New York Form CT-3, also known as the "New York State Department of Taxation and Finance Form CT-3," is a crucial document for businesses operating in the state of New York. The form is used to report and pay franchise taxes, and its accuracy and timeliness are essential to avoid penalties and fines. Here are five essential facts about New York Form CT-3 that businesses need to know:

Who Needs to File New York Form CT-3?

New York Form CT-3 is required for businesses that are subject to the New York State franchise tax. This includes:

- Corporations (including S corporations and C corporations)

- Limited liability companies (LLCs)

- Limited partnerships (LPs)

- Limited liability partnerships (LLPs)

These businesses must file the form annually, even if they have no tax liability or have not conducted any business in the state. Failure to file the form or pay the required tax can result in penalties, fines, and interest.

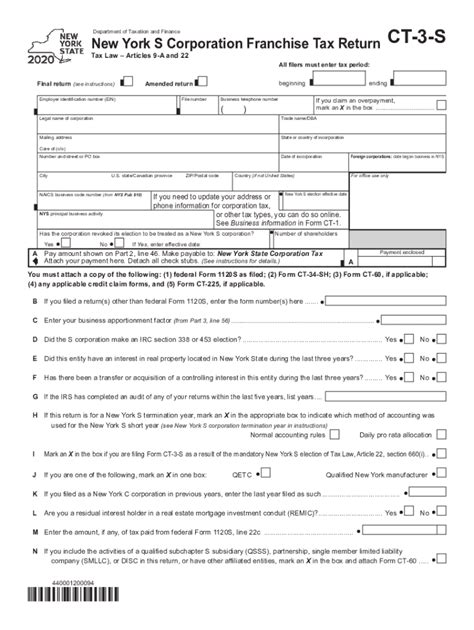

What Information is Required on New York Form CT-3?

The form requires businesses to provide detailed information about their income, expenses, and tax credits. Some of the key information required includes:

- Business name and address

- Federal Employer Identification Number (FEIN)

- New York State tax account number

- Gross income and net income

- Taxable income and tax liability

- Credits and deductions claimed

Businesses must also attach supporting schedules and documentation, such as financial statements and tax returns, to the form.

How to Calculate the Franchise Tax

The franchise tax is calculated based on the business's taxable income, which is determined by subtracting allowed deductions and credits from the business's gross income. The tax rate varies depending on the type of business and its taxable income.

- Corporations: The tax rate ranges from 6.5% to 8.82% of taxable income, depending on the corporation's tax classification and taxable income.

- LLCs and LPs: The tax rate is 6.5% of taxable income.

Businesses can also claim credits and deductions to reduce their tax liability, such as the New York State research and development tax credit and the New York State brownfield redevelopment tax credit.

Penalties for Late Filing or Non-Filing

Businesses that fail to file New York Form CT-3 or pay the required tax by the due date (typically March 15th for corporations and April 15th for LLCs and LPs) may be subject to penalties and fines. These can include:

- Late filing penalty: 5% to 25% of the unpaid tax, depending on the number of months or quarters the tax is late.

- Late payment penalty: 5% to 25% of the unpaid tax, depending on the number of months or quarters the tax is late.

- Interest on the unpaid tax: calculated at a rate of 6% to 14% per annum, depending on the type of tax and the number of months or quarters the tax is late.

Businesses that fail to file the form or pay the required tax may also be subject to audits, fines, and other enforcement actions.

Conclusion

New York Form CT-3 is a critical document for businesses operating in the state of New York. Businesses must accurately complete the form, attach supporting documentation, and file it on time to avoid penalties and fines. By understanding the essential facts about New York Form CT-3, businesses can ensure compliance with state tax laws and regulations.

Additional Tips and Resources

- Businesses can file New York Form CT-3 electronically through the New York State Department of Taxation and Finance's website or by mail.

- The form and supporting documentation must be kept for a minimum of three years in case of an audit.

- Businesses can consult the New York State Department of Taxation and Finance's website or contact a tax professional for guidance on completing the form.

By following these tips and resources, businesses can ensure accurate and timely completion of New York Form CT-3 and avoid penalties and fines.

What is the deadline for filing New York Form CT-3?

+The deadline for filing New York Form CT-3 is typically March 15th for corporations and April 15th for LLCs and LPs.

Can I file New York Form CT-3 electronically?

+Yes, businesses can file New York Form CT-3 electronically through the New York State Department of Taxation and Finance's website.

What are the penalties for late filing or non-filing of New York Form CT-3?

+Businesses that fail to file New York Form CT-3 or pay the required tax by the due date may be subject to penalties and fines, including late filing and payment penalties, interest on the unpaid tax, and other enforcement actions.