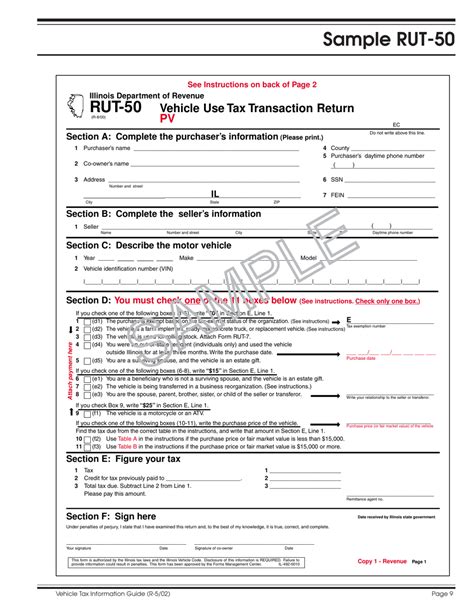

The Illinois RUT-50 form is a crucial document for businesses operating in Illinois, as it is used to report and pay the state's use tax. The form can be challenging to fill out, especially for those who are new to the process. In this article, we will provide you with a comprehensive guide on how to fill out the Illinois RUT-50 form.

Understanding the Illinois RUT-50 Form

Before we dive into the step-by-step guide, it's essential to understand what the Illinois RUT-50 form is and why it's necessary. The RUT-50 form is used to report and pay the Illinois use tax, which is a tax on the use of tangible personal property in the state. Businesses must file this form to report their use tax liability and make payments to the Illinois Department of Revenue.

What is Use Tax?

Use tax is a tax on the use of tangible personal property in Illinois. It is similar to sales tax, but it applies to purchases made outside of Illinois or from vendors who are not required to collect Illinois sales tax. Businesses must pay use tax on these purchases, and the RUT-50 form is used to report and pay this tax.

Method 1: Filing the RUT-50 Form Manually

One way to fill out the Illinois RUT-50 form is to file it manually. This involves downloading the form from the Illinois Department of Revenue's website, printing it out, and filling it out by hand. You will need to have the following information ready:

- Your business's name and address

- Your business's Illinois tax ID number

- A detailed list of your purchases, including the date, description, and cost of each item

- The total amount of use tax due

To fill out the form manually, follow these steps:

- Download the RUT-50 form from the Illinois Department of Revenue's website.

- Print out the form and fill it out by hand, using a pen or pencil.

- Make sure to sign and date the form.

- Attach any required documentation, such as receipts or invoices.

- Mail the completed form to the Illinois Department of Revenue.

Method 2: Filing the RUT-50 Form Electronically

Another way to fill out the Illinois RUT-50 form is to file it electronically. This involves using the Illinois Department of Revenue's online system, MyTax Illinois, to submit your return. To file electronically, you will need to have the following information ready:

- Your business's name and address

- Your business's Illinois tax ID number

- A detailed list of your purchases, including the date, description, and cost of each item

- The total amount of use tax due

To file the RUT-50 form electronically, follow these steps:

- Log in to your MyTax Illinois account.

- Click on the "File a Return" button.

- Select the RUT-50 form and follow the prompts to enter your information.

- Review your return for accuracy and completeness.

- Submit your return electronically.

Method 3: Using a Tax Professional

If you are not comfortable filling out the Illinois RUT-50 form yourself, you can hire a tax professional to do it for you. A tax professional can help ensure that your return is accurate and complete, and can also represent you in case of an audit.

To use a tax professional, follow these steps:

- Research and find a reputable tax professional.

- Provide the tax professional with the necessary information, including your business's name and address, your business's Illinois tax ID number, and a detailed list of your purchases.

- Review the return for accuracy and completeness.

- Sign and date the return.

- Have the tax professional submit the return on your behalf.

Method 4: Using Tax Software

Another option for filling out the Illinois RUT-50 form is to use tax software. Tax software can guide you through the process and help ensure that your return is accurate and complete.

To use tax software, follow these steps:

- Research and find a reputable tax software program.

- Download and install the software.

- Enter your information, including your business's name and address, your business's Illinois tax ID number, and a detailed list of your purchases.

- Review the return for accuracy and completeness.

- Submit the return electronically.

Method 5: Outsourcing to a Third-Party Provider

Finally, you can outsource the preparation and filing of your Illinois RUT-50 form to a third-party provider. This can be a good option if you don't have the time or expertise to handle the process yourself.

To outsource the preparation and filing of your Illinois RUT-50 form, follow these steps:

- Research and find a reputable third-party provider.

- Provide the provider with the necessary information, including your business's name and address, your business's Illinois tax ID number, and a detailed list of your purchases.

- Review the return for accuracy and completeness.

- Sign and date the return.

- Have the provider submit the return on your behalf.

We hope this article has provided you with a comprehensive guide on how to fill out the Illinois RUT-50 form. Remember to choose the method that works best for your business, and don't hesitate to seek help if you need it.

What is the Illinois RUT-50 form?

+The Illinois RUT-50 form is a document used to report and pay the state's use tax.

Who needs to file the Illinois RUT-50 form?

+Businesses operating in Illinois need to file the RUT-50 form to report their use tax liability.

How do I file the Illinois RUT-50 form?

+You can file the RUT-50 form manually, electronically, or by using a tax professional or tax software.