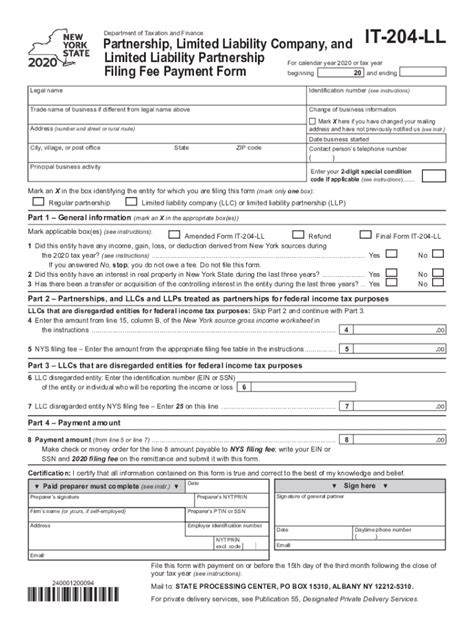

Before diving into the completion process, it's essential to understand the purpose and content of the NYS Form IT-204-LL. This form is used by LLCs to report their income and losses to the New York State Department of Taxation and Finance. The form requires various pieces of information, including:

- Business identification

- Income and expenses

- Capital contributions and distributions

- Tax credits and deductions

Who Needs to File the NYS Form IT-204-LL?

Not all LLCs are required to file the NYS Form IT-204-LL. However, if your LLC meets any of the following criteria, you must submit this form:

- Your LLC has income or losses from New York State sources

- Your LLC has New York State tax withholding or estimated tax payments

- Your LLC is claiming a tax credit or deduction

5 Ways to Complete the NYS Form IT-204-LL

Now that you understand the importance of the NYS Form IT-204-LL, let's explore five ways to complete it accurately and efficiently.

1. E-File Using the New York State Tax Department's Website

The New York State Tax Department offers an e-file option for the IT-204-LL form. This method is convenient and reduces the risk of errors. To e-file, you'll need to create an account on the tax department's website and follow the prompts to complete the form.

2. Use Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can guide you through the completion process. These programs often include tools and resources to help you navigate the form and ensure accuracy.

3. Consult with a Tax Professional

If you're unsure about completing the form or need guidance, consider consulting a tax professional. They can provide expert advice and ensure that your form is completed correctly.

4. Complete the Form Manually

If you prefer to complete the form manually, you can download the IT-204-LL form from the New York State Tax Department's website. Make sure to follow the instructions carefully and complete all required sections.

5. Use a Tax Preparation Service

Tax preparation services, such as those offered by accounting firms or tax preparation companies, can complete the form on your behalf. These services often include a review of your financial records and ensure that your form is completed accurately.

Additional Tips and Reminders

When completing the NYS Form IT-204-LL, keep the following tips and reminders in mind:

- Ensure that you have all necessary financial records and documents before starting the completion process.

- Use the correct form version, as the New York State Tax Department updates the form periodically.

- Double-check your calculations and entries to avoid errors.

- Submit the form on time to avoid penalties and interest.

Staying Organized and Meeting Deadlines

To ensure that you meet the necessary deadlines and requirements, consider the following strategies:

- Create a tax preparation checklist to keep track of necessary documents and deadlines.

- Set reminders for important dates, such as the filing deadline.

- Keep accurate and detailed financial records throughout the year.

Conclusion: Completing the NYS Form IT-204-LL with Confidence

Completing the NYS Form IT-204-LL can seem daunting, but with the right approach, you can ensure accuracy and meet the necessary requirements. By understanding the form's purpose and content, using the right resources, and staying organized, you can complete the form with confidence.

If you have any questions or concerns about the NYS Form IT-204-LL, please share them in the comments below.

What is the deadline for filing the NYS Form IT-204-LL?

+The deadline for filing the NYS Form IT-204-LL is typically March 15th of each year, but this date may vary depending on your LLC's tax year.

Can I file the NYS Form IT-204-LL electronically?

+Yes, you can file the NYS Form IT-204-LL electronically through the New York State Tax Department's website or using tax preparation software.

What are the penalties for not filing the NYS Form IT-204-LL?

+The penalties for not filing the NYS Form IT-204-LL can include fines, interest, and potential loss of business privileges.