As an employee or employer in Minnesota, understanding the Minnesota Withholding Form is crucial for ensuring compliance with state tax laws. The form, also known as the Minnesota Income Tax Withholding Form, is used to determine the amount of state income tax to be withheld from an employee's wages. In this article, we will delve into the details of the Mn Withholding Form, including its purpose, who needs to use it, and how to fill it out accurately.

What is the Mn Withholding Form?

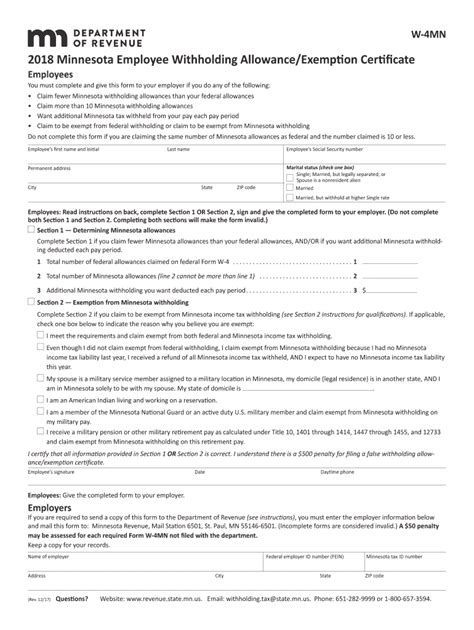

The Mn Withholding Form is a tax form used by employers in Minnesota to determine the correct amount of state income tax to withhold from an employee's wages. The form is used to calculate the employee's tax liability based on their income, filing status, and number of dependents. Employers are required to withhold state income tax from employee wages and remit the withheld amount to the Minnesota Department of Revenue on a regular basis.

Who Needs to Use the Mn Withholding Form?

The following individuals and businesses are required to use the Mn Withholding Form:

- Employers with employees who are Minnesota residents or have Minnesota-sourced income

- Employees who want to adjust their state income tax withholding

- New employees who need to complete the form as part of the hiring process

How to Fill Out the Mn Withholding Form

To fill out the Mn Withholding Form accurately, follow these steps:

- Employee Information: Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Filing Status: Choose your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Number of Dependents: Enter the number of dependents you claim, including yourself, your spouse, and any dependents you support.

- Income Information: Enter your estimated annual income from all sources, including wages, tips, and self-employment income.

- Tax Withholding: Choose the amount of state income tax you want to withhold from your wages, which can be a fixed amount or a percentage of your income.

Tips for Filling Out the Mn Withholding Form

To ensure accuracy and avoid errors, follow these tips when filling out the Mn Withholding Form:

- Use the correct filing status and number of dependents to avoid under- or over-withholding.

- Estimate your annual income accurately to avoid under- or over-withholding.

- Consider consulting with a tax professional or financial advisor if you're unsure about how to fill out the form.

Common Mistakes to Avoid

When filling out the Mn Withholding Form, avoid the following common mistakes:

- Inaccurate income information: Failing to report all sources of income can result in under-withholding and penalties.

- Incorrect filing status: Using the wrong filing status can result in incorrect tax withholding and penalties.

- Insufficient or excessive withholding: Withholding too little or too much tax can result in penalties and interest.

Penalties for Non-Compliance

Failure to comply with Minnesota state tax laws, including accurate completion of the Mn Withholding Form, can result in penalties and interest. Employers who fail to withhold state income tax or remit withheld amounts to the Minnesota Department of Revenue may be subject to penalties and fines.

Resources for Employers and Employees

For more information on the Mn Withholding Form and Minnesota state tax laws, employers and employees can access the following resources:

- Minnesota Department of Revenue website:

- Minnesota Taxpayer Service Center: 1-800-652-9094

- IRS website:

Conclusion

The Mn Withholding Form is a critical tax form for employees and employers in Minnesota. By understanding the form's purpose, who needs to use it, and how to fill it out accurately, employers and employees can ensure compliance with state tax laws and avoid penalties. Remember to use the correct filing status, number of dependents, and income information to avoid errors and ensure accurate tax withholding.

We encourage you to share your thoughts and questions about the Mn Withholding Form in the comments below. If you found this article helpful, please share it with your colleagues and friends who may benefit from this information.

What is the purpose of the Mn Withholding Form?

+The Mn Withholding Form is used to determine the correct amount of state income tax to withhold from an employee's wages.

Who needs to use the Mn Withholding Form?

+Employers with employees who are Minnesota residents or have Minnesota-sourced income, employees who want to adjust their state income tax withholding, and new employees who need to complete the form as part of the hiring process.

What happens if I fail to comply with Minnesota state tax laws?

+Failure to comply with Minnesota state tax laws, including accurate completion of the Mn Withholding Form, can result in penalties and interest.