Are you a North Carolina resident looking to file your state income tax return? The NC-4EZ form is a simplified version of the standard NC-4 form, designed for individuals with straightforward tax situations. Filling out the NC-4EZ form can be a breeze if you know what you're doing. In this article, we'll break down the process into five easy steps, making it simple for you to complete and submit your form.

The NC-4EZ form is perfect for individuals who have a basic tax situation, including those who are single, married filing jointly, or qualifying widows/widowers. If you have dependents, you'll need to file the standard NC-4 form. However, if you're eligible to file the NC-4EZ, you'll enjoy a faster and more straightforward tax filing experience.

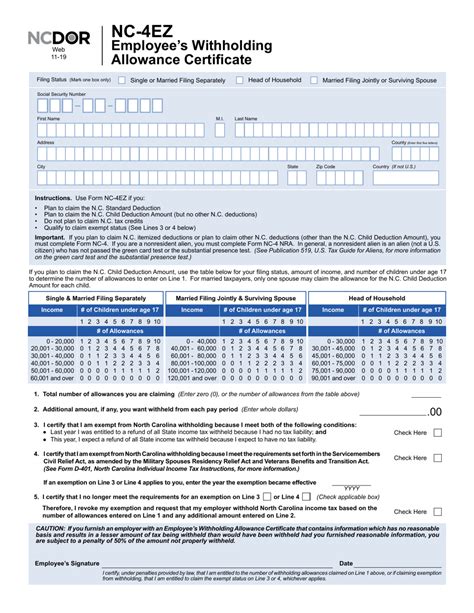

Understanding the NC-4EZ Form

Before we dive into the steps, let's take a glance at what the NC-4EZ form looks like. The form is divided into several sections, including personal information, income, deductions, and credits. You'll need to provide basic information, such as your name, address, and Social Security number, as well as report your income, claim deductions, and calculate your tax liability.

Step 1: Gather Your Documents

To fill out the NC-4EZ form, you'll need to gather a few essential documents. These include:

- Your W-2 forms from your employer(s)

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your address and date of birth

- Any 1099 forms for interest, dividends, or capital gains

Having these documents ready will make it easier to fill out the form accurately and efficiently.

Step 2: Fill Out Your Personal Information

The first section of the NC-4EZ form requires you to provide your personal information. This includes your name, address, Social Security number or ITIN, and date of birth. Make sure to double-check your information for accuracy.

Important:

- Use your legal name as it appears on your Social Security card or ITIN.

- Provide your correct address, including your street address, city, state, and ZIP code.

- Ensure your Social Security number or ITIN is accurate to avoid delays in processing your return.

Step 3: Report Your Income

The next section requires you to report your income from various sources. This includes:

- Wages, salaries, and tips from your W-2 forms

- Interest and dividends from 1099 forms

- Capital gains from the sale of assets

Report your income accurately, using the information from your W-2 and 1099 forms.

Tip:

- Use the correct income reporting codes to ensure accurate reporting.

- Report all income, including tips and self-employment income.

Step 4: Claim Deductions and Credits

The NC-4EZ form allows you to claim certain deductions and credits, including:

- Standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Claim the deductions and credits you're eligible for to reduce your tax liability.

Important:

- Review the eligibility criteria for each deduction and credit.

- Claim only the deductions and credits you're eligible for to avoid audit issues.

Step 5: Calculate Your Tax Liability

The final step is to calculate your tax liability. Use the information from the previous sections to calculate your total tax liability.

Tip:

- Double-check your calculations to ensure accuracy.

- Use tax software or consult a tax professional if you're unsure about any part of the process.

By following these five easy steps, you'll be able to fill out the NC-4EZ form accurately and efficiently. Remember to gather your documents, fill out your personal information, report your income, claim deductions and credits, and calculate your tax liability.

Additional Tips and Reminders

Here are some additional tips and reminders to keep in mind:

- File your return electronically to speed up processing and refunds.

- Use tax software or consult a tax professional if you're unsure about any part of the process.

- Keep accurate records of your income and expenses in case of an audit.

- Review your return carefully before submitting to ensure accuracy.

By following these tips and reminders, you'll be able to navigate the tax filing process with ease.

Take Action Today!

Don't wait until the last minute to file your taxes. Take action today and fill out the NC-4EZ form. With these five easy steps, you'll be able to complete and submit your form in no time. Share your tax filing experience with friends and family, and don't hesitate to comment below with any questions or concerns.

What is the NC-4EZ form?

+The NC-4EZ form is a simplified version of the standard NC-4 form, designed for individuals with straightforward tax situations.

Who is eligible to file the NC-4EZ form?

+Individuals who are single, married filing jointly, or qualifying widows/widowers with basic tax situations are eligible to file the NC-4EZ form.

What documents do I need to fill out the NC-4EZ form?

+You'll need your W-2 forms, Social Security number or ITIN, address, and date of birth, as well as any 1099 forms for interest, dividends, or capital gains.