As an employee in Missouri, understanding the Missouri tax withholding form is crucial for accurate tax filing and avoiding any penalties. The Missouri tax withholding form, also known as the MO W-4, is used to determine the correct amount of state income tax to withhold from an employee's paycheck. In this article, we will delve into the details of the Missouri tax withholding form, its importance, and provide a step-by-step guide on how to complete it accurately.

Why is the Missouri Tax Withholding Form Important?

The Missouri tax withholding form is essential for both employees and employers. For employees, it ensures that the correct amount of state income tax is withheld from their paycheck, avoiding any unexpected tax bills or penalties. For employers, it helps them comply with Missouri state tax laws and regulations, reducing the risk of penalties and fines.

Who Needs to Complete the Missouri Tax Withholding Form?

All Missouri employees who earn income subject to Missouri state income tax must complete the MO W-4 form. This includes employees who are:

- Residents of Missouri

- Non-residents who work in Missouri

- Employees who have previously claimed exemption from Missouri state income tax withholding

How to Complete the Missouri Tax Withholding Form

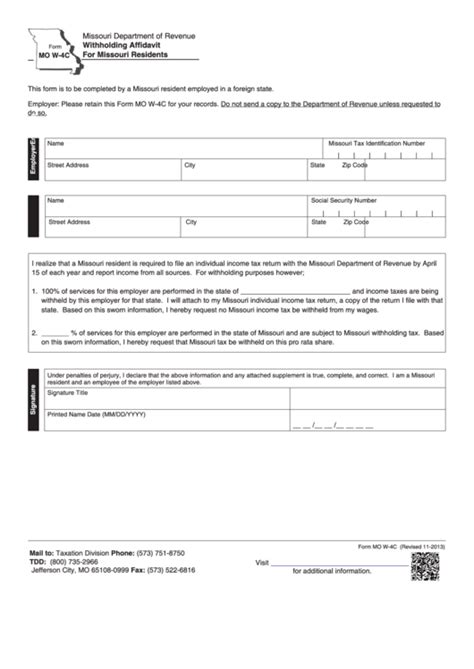

Completing the Missouri tax withholding form is a straightforward process that requires some basic information. Here's a step-by-step guide:

Step 1: Gather Required Information

Before completing the MO W-4 form, gather the following information:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your filing status (single, married, head of household, etc.)

- The number of allowances you want to claim

- Any additional income or deductions you want to report

Step 2: Determine Your Filing Status

Choose your filing status from the options provided on the form. Your filing status determines the amount of state income tax withheld from your paycheck.

Step 3: Claim Allowances

Claim the number of allowances you are eligible for. Allowances reduce the amount of state income tax withheld from your paycheck. You can claim allowances for:

- Yourself

- Your spouse

- Your dependents

- Other qualified individuals

Step 4: Report Additional Income or Deductions

If you have additional income or deductions, report them on the form. This includes:

- Other income (e.g., investments, self-employment income)

- Deductions (e.g., mortgage interest, charitable donations)

Step 5: Sign and Date the Form

Once you have completed the form, sign and date it. Make sure to keep a copy of the completed form for your records.

Missouri Tax Withholding Form Allowances

The number of allowances you claim on the Missouri tax withholding form affects the amount of state income tax withheld from your paycheck. Here's a breakdown of the allowances you can claim:

- Single: 1 allowance

- Married: 2 allowances (1 for yourself and 1 for your spouse)

- Head of Household: 2 allowances (1 for yourself and 1 for your dependents)

- Qualifying Widow(er): 2 allowances (1 for yourself and 1 for your dependents)

Missouri Tax Withholding Form Exemptions

Some individuals may be exempt from Missouri state income tax withholding. These include:

- Retirees: If you are a retiree and receive only retirement income, you may be exempt from Missouri state income tax withholding.

- Disabled Individuals: If you are a disabled individual and receive only disability income, you may be exempt from Missouri state income tax withholding.

- Non-Residents: If you are a non-resident of Missouri and do not work in the state, you may be exempt from Missouri state income tax withholding.

Common Mistakes to Avoid

When completing the Missouri tax withholding form, avoid the following common mistakes:

- Incorrect Filing Status: Make sure to choose the correct filing status, as this affects the amount of state income tax withheld from your paycheck.

- Incorrect Allowances: Claim the correct number of allowances, as this affects the amount of state income tax withheld from your paycheck.

- Incomplete Information: Make sure to complete all required fields on the form, as incomplete information may delay processing.

Conclusion

The Missouri tax withholding form is a crucial document that ensures accurate tax filing and avoids penalties. By following the step-by-step guide provided in this article, you can complete the form accurately and ensure that the correct amount of state income tax is withheld from your paycheck. Remember to review and update your MO W-4 form regularly to reflect any changes in your income or filing status.

What is the Missouri tax withholding form?

+The Missouri tax withholding form, also known as the MO W-4, is used to determine the correct amount of state income tax to withhold from an employee's paycheck.

Who needs to complete the Missouri tax withholding form?

+All Missouri employees who earn income subject to Missouri state income tax must complete the MO W-4 form.

How do I complete the Missouri tax withholding form?

+Complete the form by gathering required information, determining your filing status, claiming allowances, reporting additional income or deductions, and signing and dating the form.