As a student, navigating the world of taxes can be overwhelming, especially when it comes to understanding the various forms and benefits available to you. One such form is the 1098-T, which is a crucial document for students to claim tax benefits on their education expenses. In this article, we will delve into the details of the 1098-T form, its purpose, and how students can leverage it to maximize their tax benefits.

The 1098-T form is an annual information return that eligible educational institutions are required to provide to students who have paid qualified tuition and related expenses during the tax year. The form reports the amount of qualified tuition and fees paid by the student, as well as any scholarships, grants, or other forms of financial aid received.

What is the Purpose of the 1098-T Form?

The primary purpose of the 1098-T form is to help students claim tax benefits on their education expenses. The form provides essential information that students need to complete their tax returns and claim credits or deductions for qualified education expenses. By reporting the amount of qualified tuition and fees paid, as well as any scholarships or grants received, the 1098-T form enables students to accurately calculate their tax benefits.

Who is Eligible to Receive a 1098-T Form?

To be eligible to receive a 1098-T form, students must meet certain criteria. These include:

- Being enrolled in a degree-granting program at an eligible educational institution

- Having paid qualified tuition and related expenses during the tax year

- Not having been claimed as a dependent on another person's tax return

- Not having received a 1098-T form from another institution for the same tax year

What Information is Reported on the 1098-T Form?

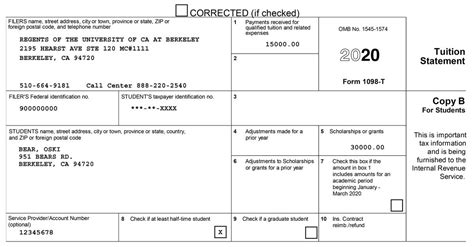

The 1098-T form reports several key pieces of information that students need to claim tax benefits. These include:

- The student's name, address, and taxpayer identification number (TIN)

- The name, address, and employer identification number (EIN) of the educational institution

- The amount of qualified tuition and related expenses paid by the student during the tax year

- The amount of any scholarships, grants, or other forms of financial aid received by the student during the tax year

How to Use the 1098-T Form to Claim Tax Benefits

To claim tax benefits using the 1098-T form, students need to follow these steps:

- Review the form carefully to ensure that all information is accurate and complete

- Use the form to complete Form 8863, Education Credits, or Form 8917, Tuition and Fees Deduction, as applicable

- Claim the applicable tax credit or deduction on the student's tax return

Tax Benefits Available to Students

The 1098-T form is a crucial document for students to claim tax benefits on their education expenses. The two main tax benefits available to students are the American Opportunity Tax Credit and the Lifetime Learning Credit.

- American Opportunity Tax Credit: This credit is worth up to $2,500 per eligible student and is available for the first four years of post-secondary education.

- Lifetime Learning Credit: This credit is worth up to $2,000 per tax return and is available for an unlimited number of years.

Common Mistakes to Avoid When Claiming Tax Benefits

When claiming tax benefits using the 1098-T form, students should avoid the following common mistakes:

- Failing to accurately report qualified tuition and fees paid

- Claiming credits or deductions for which the student is not eligible

- Failing to keep accurate records of education expenses

Conclusion

In conclusion, the 1098-T form is a critical document for students to claim tax benefits on their education expenses. By understanding the purpose and information reported on the form, students can accurately claim credits or deductions and maximize their tax benefits. Remember to review the form carefully, use it to complete the applicable tax forms, and avoid common mistakes when claiming tax benefits.

We encourage our readers to share their experiences with claiming tax benefits using the 1098-T form in the comments section below. Additionally, if you have any questions or concerns, please don't hesitate to reach out to us.

FAQ Section:

What is the deadline for receiving a 1098-T form?

+The deadline for receiving a 1098-T form is January 31st of each year.

Can I claim tax benefits without a 1098-T form?

+No, the 1098-T form is required to claim tax benefits on education expenses. However, if you did not receive a 1098-T form, you may still be eligible to claim tax benefits using Form 8863 or Form 8917.

Can I claim tax benefits for education expenses paid with student loans?

+No, you cannot claim tax benefits for education expenses paid with student loans. However, you may be eligible to deduct the interest paid on student loans.