As the world shifts towards a more sustainable future, electric vehicles (EVs) have become an increasingly popular choice for environmentally conscious drivers. One of the major benefits of owning an EV is the potential to claim a significant tax credit. The Turbotax Form 8936 is the key to unlocking this credit, and in this article, we'll break down the process of claiming the electric vehicle credit in a clear and concise manner.

The electric vehicle credit is a non-refundable tax credit of up to $7,500, designed to encourage the adoption of eco-friendly vehicles. To qualify, the vehicle must meet specific requirements, including a battery capacity of at least 4 kilowatt-hours and a gross vehicle weight rating of less than 14,000 pounds. The credit is available for both new and used vehicles, but there are some restrictions on who can claim it.

Who Can Claim the Electric Vehicle Credit?

The electric vehicle credit is available to individuals who purchase a qualified electric vehicle for personal use. This includes both new and used vehicles, as long as they meet the eligibility criteria. However, there are some restrictions on who can claim the credit:

- The vehicle must be used primarily for personal use, rather than for business purposes.

- The vehicle must be registered in the owner's name.

- The owner must have a valid social security number or individual taxpayer identification number.

- The credit is phased out for taxpayers with modified adjusted gross income (MAGI) above certain thresholds.

How to Claim the Electric Vehicle Credit

Claiming the electric vehicle credit is a relatively straightforward process. Here's a step-by-step guide:

- Determine if your vehicle is eligible: Check the IRS website or consult with a tax professional to ensure your vehicle meets the eligibility criteria.

- Gather required documentation: You'll need to provide proof of purchase, including the vehicle's make, model, and year, as well as the purchase price and date.

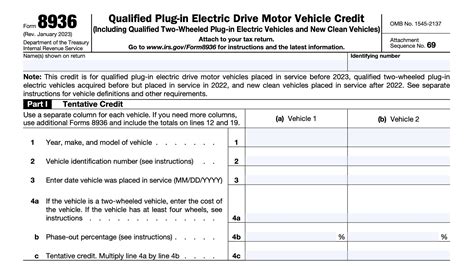

- Complete Form 8936: This form is used to calculate the electric vehicle credit. You'll need to provide information about the vehicle, including its battery capacity and gross vehicle weight rating.

- Attach Form 8936 to your tax return: Once you've completed the form, attach it to your tax return (Form 1040).

- Claim the credit: The electric vehicle credit is a non-refundable credit, which means it can only reduce your tax liability to zero. If the credit exceeds your tax liability, you won't receive a refund.

Common Errors to Avoid

When claiming the electric vehicle credit, there are several common errors to avoid:

- Incorrect vehicle identification: Make sure to accurately identify your vehicle's make, model, and year.

- Ineligible vehicles: Ensure your vehicle meets the eligibility criteria, including battery capacity and gross vehicle weight rating.

- Incomplete or missing documentation: Provide all required documentation, including proof of purchase and vehicle specifications.

Turbotax and the Electric Vehicle Credit

Turbotax is a popular tax preparation software that can help you navigate the process of claiming the electric vehicle credit. Here's how:

- Guided interview: Turbotax will guide you through a series of questions to determine if you're eligible for the credit.

- Automatic calculations: Turbotax will calculate the credit amount based on your vehicle's specifications and your tax situation.

- Error checking: Turbotax will check for common errors and ensure you have all required documentation.

Conclusion: Take Advantage of the Electric Vehicle Credit

The electric vehicle credit is a valuable incentive for eco-friendly drivers. By following the steps outlined in this article and using Turbotax Form 8936, you can easily claim the credit and reduce your tax liability. Remember to avoid common errors and ensure you have all required documentation. With the electric vehicle credit, you can drive away in a sustainable vehicle and enjoy significant tax savings.

We hope this article has provided you with a comprehensive understanding of the Turbotax Form 8936 and the electric vehicle credit. Share your thoughts and experiences in the comments below!

FAQ Section

What is the electric vehicle credit?

+The electric vehicle credit is a non-refundable tax credit of up to $7,500, designed to encourage the adoption of eco-friendly vehicles.

Who is eligible for the electric vehicle credit?

+The credit is available to individuals who purchase a qualified electric vehicle for personal use, including both new and used vehicles.

How do I claim the electric vehicle credit?

+Claiming the credit involves completing Form 8936 and attaching it to your tax return (Form 1040).