The importance of protecting one's financial information cannot be overstated. With the increasing threat of identity theft and data breaches, consumers need to be vigilant about safeguarding their personal and financial data. One effective way to do this is by placing a security freeze on one's credit report. Navy Federal, a prominent credit union, offers its members the option to freeze their credit reports to prevent unauthorized access. However, there may be situations where a member needs to lift the freeze, and that's where the Navy Federal Security Freeze Appeal Form comes in.

In this article, we will delve into the world of security freezes, their benefits, and the process of appealing to lift one. We will also provide a comprehensive guide on how to fill out the Navy Federal Security Freeze Appeal Form, making it easier for members to navigate the process.

What is a Security Freeze?

A security freeze, also known as a credit freeze, is a tool that allows consumers to restrict access to their credit report. By placing a freeze on their credit report, members can prevent lenders and other entities from accessing their credit information, thereby reducing the risk of identity theft and unauthorized credit inquiries. A security freeze is different from a credit lock, which is a less restrictive measure that allows consumers to lock and unlock their credit report at will.

Benefits of a Security Freeze

There are several benefits to placing a security freeze on one's credit report:

- Prevents Identity Theft: A security freeze makes it difficult for identity thieves to open new credit accounts in the member's name.

- Reduces Credit Inquiry: By restricting access to the credit report, members can reduce the number of credit inquiries, which can negatively affect their credit score.

- Increases Security: A security freeze provides an additional layer of security, giving members peace of mind knowing that their credit information is protected.

Navy Federal Security Freeze Appeal Form

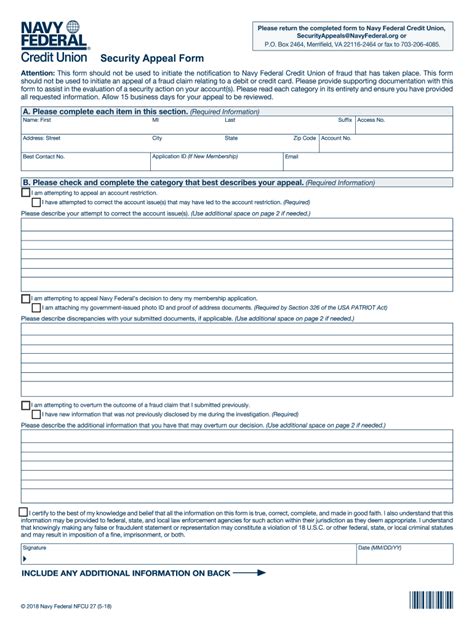

In some cases, a member may need to lift the security freeze to apply for credit or allow a lender to access their credit report. To do this, they need to fill out the Navy Federal Security Freeze Appeal Form. The form is used to appeal the decision to place a security freeze on the member's credit report.

Here's a step-by-step guide on how to fill out the Navy Federal Security Freeze Appeal Form:

Section 1: Member Information

- Provide the member's name, address, and phone number.

- Include the member's account number and social security number.

Section 2: Reason for Appeal

- Explain the reason for appealing the security freeze.

- Provide documentation to support the appeal, such as a copy of the member's identification or a letter from a lender.

Section 3: Freeze Information

- Provide the date the security freeze was placed.

- Include the name of the credit reporting agency that placed the freeze.

Section 4: Appeal Request

- Clearly state the request to lift the security freeze.

- Provide the member's signature and date.

Section 5: Additional Information

- Include any additional information that supports the appeal.

- Provide contact information for any questions or concerns.

Frequently Asked Questions

- What is the difference between a security freeze and a credit lock? A security freeze is a more restrictive measure that requires a PIN or password to lift, while a credit lock is a less restrictive measure that allows consumers to lock and unlock their credit report at will.

- How long does it take to process a security freeze appeal? The processing time may vary depending on the credit reporting agency and the complexity of the appeal. Typically, it takes 1-2 weeks to process a security freeze appeal.

- Can I appeal a security freeze online? Yes, Navy Federal allows members to appeal a security freeze online through their website.

By following the steps outlined in this guide, Navy Federal members can easily fill out the Security Freeze Appeal Form and lift the freeze on their credit report.