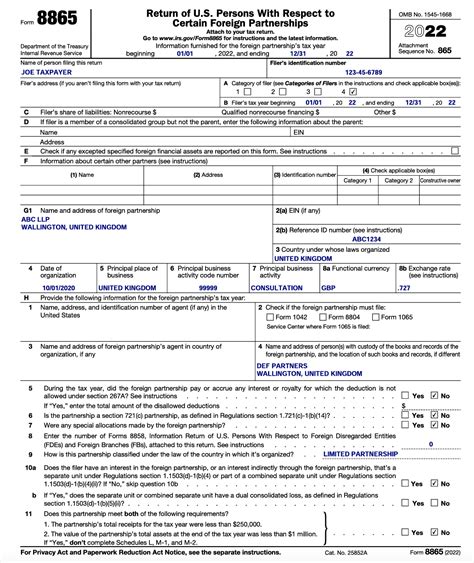

The Form 8865 is a crucial document for certain U.S. persons with interests in foreign entities, particularly those with interests in controlled foreign corporations (CFCs). One of the schedules that accompany Form 8865 is Schedule G, which requires specific information about certain transfers of property to a foreign corporation. In this article, we will delve into the requirements of Form 8865 Schedule G, its significance, and the necessary steps to complete it accurately.

What is Form 8865 Schedule G?

Form 8865 is a Return of U.S. Persons with Respect to Certain Foreign Partnerships, filed by certain U.S. persons who have interests in foreign partnerships, including CFCs. Schedule G, "Transfers of Property to a Foreign Corporation," is an attachment to Form 8865 that requires information about specific transfers of property. This schedule is used to report transfers of property that may be subject to certain rules and penalties, such as the PFIC (Passive Foreign Investment Company) rules.

Who Must File Form 8865 Schedule G?

Not all U.S. persons with interests in foreign entities need to file Form 8865 Schedule G. The schedule is required for certain transfers of property to a foreign corporation, typically when a U.S. person transfers property to a CFC in exchange for stock or other property. This includes transfers of:

- Property with a fair market value exceeding $100,000

- Property that constitutes 10% or more of the total value of the foreign corporation's assets

- Certain types of intangible property, such as patents, copyrights, or trademarks

What Information is Required on Form 8865 Schedule G?

Schedule G requires detailed information about the transfer of property, including:

- A description of the property transferred

- The fair market value of the property on the date of transfer

- The amount of any gain or loss recognized on the transfer

- The identity of the foreign corporation and its country of incorporation

- The type and amount of stock or other property received in exchange for the transferred property

How to Complete Form 8865 Schedule G?

To complete Form 8865 Schedule G, follow these steps:

- Determine if the transfer of property meets the requirements for filing Schedule G.

- Gather all necessary documentation, including records of the property transfer and any relevant financial statements.

- Complete the schedule in duplicate, attaching one copy to Form 8865 and retaining the other copy for your records.

- Report the transfer of property on the schedule, including the required information listed above.

- Sign and date the schedule, and ensure it is properly attached to Form 8865.

Penalties for Failure to File or Inaccurate Reporting

Failure to file Form 8865 Schedule G or providing inaccurate information can result in significant penalties, including:

- A penalty of $10,000 or more for each year the schedule is not filed or is filed with incorrect information

- Additional penalties for willful failure to file or intentional disregard of the reporting requirements

Best Practices for Compliance

To ensure compliance with the requirements of Form 8865 Schedule G, follow these best practices:

- Maintain accurate and detailed records of all property transfers to foreign corporations.

- Consult with a qualified tax professional or attorney to ensure compliance with all reporting requirements.

- File Form 8865 and Schedule G on time, and ensure all required information is accurately reported.

In conclusion, Form 8865 Schedule G is a critical component of the tax reporting requirements for certain U.S. persons with interests in foreign entities. By understanding the requirements and following the necessary steps, you can ensure compliance and avoid potential penalties.

We encourage you to share your thoughts and experiences with Form 8865 Schedule G in the comments below. If you have any questions or concerns, please do not hesitate to reach out to a qualified tax professional or attorney for guidance.

What is the purpose of Form 8865 Schedule G?

+Form 8865 Schedule G is used to report certain transfers of property to a foreign corporation, particularly those that may be subject to the PFIC rules.

Who must file Form 8865 Schedule G?

+Form 8865 Schedule G is required for certain U.S. persons who transfer property to a foreign corporation in exchange for stock or other property, typically when the property has a fair market value exceeding $100,000 or constitutes 10% or more of the total value of the foreign corporation's assets.

What are the penalties for failure to file or inaccurate reporting on Form 8865 Schedule G?

+Failure to file Form 8865 Schedule G or providing inaccurate information can result in penalties of $10,000 or more for each year the schedule is not filed or is filed with incorrect information, as well as additional penalties for willful failure to file or intentional disregard of the reporting requirements.