Minnesota is known for its natural beauty, vibrant culture, and strong economy. As a resident of the North Star State, it's essential to understand the ins and outs of Minnesota state taxes, particularly when it comes to withholding taxes. In this article, we'll delve into the world of Minnesota Form M1W, exploring its purpose, key facts, and a step-by-step guide on how to file it.

Understanding Minnesota Withholding Taxes

Minnesota withholding taxes refer to the taxes withheld from an employee's wages by their employer and paid to the state on their behalf. This tax is a crucial aspect of Minnesota's tax system, as it helps fund public services and infrastructure projects. As an employer or employee, it's vital to comprehend the withholding tax process to avoid any potential issues or penalties.

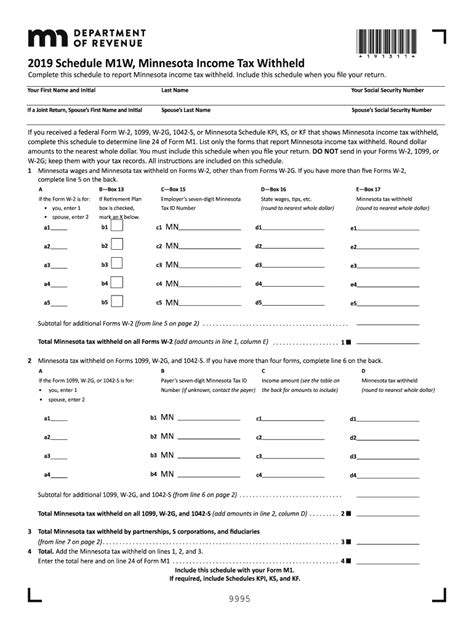

What is Minnesota Form M1W?

Minnesota Form M1W, also known as the Withholding Tax Return, is a quarterly tax return filed by employers to report the withholding taxes deducted from their employees' wages. This form is used to reconcile the withholding taxes paid by the employer with the amounts reported on the employees' W-2 forms.

Key Facts About Minnesota Form M1W

Before we dive into the filing process, here are some essential facts to keep in mind:

- Quarterly Filing: Minnesota Form M1W is filed on a quarterly basis, with due dates on April 30th, July 31st, October 31st, and January 31st of each year.

- Employer Requirements: All employers in Minnesota are required to file Form M1W, regardless of the number of employees or the amount of withholding taxes.

- W-2 Reconciliation: The form is used to reconcile the withholding taxes paid by the employer with the amounts reported on the employees' W-2 forms.

- Electronic Filing: Minnesota encourages electronic filing, which can be done through the state's online tax system or through a tax professional.

Benefits of Filing Minnesota Form M1W

Filing Minnesota Form M1W on time and accurately has several benefits for employers, including:

- Avoiding Penalties: Late or inaccurate filing can result in penalties and interest, which can be costly for employers.

- Streamlined Tax Process: Filing Form M1W helps streamline the tax process, making it easier for employers to manage their tax obligations.

- Improved Compliance: Filing the form demonstrates an employer's commitment to compliance with Minnesota tax laws.

How to File Minnesota Form M1W

Filing Minnesota Form M1W involves several steps, which we'll outline below:

- Gather Required Documents: Employers need to gather the following documents:

- W-2 forms for all employees

- Quarterly withholding tax payments

- Any other relevant tax documents

- Complete Form M1W: Employers can complete Form M1W online or through a tax professional. The form requires information such as:

- Employer identification number (EIN)

- Quarter-ending date

- Total withholding taxes deducted

- Total withholding taxes paid

- Reconcile W-2 Forms: Employers must reconcile the withholding taxes paid with the amounts reported on the employees' W-2 forms.

- Submit Form M1W: Employers can submit Form M1W electronically or by mail, depending on their preference.

Common Mistakes to Avoid

When filing Minnesota Form M1W, employers should avoid the following common mistakes:

- Late Filing: Filing the form late can result in penalties and interest.

- Inaccurate Information: Providing inaccurate information can lead to delays or rejection of the form.

- Missing Documents: Failing to include required documents can cause delays or penalties.

Additional Resources

For more information on Minnesota Form M1W, employers can visit the Minnesota Department of Revenue website or consult with a tax professional.

FAQs

Here are some frequently asked questions about Minnesota Form M1W:

- Q: What is the due date for filing Minnesota Form M1W? A: The due date for filing Minnesota Form M1W is on the last day of the month following the quarter-ending date.

- Q: Can I file Minnesota Form M1W electronically? A: Yes, Minnesota encourages electronic filing, which can be done through the state's online tax system or through a tax professional.

- Q: What are the penalties for late filing of Minnesota Form M1W? A: Late filing of Minnesota Form M1W can result in penalties and interest, which can be costly for employers.

What is the purpose of Minnesota Form M1W?

+Minnesota Form M1W is a quarterly tax return filed by employers to report the withholding taxes deducted from their employees' wages.

Who needs to file Minnesota Form M1W?

+All employers in Minnesota are required to file Form M1W, regardless of the number of employees or the amount of withholding taxes.

What are the benefits of filing Minnesota Form M1W?

+Filing Minnesota Form M1W on time and accurately helps avoid penalties, streamlines the tax process, and demonstrates an employer's commitment to compliance with Minnesota tax laws.

In conclusion, Minnesota Form M1W is an essential aspect of the state's tax system, and employers must understand its purpose, benefits, and filing requirements. By following the steps outlined in this article and avoiding common mistakes, employers can ensure a smooth and compliant tax process.